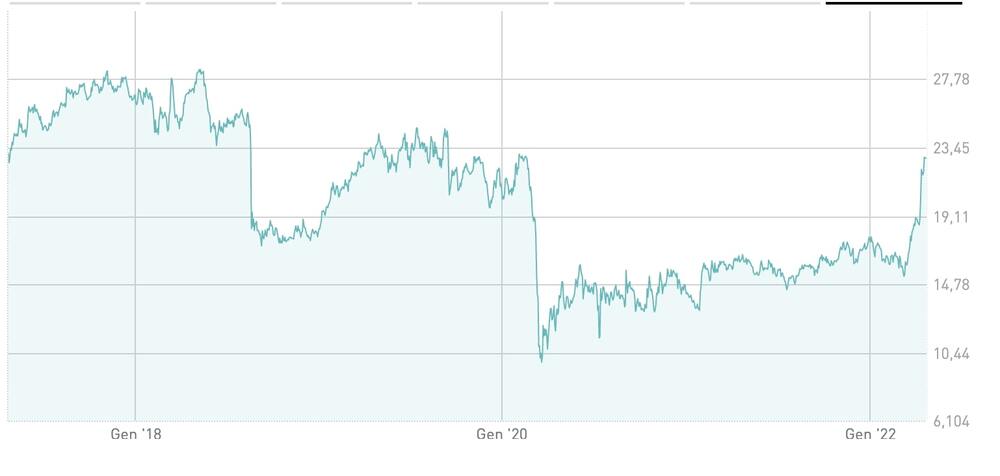

On 14 April, Thursday, the Benetton family and Blackstone Infrastructure Partners announced the launch of their public offer on Milan-listed Atlantia at 23.74 euros per share (including the dividend of 0.74 euros) or up to 12.7 billion euros (see here a previous post by BeBeez). The bidders may pay 4.48 billion euros in equity and 8.225 billions with bank loans for delisting the company. The Benetton family already owns 33.1% of Atlantia through Edizione Holding. At the closure of trading of 14 April, Thursday, the company’s market capitalization amounted to over 18 billion (+4.29%). Atlantia attracted the reported interest of Global Infrastructure Partners (GIP), Brookfield Asset Management (the owner of Oaktree Capital Management) and Madrid-listed contractor ACS (who, like the target, is a shareholder of Spanish infrastructure company Abertis) and a parallel takeover bid was also awaited from this second consortium. However in the last few days rumors are that ACS is changing its mind as the Edizione-Blackstone takerover bid is seen as potentially successful. So ACS is said to be thinking to act alone and bid instead for the Atlantia’s 15-5% stake in Getlink, the concessionaire of the Channel Tunnel, and/or Atlantia’s 50% stake plus one share in Abertis (see here a previous article by BeBeez).

Italian iconic football club AC Milan attracted the interest of Investcorp who is in exclusive talks for acquiring the asset for 1.1 billion US Dollars (see here a previous post by BeBeez). Elliott Management acquired a controlling stake in Milan in 2018. At the end of 2021, the club generated net profits of 3 million euros, increased sales by 40% yoy and fetched 20 million out of the sale of its real estate asset in Milan to Inarcassa RE Comparto Uno, a fund that Fabrica manages. In 2022, AC Milan expects to generate revenues of 300 million euros. In May 2021, The European Elite Report KPMG Football Benchmark said that AC Milan enterprise value amounted to 427 million euros. In 2021, AC Milan posted losses of 96.4 million, sales of 260.9 million and equity of 67.3 million.

Milan-listed TIM officially signed the sale contract to Ardian and other investors of a 41% stake of Daphne 3, who owns 30.2% of Infrastrutture Wireless Italiane (Inwit) (see here a previous post by BeBeez). After such a sale, Ardian will have 90% of Daphne 3 and 27.18% of Inwit. The fund will not have to launch a public offer for delisting the company. TIM will fetch 1.3 billion euros of 10.75 euros (cum dividend) out of the sale of its stake in Inwit and also cashed 200 million for the vendor loan it provided to Ardian for the acquisition of 49% of Daphne 3 in 2020. Inwit has a market capitalization of 10 billion euros. TIM net financial debt amounts to 17.6 billion while the ebitda is of 5.08 billion (6.7 billion in 2020).

