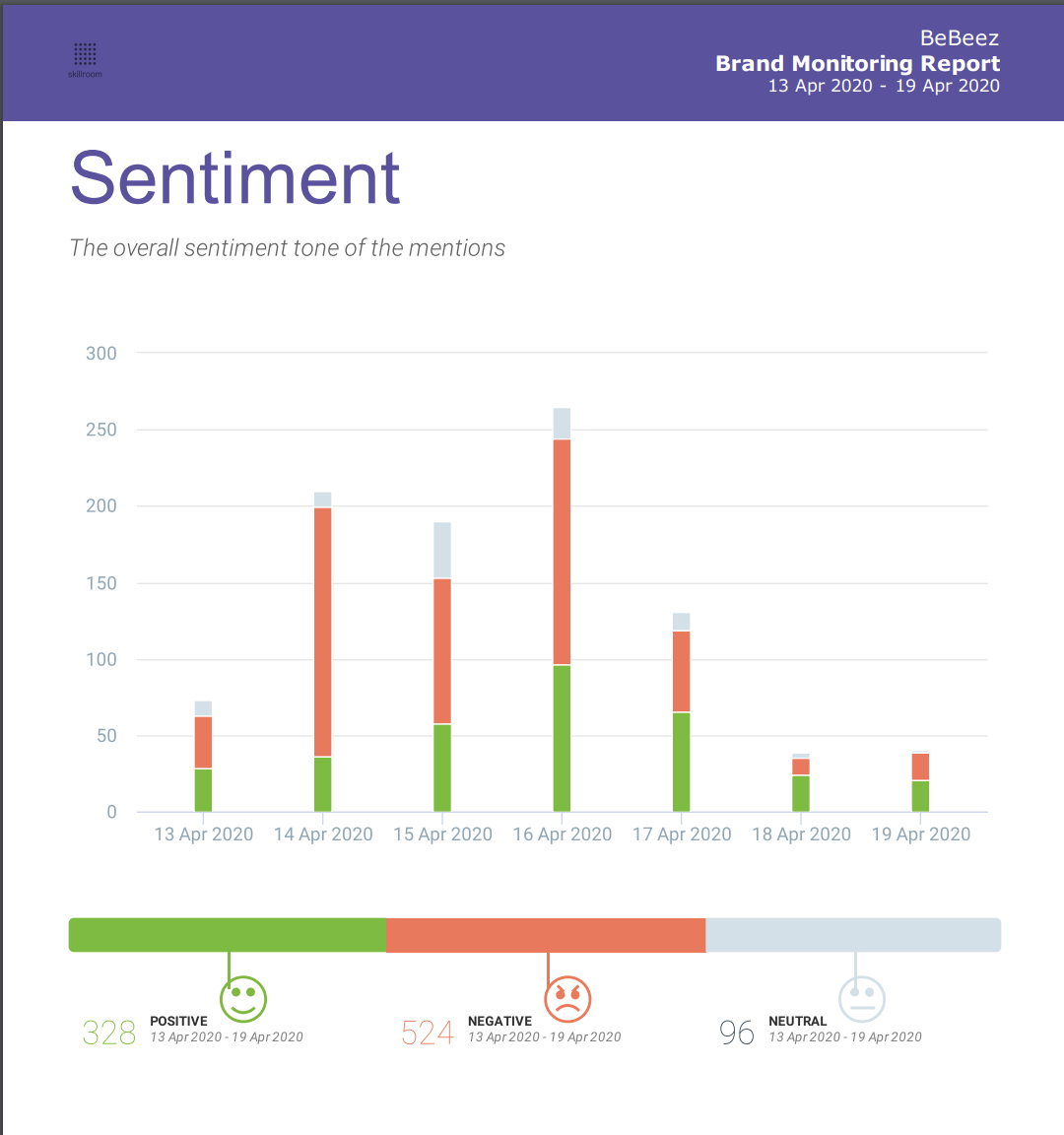

The weekly Invest in Italy Index of Skillroom and BeBeez tracked on the web a negative sentiment of international investors for Italy between 12 and 19 April, Sunday while the Italian Government is negotiating for the European Stability Mechanism (ESM) and the launch of a Recovery Fund with the European Council (see here a previous post by BeBeez). The “invest in italy” topics on the web and on the social networks reached 1068 mentions (573 in the previous week). Only 328 (30.7%) have been positive (versus 46.8% for 268 mentions in the previous week), 524 (49%) have been negative (versus 170 or 29.7%), and 96 (9%) have been neutral (versus 135 or 23.6%). Click here for a test analysis or for information.

