US private equity giant Kkr and restructuring expert Alvarez&Marsal will ready by next Spring for starting activity of their bad loans fund relating to some specific credit exposures to Italian companies in Unicredit and Intesa Sanpaolo‘s portfolio (see a previous post by BeBeez), MF-Milano FInanza wrote last Saturday December 13rd.

US private equity giant Kkr and restructuring expert Alvarez&Marsal will ready by next Spring for starting activity of their bad loans fund relating to some specific credit exposures to Italian companies in Unicredit and Intesa Sanpaolo‘s portfolio (see a previous post by BeBeez), MF-Milano FInanza wrote last Saturday December 13rd.

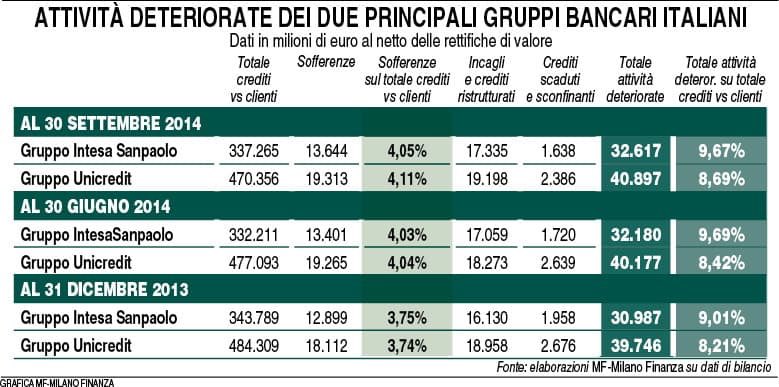

Sources close to the project told the newspaper that about ten bad credit positions common to both the banks’ portfolios have been selected and that some other positions will be selected during year 2015. The gross value of those credits is more than one billion euros. The sum of Unicredit and Intesa Sanpaolo’s exposures represents a 45-50% stake at least of the total banking exposure for each selected borrower company.

As for the structure of the project, a newco will be capitalized by Kkr and Alvarez&Marsal which is going to by the loans from the two banks. The newco will have a “silos” structure as loans to each single company will have a specific sector in the vehicle. The newco will pay for the loans part in cash (a small one) and part in two vendor loans, one senior and the other junior. As for the actual selected portfolio, about senior and junior loans are going to be issues in a 50-50 proportion.

That solution should have a positive impact on Unicredit and Intesa Sanpaolo’s capital ratios if Banca d’Italia is to judge that the credit risk associated to the two vendor loans is less than the credit risk of the original loan the borrower company. The Italian Supervisory Authority is expected to rule in the next few weeks about the issue.

Credit risk associated the the new loans should be lower if you think that each borrower company might be capitalized by the fund and the company might follow a new restructuring plan put forward by a new management. However, law in Italy does not allow lenders to impose the entrepreneur to accept a debt-equity-swap if he does not agree (it is not as it is in a US Chapter 11). An exception being a pledge on company’s stock. However Italian banks are not keen to exercise the pledge. More often Italian banks are happy with real estate or machinery guarantees which however are rather illiquid in the actual times.

The project might be stronger if other lenders of the same borrower companies selected by Kkr and Alvarez among Unicredit and Intesa Sanpaolo’s portfolio would accept to sell the newco their loans too on the same basis of Unicredit and Intesa. As for that Banca d’Italia’s decision about the project’s impact on banks’ capital ratios will have a singificant weight in pushing other banks to enter the project.

Coming to an agreement is certainly not easy anyway as it is quite common that deiffernt banks have different valuations for loans to a same company, the major reason being that guarantees associated to those loans are different. However as already said with the actual market having real estate or machinery guarantees in Italy is not quite a deal.

Project for Unicredit and Intesa Sanpaolo’s bad loans is one of a punch of other projects being put forward by different players in Italy in order to solve Italian system’s bad loans problem (see a previous post by BeBeez).