Oxy Capital Italia e Attestor Capital put forward a non binding offert to buy control of Italy’s casual wear maker Stefanel after the company had asked the Treviso Court for creditor protection last November (in the form of “concordato preventivo in bianco o con riserva” on the basis of art. 161, 6° co of Italy’s Bakrupcty Law, see here a prvious post by BeBeez).

More in detail Stefanel said in a press release yesterday evening chthat the two funds are in talks with the company and its senior lenders (Bnl-Bnp Paribas, Banco Popolare, Intesa Sanpaolo, Mps and Unicredit) in the framework of a debt restructuring agreement as for art 182-bis of the Italian Bakrupcty Law, which will include a recapitalization of the company and the injection of new money to support a plan of relaunch of the business.

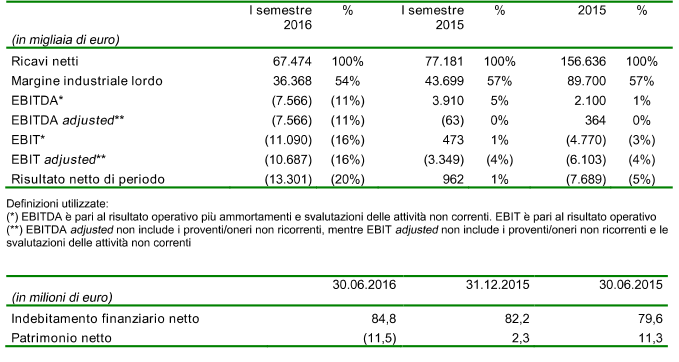

Stefanel reached 67.4 million euros in revenues in the six months ended on June 30th, with a negative ebitda of 7.6 millions and a net loss of 13.3 millions, having a net financial debt of 84.8 millions. The group had ended year 2015 with 156-6 million euros in revenues, a positive ebitda of 2.1 millions, a 7.7 million euros net loss and a net financial debt of 82,2 million euros.

The deal structure has not been disclosed BeBeez was said Oxy’s idea is to invest about 25 million euros of new money while asking the banks to swap about 25 millione uros of their loans into equity, which is in part what Oxy and Attestor have done in their previous two deals on Ferroli and Oleifici Mataluni-Olio Dante.

Actually in those cases banks did not suffer a write-off but simply accepted not to cash in any interest on their loans and wait for the companies to be relaunched in order to see the reimbursement of their whole loans and maybe a yield. Acutally that is a structure known as DIP or Debtor-In-Possession.