Investindustrial tabled an offer for acquiring 22.6% of Milan-listed Guala Closures at 6 euros per share or up to 90.996 million euros (see here a previous post by BeBeez). In September 2019, Guala Closures attracted the interest of Silgan Holdings, Astorg, and Advent International. At the closure of trading on 16 April, Thursday, Guala’s share price was of 5,83 euros (4.8 euros on 15 April) for a total market capitalization of 300.9 million. Investindustrial aims to support the m&a strategy of Guala Closures. The target listed on Milan market in 2019 after a business combination with the Italian Spac Space 4. Guala Closures major shareholders are Amber, Peninsula Capital (10%), Mojto Luxco 2 (5.6%), and Marco Giovannini (24.2%). Guala has sales of 606.5 million (543.1 million yoy), an adjusted ebitda of 113.5 million (104.5 million), and net debt of 462.5 million (454.4 million). In October 2017 Guala acquired Chilean Icsa and in December 2018, the company paid 21.1 million for Scotland’s United Closures and Plastic. Earlier in January, Guala acquired Germany’s Closurelogic and in March sold GCL Pharma to Bormioli Pharma for 8.9 million euros. Investindustrial is one of the private capital investors that BeBeez Private Data monitors. Find out here how to subscribe for the Combo version that includes BeBeez News Premium.

Asacha Media Group, the movie production company that Marc Antoine d’Halluin founded with Gaspard de Chavagnac and Marina Williams, acquired 75% of Italian competitors Stand By Me and Picomedia with the support of Oaktree Capital Management, which invested 100 million euros (see here a previous post by BeBeez). The three companies have a cumulated turnover of about 50 million. The merged entity will be active in the EMEA region with a focus on France, Italy, Germany, Spain, and the counties of central and eastern Europe. However, the company ams to develop its business in the UK, Scandinavian countries, the Middle East and Turkey through startups and joint ventures. Simonetta Ercolani founded Stand by Me and owns 50% of the business. Francesco Nespega (40%) and Giuliano Tranquilli (10%) will sell their holding and reinvest with Oaktree in the new group of which Ercolani will hold 25%. Stand by me has sales of 1.7 million. Picomedia belongs to Roberto Sessa that may keep a minority of the firm which has sales of 16 million and profits in the region of 3 million.

Italian insurance broker First Advisory, a portfolio company of Riello Investimenti, aims to grow in Italy and abroad through the digitalization of its platform and m&a transactions (see here a previous post by BeBeez). For implementing such a strategy, the company hired William Folini (Chief Innovation Officer), Giulio Marconi (cfo) and Edoardo Bianchi (coo). In 2016 -2019, First Advisory posted a growth rate of above 60% (turnover- active commissions) with an ebitda of 4.2 million euros in 2019. Riello Investimenti acquired 51% of First Advisory at the end of March 2020. Massimiliano Merlo, Giuseppe Frasca and Lorenzo Fanti have 49% of the business. Investors club deal Ninja 2 invested in First Advisory in 2017 and sold all its stake in the company. Ninja 2 members are Leonardo Bruzzichesi, Nicola Pedrone, Ivano Sessa, Maria Giovanna Calloni, Dario Frigerio, Roberto Nicastro, Federico and Michele De Nora, Gianandrea Caselli, and Michelangelo Mantero.

Iaf Store, the Italian online retailer of food integrators, hired Milan-based advisor Ethica for selling a stake to private equity investors (see here a previous post by BeBeez). The asset attracted the interest of Trilantic Capital. The Corradi brothers founded Iaf Store in 2007 has sales of 20.38 million euros with an ebitda of 0.771 million. The company aims to generate sales of 40 million with an ebitda of 6 million in 2020. Trilantic Capital Partners acquired 90% of Doppel Farmaceutici in 2015.

