Binding offers for a 1.35 billion euros non performing exposures portfolio (the Rep Project) originated by Intesa Sanpaolo were delivered about ten days ago by three investors’ consortiums and the bank led by ceo Carlo Messina is expected to choose one counterparty for exclusive talks quite soon.

Binding offers for a 1.35 billion euros non performing exposures portfolio (the Rep Project) originated by Intesa Sanpaolo were delivered about ten days ago by three investors’ consortiums and the bank led by ceo Carlo Messina is expected to choose one counterparty for exclusive talks quite soon.

As was already anticipated last September (see here a previous post by BeBeez) the three consortiums in the race are Gwm-Pimco advised by Leonardo & Co, Pillarstone-Kkr-Coima advised by Lazard and Mediobanca and Tpg-Starwood-Prelios advised by Rotschild. The deal will be implemented through a securitization and Intesa Sanpaolo will remain involved together with the winning consortium.

Rep portfolio includes a major part of real estate loans in restructuring phase: 78 positions for a total of 1.25 billion euros with corporates as debtors and 100 million euros with real estate funds as debtors. About 8% or 110 million euros is made of offices, another 8% or 114 million euros of retail real estate, 4% or 52 million euro industrial or logistic real estate, 15% or 202 millions are mixed destination real estate, 58% or 781 million euros are residential real estate and 7% or 89 millions are hotels.

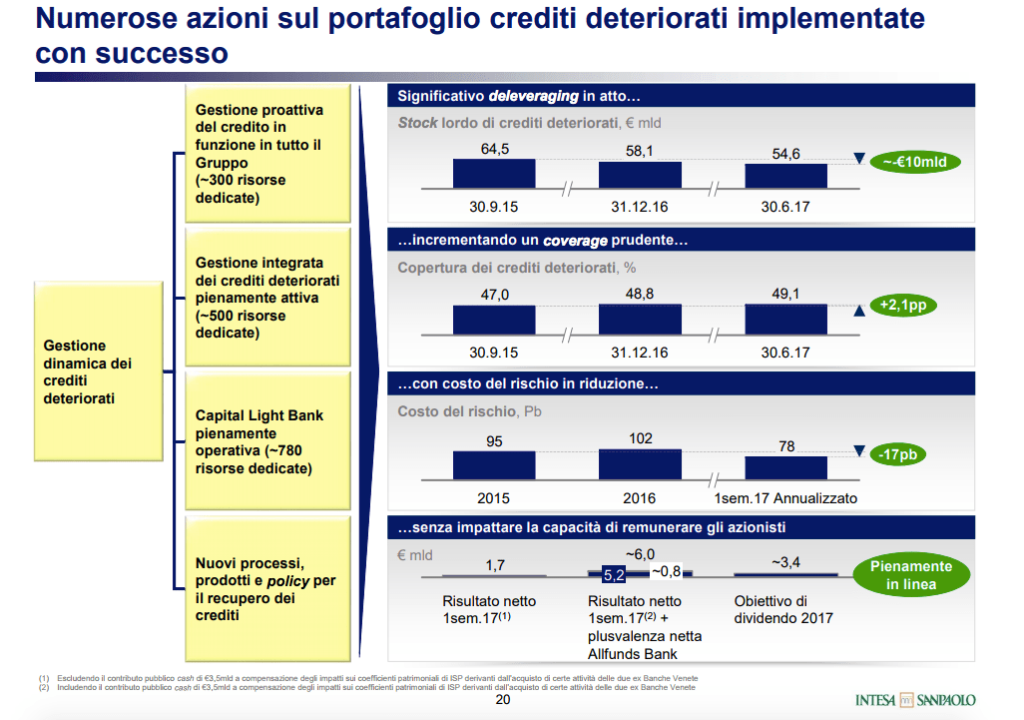

The sale of Project Rep is part of strategy of proactive management of non performing exposures by Intesa Sanpaolo and follows the sale of a 2 billion euros Npl portfolio, named Beyond the Clouds, to Christofferson Robb & Company (Crc), Bayview and Prelios Credit Servicing last May (see here a previous post by BeBeez).

In the meantime Intesa Sanpaolo is also selling a 600 million euros portfolio made of unsecured non performing exposures named Sherazade, MF Milano Finanza wrote, adding that the portfolio is made of about 65k positions and that binding offers have been delivered already with two bidders who are still in the race: Mediobanca Credit Solution and Lindorff-Intrum Iustitiae.

Finally, Intesa Sanpaolo is also selling the Hemera portfolio, made of about 100 real estate repossessed assets (industrial assets above all), of which the bank became owner after bankrupcty procedures. Bain Capital, Cerberus and Negentropy Capital are said to be on the dossier.