In February 2024, Yandex – the company often referred to as Russia’s answer to Google – announced it was selling its Russian assets to a consortium of investors for $5.2 billion.

The news came almost two years to the day of the illegal Russian invasion of Ukraine, a conflict that has become the largest and deadliest in Europe since World War II.

Within months of war breaking out, Yandex had already sold off its media business to Russian state-controlled social media giant VK (the division’s head was sanctioned in the months following the invasion) and was reportedly looking for a way to exit Russia.

Prior to the sale, Yandex’s holding company had already been based in the Netherlands for more than a decade and it is in Amsterdam where the newly-rebranded Nebius Group is now headquartered. The Dutch capital is home to around 500 Nebius employees, although following the company’s exit from Russia, its employees – in particular Russian workers who had to leave the country – settled in all corners of the world.

The new company retained control of Yandex’s Finnish data center and its Nebius AI unit – the inspiration for its new moniker – as well as data firm Toloka AI, edtech provider TripleTen, and autonomous driving developer Avride.

Unsurprisingly, given its new name, Nebius also announced it was “building one of the largest commercially available artificial intelligence (AI) infrastructure businesses based in Europe,” and would be offering an AI-centric cloud platform built for intensive AI workloads. Its full-stack infrastructure will be designed to service the growth of the global AI industry, including large-scale GPU clusters, cloud platforms, and tools and services for developers.

On a cold weekend at the beginning of October 2024, DCD was invited to Finland to visit the Nebius data center in Mäntsälä.

After a long time unable to say very much for obvious reasons, the company was finally ready to emerge in its new form and show Nebius off to the world, as was demonstrated by the flurry of announcements that bookended the trip.

Earlier in October, Nebius had announced plans to deploy an Nvidia H200 cluster in Paris as part of the company’s stated aim to invest more than $1 billion in AI infrastructure in Europe by mid-2025.

In the week following the visit, Nebius publicly stated it would be tripling the capacity of its Finnish data center, placing upwards of 60,000 GPUs at the site to expand its capacity to 75MW. The $1bn investment figure includes what the company will spend on its planned Finnish expansion.

Subsequently, Nebius announced it would deploy an Nvidia H200 GPU cluster at a data center owned by Patmos in Kansas City, Missouri, began trading again on the Nasdaq, and revealed details of a $700m equity fundraise. The company also plans to invest up to $1.5 billion in capex this year, with a significant portion going into GPUs and data center infrastructure.

Bringing efficiency to the south of Finland

Located in south Finland, 60km (37.2 miles) outside of Helsinki, the trip to the Mäntsälä data center begins and ends with an hour-long drive through the beautiful Scandinavian countryside.

The trip marks the first time Nebius has opened its doors since the sale and rebranding. Following all the usual security checks that accompany any data center visit, DCD is ushered inside for the tour, hosted by Nebius’ head of infrastructure, Andrey Korolenko, a former long-time Yandex employee who held the same job title prior to the separation.

In the company’s introductory remarks, chief marketing officer Anastasia Zemskova says that Nebius is looking to bridge the gap between AI practitioners and the current offerings being provided by specialized AI cloud providers, which it believes are inadequate.

“Our approach to building the cloud has always been based on what we see on the market, in the real consumption, in the real world of data scientists and mathematicians that are currently being stretched all over the place trying to not only train their models but also build the infrastructure that could sustain those models well,” says Zemskova. “We are very user-centric.

“What we see on the market is that cloud providers are not capable of keeping up with what machine learning engineers are needing, and it’s very common that users are offered GPUs with no cloud on top of it.”

She adds the cloud “has been evolving all the time,” so the company’s goal is to deliver a “hyperscaler-like experience combined with GPUs, so that users of our AI-centric cloud can utilize the best from the cloud, but have it tailor-made for AI.”

At present, in addition to the tens of thousands of GPUs it currently houses, the 25MW facility is also home to the ISEG supercomputer; a 46.54 petaflops system equipped with Intel Xeon CPUs and Nvidia H100 GPUs. On the November 2024 edition of the Top500 list of the world’s most powerful supercomputers, ISEG ranked 29th.

At its current capacity, the Mäntsälä data center only uses air-cooling technology to chill its servers – one of the benefits of building your facility in a country where cold air is freely available all year round.

The facility also exports heat via a local district heating network, providing warmth for around 2,500 homes in the area. As a result, Nebius says the data center is among the most energy-efficient in the world, and presently, the facility has a PUE of 1.12.

The data center uses two levels of filtering for air quality, with the air intake system able to handle 7-8 million cubic meters of air per hour. The outside air is cleaned by the filters before being directed down onto the servers, through the cold aisle, and then back into Mäntsälä.

However, this will change as the company deploys more powerful GPUs. After all, even the frigid Finnish air can only do so much when confronted with 1kW chips. As of December 2024, Nebius said a “liquid cooling system designed by Nvidia” is being installed in Finland, and at the company’s new colocation facility in Kansas City, to accommodate Nvidia Blackwell GPUs.

Another change that the data center will see following its expansion is the move away from diesel generators. Originally installed to ensure uptime in the first data center building, Korolenko says that the second, third, and fourth buildings will not use diesel generators, due to both an improvement in design and the reliability of the Finnish power grid.

The data center also doesn’t have any UPS batteries – “batteries are a huge headache, to be honest,” instead relying on a flywheel to generate kinetic energy that will feed the alternator if the facility experiences a drop in power.

Do you want to build a rack?