In 2019, Italian independent corporate family office CFO sim is carrying on the acquisition of Italian competitor Alpe Adria Gestioni sim (see here a previous post by BeBeez). Alpe’s ceo Umberto Spadotto will be the ceo of CFO sim which acquired a 52% stake from Banca Credinvest. The target’s founders kept the remaining 48%. In February 202, CFO sim acquired the whole Alpe Adria Gestioni. Spadotto founded the firm with Felice Fort and Michelangelo Canova in 1995 as a subsidiary of Dutch ABN Amro Bank. The founders acquired ABN’s stake in Alpe in 1998

Negma Group, an investor based in London and Dubai, will pour 7.5 million euros in the bond and equity of Milan-listed Energica Motor Company, a producer of electric motorbikes (see here a previous post by BeBeez). Negma will subscribe a 0.5 million capital increase a 1.65 euros per shares and a 4 million bond convertible with warrants that the company may renew for up to 3 million at the same conditions. In 2018, the company posted sales of 2.15 million (0.507 million yoy), net losses of 7.27 million (5.82 million), net debt of 1.4 million (3.3 million). Energica expects sales for 2019 to amount to 3.25 million (+50% yoy), while in early 2020 the orders portfolio amounted to 40% of the whole sales for 2019. Energica Motor’s ceo Livia Cevolini said that with this agreement, the company received 0.5 million in equity and 4 – 7 million through a convertible bond.

IDAK Holding, the holding of Swiss food player KADI, a company of private equity funds Invision and Nord Holding, acquired the majority of Margherita, a producer of frozen pizzas and snacks (See here a previous post by BeBeez). IDAK belongs to KADI’s management and aims to develop a producer of premium food products. Fabrizio Taddei founded Margherita in 2001. In 2014, Mirko Baldi and Werner Furrer, the founders of Swiss Fresh & Frozen Food, invested in Margherita and founded Margherita (Schweiz). Margherita has sales of 42.1 million euros, an ebitda of 12.3 million and net cash of 3.9 million. Andrea Ghia will replace Taddei in the role of ceo. KADI has sales of above 80 million CHF.

TIM Management, an advisor for interim management, transition, turnaround and foreign subsidiaries management, hired Paolo Ciccarelli as head of the IPO advisory and Ettore Del Borrello as head of private equity (See here a previous post by BeBeez). Ciccarelli, a chartered accountant since 1985, is the ceo of Schmid and an independent director of Almaviva and previously worked as cfo for Gruppo Borsa Italiana, Director of Finance at London Stock Exchange, cfo of Barclays Italy. Del Borrello is a seasoned m&a director with a solid experience as chief restructuring officer for mid-size and big companies. TIM’s partners are Domenico Costa, chairman, Cesare Tocchio, ceo, Federico Costa, Alberto De Bernardi, cfo, and Vittorio Ferrero.

Richard Garnier joined Italian industrial holding Bemycompany Capital Partners (see here a previous post by BeBeez). Garnier is a serial startupper that worked as CEO/COO for Financial Times Group, Thomson Reuters, Allianz Group Company Euler Hermes. Garnier will support Bemycompany for the roadshow that is about to start for attracting new international investors, said Antonio Quintino Chieffo, who founded the firm in October 2019 . Bemycompany aims to support Italian SMEs towards the growth through acquisitions and the launch of IPOs. Bemycompany aims to raise resources of 15 million and invests in companies with sales of 0.5 – 15 million that posted annual growth of 10% for the previous three years.

Alto Partners launched a club deal for investing in spare parts for trucks, tractors and earthmoving equipment (see here a previous post by BeBeez). The fund set the newco Spare Partners, which created the newco Optimus, a firm with resources of one million euros. Spare Partners’ further shareholders are Vitaliano Borromeo Arese (1.6%), Francesco Baggi Sisini (2.4%), Gerardo Braggiotti (3.2%), and Investitori Truck (9.5%), which belongs to Hydro Holding, a portfolio company of NB Renaissance since December 2018.

Fondo Ania F2i acquired 92.5% of Compagnia Ferroviaria Italiana (CFI), the main Italian rail freight operator (see here a previous post by BeBeez). Giacomo Di Patrizi, ceo, shareholder and founder of the asset, sold the stake while keeping his role and a 7.5% of the company. CFI has sales of 64 million euros. Renato Ravanelli, the ceo of F2i, said that the fund aims to implement a buy and build strategy for the company and to develop intermodal synergies with other portfolio companies of the fund. Earlier in February, Fondo Ania F2i made its first 320 million closing, above a 250-300 million target and ahead of a target of 500 million by the end of 2020.

