Safilo closed with a 3.13% gain yesterday at the Milan Stock Exchange at a price of 5.28 euros per share, after having reached an 8% gain during the morning toward 5.5 euro per shares. The reason of the sprint for the stock of the second leading eyewear maker in the world after giant Luxottica-Essilor was an article by Affari e Finanza La Repubblica newspaper saying that Safilo might be a target for private equity funds or fashion groups or that Hal Holdings, now the major shareholder with a 41% stake, might decide to takeover the whole group as Richemont did when it decided to buy the 51% stake in Ynap that it did not own yet launching a tender offer on the stock.

Safilo closed with a 3.13% gain yesterday at the Milan Stock Exchange at a price of 5.28 euros per share, after having reached an 8% gain during the morning toward 5.5 euro per shares. The reason of the sprint for the stock of the second leading eyewear maker in the world after giant Luxottica-Essilor was an article by Affari e Finanza La Repubblica newspaper saying that Safilo might be a target for private equity funds or fashion groups or that Hal Holdings, now the major shareholder with a 41% stake, might decide to takeover the whole group as Richemont did when it decided to buy the 51% stake in Ynap that it did not own yet launching a tender offer on the stock.

Hal Holding, which is controlling Safilo since December 2009, after a tender offer on Safilo’s bonds and a recapitalization of the group, said yesterday evening with a note that at the moment it is not willing to raise its stake in Safilo. However the stock remains under observation by investors and analysts.

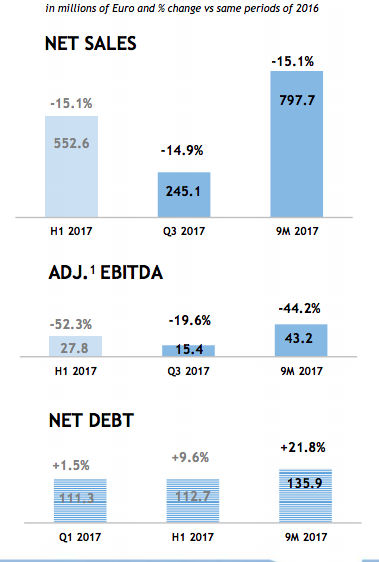

Safilo group, led by ceo Luisa Delgado, has a market cap of about 300 million euros and closed Q3 2017 with 797.9 million euros in revenues (after 1.2 billions in whole 2016), 43.2 million euros in adjusted ebitda (from 81 millions in all 2016) and a net financial debt of 135.9 millions (up from 48.4 millions at the end of 2016) (see here the press release).

Safilo is now half the way of its 2016-2020 strategic plan with results below the target, however analysts’ expectations are that the company will be able to reach good results in 2018, up from Fy 2017’s expected ones that are 1.06-1.07 billion euros in revenues, 30-60 million euros in adjusted ebitda and 130-140 million euros in net financial debt. In FY 2018, actually, revenues are seen at 1.08-1.11 billion euros, adjusted ebitda at 70-90 millions and net financial debt at 120-130 millions.

Meanwhile, as for the licences, Safilo will loose the ones by Kering (Gucci, Saint Laurent), ha lost Lvmh‘s Celine and is risking the renewal of Lvmh’s Dior, Marc Jacobs, Fendi and Givenchy as Lvmh has joined forces with Safilo’s competitor Marcolin (see here a previous post by BeBeez).

However, Safilo might conquer a license from Chanel which is now produced by Luxottica of from Tom Ford which is now produced by Marcolin. This is because Luxottica-Essilor might be seen to big for an exclusive griffe such as Chanel while the agreement between Lvmh and Marcolin might make Tom Ford to choose an independent eqyewear maker such as Safilo.