CEF 3 Wind Energy spa, an investment holding developing onshore wind farms in Italy, has refinenced its portfolio issuing a 170 million euros bond maturing in January 2025 and paying a 2.01% coupon. The bond has been listed at the ExtraMot Pro market.

CEF 3 Wind Energy spa, an investment holding developing onshore wind farms in Italy, has refinenced its portfolio issuing a 170 million euros bond maturing in January 2025 and paying a 2.01% coupon. The bond has been listed at the ExtraMot Pro market.

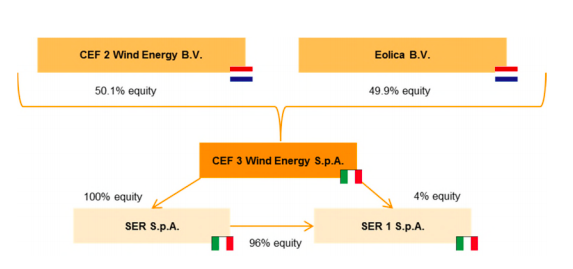

The Admission document explains that proceeed from the issue will be used to repay debt issued by i Società Energie Rinnovabili spa (SER), which is operating wind farms with a total 112.9 MW capacity and owning a 96% stake in Società Energie Rinnovabili 1 spa (SER 1) which is operating 6 wind farms for a total capacity of 131.8 MW.

This is one of the biggest wind farm portfolios in Italy. The company colosed FY 2016 with 28.1 million euros in revenues, 21.2 millions in ebitda and a net financial debt of 174.2 million euros.

CEF 3 Wind Energy is controlled with a 50.1% stake by CEF 2 Wind Energy bv, which in turn is controlled by Glennmont Partners, one of the major European infrastructure asset managers. Gelnnmont has already invested 350 million euros in equity in Italy. The remaining 49.9% of CEF 3 Wind’s capital is instead owned by Eolica bv, an investment veichle owned by Dutch asset manager PGGM.