In addition to improving current AI cloud offerings, Nebius is also looking to address the GPU imbalance that exists between Europe and the US, noting that because the States is so “compute hungry” a hardware sparsity exists on the continent.

“From day one, we’ve been concentrating on building huge clusters for these great distributed workloads,” Zemskova said. “But we also see the inadequacy in the fact that people who need a lot less cannot find those GPUs on the market. This is why we cover infrastructure needs of any scale, from a single GPU to these large-scale clusters.”

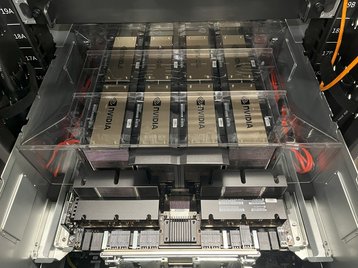

Nebius designs its own racks to house the frankly astonishing amount of GPUs the company has been able to get its hands on, including Nvidia H100s, H200s, and Blackwell GPUs, which, as of late January, should be in the company’s possession “in a matter of weeks.”

The racks in Mäntsälä – in addition to those soon to be deployed in Paris and Kansas City – have been designed by the company’s own R&D team and, according to Nebius, are optimized for free cooling, operating within an inlet temperature range of 15-40°C (59-104°F).

The company also claims that Nebius-designed servers are 28 percent more efficient compared to those in an “average data center” and, in combination with the facility’s “outstanding power usage efficiency” allows it to offer “competitive pricing for GPU resources.”

In a briefing document provided to DCD before the visit, Nebius said its hardware “consumes approximately 30-50 percent less energy for computations than servers with standard architecture while delivering twice the performance.”

While Nebius did not detail how it was defining the “average data center,” at a London event organized by the company in February 2025, Gleb Evstropov, head of compute and network services, explained that the figure was reached by calculating the difference between the power consumed by a standard 19” HGX server and a Nebius HGX server across different inlet temperatures.

However, he went on to note that, while the 28 percent figure related to servers deployed in Nebius data centers, it was closer to 22 percent for servers deployed in colocation facilities.

Mid-way through our visit to the Mäntsälä data center, a fresh batch of racks had just arrived from the manufacturer in Taiwan, and we stopped to watch as they were unpacked.

Turning to a rack that had already been unboxed, Korolenko asked the group if we’d like to see some H100s, before pulling out one of the shelves to reveal Nvidia hardware worth $600,000.

“That’s a couple of Lamborghinis in this one rack,” he says, rather casually.

Nebius is a preferred cloud service provider in the Nvidia Partner Network, and as a result, approximately 450 of the 1,000 engineers the company had employed as of October 2024 work exclusively with Nvidia.

Furthermore, Nebius’ recent $700m fundraise included participation from Nvidia.

Speaking to DCD several months after the trip, Korolenko says that Nebius is still primarily deploying H100s at the moment but will soon be taking shipments of more than 22,000 Blackwell GPUs, with the order consisting of B200s, GB200s, B300s, and GB300s, expected to arrive in that order. Nebius will start by deploying its Blackwell chips in the US, with European deployments to follow soon after.

“It will take longer [to deploy Blackwell] than it takes us to deploy the current generation, for the purely technical reason that first deployments are usually just longer as you need to test everything and fix everything,” Korolenko says.

When asked if he was concerned about the previously reported overheating issues that had plagued early Blackwell deployments, Korolenko says it’s not a worry for the company as Nebius has been working on its Blackwell racks since early November and has not encountered any problems under laboratory conditions.

However, he adds that, while it’s normal to re-architect racks for most new chip generations, Blackwell is noticeably different – “you have different power, different management, and a different layout.

“We’ll see how the mass deployment goes, but I believe that we are leaving ourselves a margin for error, so I believe that it will be good. It will be a learning curve from the start, but so far, it looks okay.”

The future is Nebius

Although Nebius is currently spinning a lot of GPU-shaped plates across multiple regions, speaking in January, Korolenko is confident the company’s various plans are on schedule.

On its decision to launch in the US market, where Nebius is leasing space at a former printing press turned data center in Kansas City, Missouri, he says having a presence in America is important as “most of the customers and most of the money is coming from the US.”

Initially, the company plans to deploy a 5MW Nvidia H200 GPU cluster at the Patmos-owned data center, which can expand to a maximum of 40MW, or about 35,000 GPUs, at full capacity.

While Korolenko acknowledges that Kansas City isn’t the first place you might think of when it comes to data center locations, he says the site was chosen for its power price and availability. The company has since announced a 300MW site in New Jersey.

However, this new focus on the US doesn’t mean that Nebius’s ambitions to plug the European GPU deficit have been put on hold, although Korolenko does note that it’s not just hardware Europe is short on, saying that equipment and construction workers are also harder to come by on the continent compared to other regions. This March, the company announced a small deployment at Verne’s data center in Iceland.

“[The US] is also not so concerned about green power, for example, it’s not even close, to be honest,” he says. “They’re also way more pragmatic and focused on the delivery dates, whereas Europe is just a bit more relaxed.”

Despite the challenges, given how much time the company spent grappling with the uncertainty of its future, Nebius seems happy to find itself in a position where it can speak about these things openly.

Korolenko says it has been an “extremely intense” period for the company, but argues the projects it has unveiled “prove that we can do [what Nebius set out to do].” He adds: “We are pretty much in the form we should be as a company.“

More in Cloud & Hyperscale

Read the orginal article: https://www.datacenterdynamics.com/en/analysis/becoming-nebius/