Teamsystem, an Italian publisher of B2B software for corporates and professionals that belongs to Hellman&Friedman since December 2015, acquired 61% of competitor MBM Italia (see here a previous post by BeBeez). MBM Italia has sales of 6.9 million euros with an ebitda of 3.5 million. Teamsystem has sales of 417.9 million, an adjusted ebitda of 170.5 million, and a net financial debt of 750.9 million. Earlier in February, Teamsystem acquired Italian IT company Soluzioni Informatiche.

Vincenzo Nicastro, the extraordinary commissioner in charge of handling the sale of Piaggio Aerospace’s subsidiaries Piaggio Aero Industries and Piaggio Aviation, deferred to 29 May 2020 the deadline for expressing interest for the assets (see here a previous post by BeBeez). Mubadala, Abu Dhabi’s sovereign fund, is the owner of Piaggio Aerospace, which has a portfolio of orders amounting to 900 million euros. Mubadala acquired 35% of the asset in 2006, while the Ferrari and Di Mase Families kept 55%. Banks and minor shareholders kept 10% of the company. In November 2013, Tata Limited, a British subsidiary of India’s conglomerate Tata and Mubadala subscribed a 190 million capital increase of Piaggio Aero Industries. Tata Limited had 44.5% of Piaggio Aero Industries, Mubadala Development 41%, Piero Ferrari 2%, and HDI 12.5%. Mubadala acquired 98.05% of Piaggio Aero Industries in 2014, while Pietro Ferrari kept 1.95%. In 2018, Piaggio Aerospace’s debt amounted to 618.8 million euros, sales at 100 million (-66% since 2014).

Impresa San Siro American Funerals acquired Italian competitor Cellini (see here a previous post by BeBeez). Cellini has sales of 0.5 million euros. Impresa San Siro has now sales of 20.5 million and an ebitda of 4.4 million. Earlier in January it acquired 70% of Onoranze Funebri Serpi Fabio from Giorgio and Aldo Serpi. Impresa San Siro belongs to Augens Capital and BMO Global Asset Management, part of BMO Financial Group (Bank of Montreal), since February 2019 when second generation owners Andrea and Massimo Cerato reinvested for a 20% and kept their role of chairman and ceo.

Angelomario Moratti acquired Inca Cosmetici from Inca (Industria Nazionale Cosmetici e Affini), a company in receivership (see here a previous post by BeBeez). Inca has sales of 22.8 million euros, an ebitda of 1.9 million and a net financial debt of 2.8 million. Varese Court accepted Inca’s application for receivership on 4 June 2019. Inca went up for sale for 0.8 million and one million for the repayment of debt.

Massimiliano Dendi (One Factory), Andrea Marangione (Maider), Dino Poggio (manager and business angel), and Gabriele Rossi (Aetos Partners) launched Net4Capital, a club deal vehicle for investiing in private equity and venture capital (See here a previous post by BeBeez). Poggio is the ceo of Net4Capital.

In 2019, Italmobiliare posted profits of 77 million euros and net cash of 569.9 million (see here a previous post by BeBeez). As previously reported, the company will pay an ordinary dividend of 0.60 euros per share (0.55 euros in 2018) and an extraordinary dividend of 1.2 euros per share on 6 May, Wednesday. The portfolio’s NAV is of 1.74 billion. The company appointed as board members Laura Zanetti (president), Carlo Pesenti (ceo and coo), Livio Strazzera (vicepresident), Elsa Maria Olga Fornero, Vittorio Bertazzoni, Mirja Cartia d’Asero, Chiara Palmieri, Luca Massimo Fabio Minoli, Giorgio Bonomi, Sebastiano Mazzoleni, Marinella Soldi, and Antonio Salerno (representing RWC Asset Management and Fidelity International). The new members of the auditing board are Pierluigi De Biasi (president – representing RWC Asset Management and Fidelity International), Gabriele Villa and Luciana Ravicini, Maria Maddalena Gnudi, Michele Casò, and Tiziana Nesa.

The readers of BeBeez News Premium have access to the BeBeez Reports and Insight Views. The monthly subscription fee is 20 euros per month plus VAT (or 240 euros per year plus VAT). The subscription to BeBeez Private Data Combo grants access to BeBeez Private Data, a database that includes the financials of more than 1700 Italian companies that belong to private equity, venture capital and private debt investors, and allows to access BeBeez News Premium for a monthly fee of 110 euros plus VAT (or 1320 euros plus VAT per year). Students can subscribe to BeBeez News Premium for 15 euros (VAT included) for the first month and renew the subscription monthly. Please click here or write to info@edibeez.it for further information about the subscription procedure.