Despite political uncertainty, the Italian deal flow for mid-market is still robust and boosts also the share price of few listed companies. Private equity firms keep adding on to their portfolio assets and selling their holdings. Meanwhile, new firms come to town.

Listed financial holding Intek Group, Diva Moriani (vicepresident of Intek and of KME) and consultancy firm Nativa founded benefit company Nextep, an investment platform with a focus on companies that leverage on sustainability (see here a previous post by BeBeez). Nextep aims to raise funds to invest in Spacs and private equity firms. Moriani is a board member of Italian blue chips ENI, Assicurazioni Generali, and Moncler as well as charities Fondazione Dynamo and Associazione Dynamo Camp.

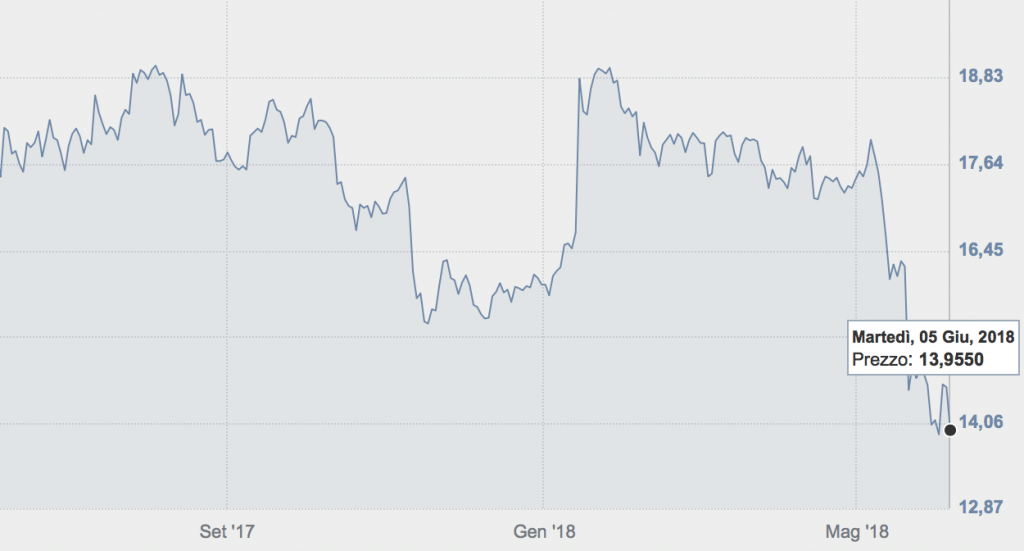

Timone Fiduciaria, the holding company that groups the shareholder of syndicate pact for Milan listed asset management firm Azimut, will raise its holding in the company to 24.2% from current 16% (see here a previous post by BeBeez). Private equity firm Peninsula Capital will join the shareholders’ agreement and Azimut managers will acquire Azimut’s shares at an average price of 14.37 euro for a total transaction value of 155 million euros.

Irideos, the Italian ICT company that belongs to financial sponsors F2i and Marguerite, acquired Enter, an Italian provider of tlc and datacenter services (see here a previous post by BeBeez). The closing of the transaction is subject to the authorization of the Italian Premier.

Icon Infrastructure, a private equity firm, acquired a controlling stake in Eco Eridania, a waste management company that has revenues of 145 million of euros (see here a previous post by BeBeez). Xenon Private Equity and Roccaforte, the hoding that belongs to the family of Andrea Giustini (Eco Eridania ceo), sold their interest in the business. Since 2014, Eco Eridania issued bonds that Muzinich Italian and European Private Debt and Pemberton Emmdf and Debt Holdings subscribed through private placement for acquiring several competitors such as Team Ambiente, Paderno Energia, Eco Mistral, Mengozzi, andElettrochimica Carrara.

Prudential Life’s advisor Kpmg has received binding offers for insurance company Pramerica Life (see here a previous post by BeBeez). The bidders list includes private equity firm Cinven, owner of Eurovita, and foreign industry peers. Pramerica Life’s reserves are worth 1 billion of euros.