Nextalia announced the acquisition of Altaformazione, an Italian provider of digital learning services for corporates (see here a previous post by BeBeez). Such a purchase is part of the consolidation of Digit’ed, a e-learning platform that Nextalia and Intesa SanPaolo Formazione created. Nextalia owns 80% of the asset, while Intesa SanPaolo has 20%. Altaformazione turnover is of 7 million euros while the ebitda amounts to 1.4 million. Nextalia, a private equity asset managing company that Francesco Canzonieri, the former Italian country head of Mediobanca launched, recently attracted the resources of Confindustria, the Italian association of entrepreneurs, who joined Intesa Sanpaolo, UnipolSai Assicurazioni, Coldiretti, and Micheli Associati who invested in the company in early 2021 (see here a previous post by BeBeez). In November 2021, Nextalia I fund reached its first closing with committments for 563 million euros .

Industry 4.0, a private equity vehicle of Quadrivio Group, acquired 65% of Gruppo SKA, a producer of installations for poultry farming from Dino Pozzato who kept a 35% of the business (see here a previous post by BeBeez). The company intends to invest further resources in technological innovation for creating plants for sustainable poultry farming. Intesa SanPaolo financed the transaction with an ESG-linked facility. SKA has sales of 32 million euros. Industry 4.0 already invested 70% of its resources.

The FITEC fund, managed by Fondo Italiano d’Investimento (FII srg), subscribed a 7.5 million euros worth capital increase for acquiring a minority in Friem, a producer of power converters for the energy transition that Angelo Pagliai founded in 1950 (see here a previous post by BeBeez). Orietta Pagliai is the company’s chairwoman while her sons Lorenzo and Fabrizio Carnelli have operative roles. Friem has sales of 29.9 million, an ebitda of 0.384 million and net cash of 2.1 million.

Giuseppe Zanotti Design, a luxury shoemaker, hired Lazard to sell a 30% that L Catterton acquired in 2014 from Vicini and eventually the majority of the business (see here a previous post by BeBeez). The company has sales of 86.6 million euros, an ebitda of minus 7.5 million and a net financial debt of 1.7 million.

Xenon Private Equity acquired 60% of Microtest, a producer of testing machines for semiconductors, from ceos Giuseppe Amelio and Moreno Lupi, who will keep their roles, and the family of the founder Francesco Cantini (see here a previous post by BeBeez). Microtest has sales of 20 million euros with an above 35% ebitda margin

Oslo-listed Avenir LNG acquired 20% and the whole ownership of Higas, the owner and manager of a LNG small-scale terminal in Sardinia (see here a previous post by BeBeez). CPL Concordia and Gas and Heat sold their even stakes in the business. Higas has sales of 0.9 million euros, an ebitda of minus one million and a net financial debt of 0.464 million

Investindustrial poured 120 million euros in Rimac Group, the owner of Rimac Technology, a producer of components for electric vehicle (see here a previous post by BeBeez). Mate Rimac (ceo) founded the company which is the majority owner of Bugatti Rimac and is a supplier of Porsche, Hyundai, Aston Martin, Koenigsegg, and Automobili Pininfarina. Rimac is based in Croatia.

Investindustrial also sold Neolith, a Spanish producer of sintered stone, to CVC (see here a previous post by BeBeez). Investindustrial acquired the majority of Neolith in June 2019 from the Esteve Family whose members kept a minority and management roles. Neolith has sales of 145 million.

Reinold Geiger and André Hoffmann, the executive chairman and ceo of Hong Kong-listed L’Occitane International acquired 80% of Save The Duck, an Italian B Corp fashion firm from Progressio, who purchased 65% of the business in 2018 (See here a previous post by BeBeez). The managers previously acquired a minority of the business and invested with Progressio, Nord Holding and the ceo Nicolas Bargi who will now keep a 20%. Alchimia (51%) and Bargi (14%) sold to Progressio in 2018. In 2020, Save the Duck had sales of 35.3 million euros, an ebitda of 5.9 million and a net financial debt of 18.3 million. In 2021, the company’s turnover has been of 47.3 million while for 2022, expected sales are of 64 million with a 20% ebitda margin.

WRM Group and Swiss energy trader Axpo, signed a una joint venture for carrying on R&D investments in the fields of renewable energies and energy efficiency for big distribution (see here a previous post by BeBeez). Axpo Italia has a production power of 1800 MW

In 2021, Italian private equity HAT Technology & Innovation recorded a NAV growth of more than 5 times yoy (see here a previous post by BeBeez). HAT Sicaf NAV grew of more than 1.1 times. HAT Sistema infrastrutture, a vehicle with resources of 130 million euros, generated a 3.1X return on the invested capital. HAT ICT (50 million resources) generated a 3.1X return. HAT has resources of 400 million and managing partners Nino Attanasio (chairman) and Ignazio Castiglioni (ceo) control the fund .