Italian Pharmaceutical company NTC, part of the portfolio of Wise private equity, acquired a portfolio of ophthalmic products from Swiss giant Novartis (see here a previous post by BeBeez). Mediocredito Italiano financed the transaction with a mix of debt and equity. With this acquisition, NTC strengthen its position in Spain, Portugal and Poland. The company belongs to Wise since 2015 and has revenues in the region of 26 million of euros, an ebitda of about 1 millio, and net financial debt of 2.5 million. Ivan Veronese, Carlo Vanoli, and Andrea Pavero, three entrepreneurs-managers with a strong experience in the pharma sector, supported Wise for this transaction. Veronese will be the ceo of NTC.

Fedrigoni, the Italian producer of special paper that belongs to Bain Capital, acquired Italian competitor Cordenons (see here a previous post by BeBeez). The target has revenues of 89 million while its headquarter is in Milan.

Nexi sold its 25% stake in Hi-Mtf sim, a multilateral trading facility for banking shares and bond platform (see here a previous post by BeBeez). Luigi Luzzatti, a company that groups several Italian saving and loans, acquired the asset and became even shareholder of the company together with Banca Sella, Iccrea, and Aletti. Nexi belongs to private equity firms Advent International, Bain Capital, and Clessidra. The company has also hired UBS and Mediobanca for selling Oasi, its developer for banking compliance solutions (see here a previous post by BeBeez). Advisors expect for non-binding offers after this summer and close the sale by this year-end. The list of potential buyers includes Cerved Group, Crif, Tecnoinvestimenti, and consultancy firms like Accenture and PwC. Vendors expect to fetch 130 – 150 million out of such a sale.

Treviso Civil Court accepted Pasta Zara’s application for receivership and appointed Marco Parpinel, Lorenzo Danzo, andDanilo Porrazzo as commissioners for the company (see here a previous post by BeBeez). These professionals have to table by 8 October a purpose for debt restructuring or definitive receivership. Veneto Sviluppo, the fund that the Veneto region created for supporting the local mid-market businesses after the bankruptcy of Veneto Banca and Banca Popolare di Vicenza, may support Pasta Zara. The fund may also support iconic bakery producer Melegatti (see here a previous post by BeBeez).

A group of entrepreneurs based in the North-Eastern region of Veneto, founded private equity Arsenic (see here a previous post by BeBeez). The firm will invest in fashion startups and young companies. Boutique M&A firm Orefici Finance will be Arsenic’s exclusive advisor.

Electa Ventures, Azimut Global Counselling, and Ipo club, the firm that Azimut and Electa created for investing in pre-booking or pre-Ipo businesses, subscribed a convertible bond worth 8 million of euros that The Organic Factory issued (see here a previous post by BeBeez). Electa, Ipo Club, and Azimut also acquired special shares of the company, an Italian producer of organic oil and lecithin with revenues of 40 million and an ebitda of 4 million.

Unigrains, the French financial holding, will launch Fondo Agroalimentare Italiano (FAI), an Italian investment firm with a focus on agri-food sectors, said Jean-François Laurain, ceo of Unigrains, and Francesco Orazi, investment director of FAI (dee here a previous post by BeBeez). Unigrains already acquired Italian logistic company Trasporti Romagna and food producer Sfoglia Torino and will add these assets to FAI’s portfolio. The fund has a fundraising target of 50-70 million of euros and announced its first closing for 40 million. Unigrains funded FAI with 25 million. The Italian firm aims to buy minorities and majorities of Italian SMEs with sales between 10 and 150 million. Furthermore, the family offices and financial sponsors that support FAI, may co-invest in selected transactions.

Recordati, the listed Italian pharmaceutical company, is again under the spotlight, as private equity firms are courting it (see here a previous post by BeBeez). Further to have reportedly held sale talks with CVC, which put negotiations on hold after the Italian political uncertainty, Recordati attracted interest from financial sponsors Cinven and Bain Capital. Recordati has a market capitalisation of 6.9 billion of euros.

Milan-listed factoring firm Banca Sistema is of interest to private equity firms (see here a previous post by BeBeez) Market rumours say that potential bidders are financial firm JC Flowers and listed competitor Banca Ifis, which denied any interest in the asset. Gianluca Garbi , the company’s ceo, said that he has not received any offer. A 46.02% of Banca Sistema’s equity belongs to a syndicated pact of shareholders including Società di Gestione delle Partecipazioni in Banca Sistema, in which Garbi has a controlling stake, and Fondazioni bancarie di Alessandria, Pisa e Sicilia.