The data now confirms what VCs and founders have been saying: defence tech has become one of the hottest sectors in Europe in 2025.

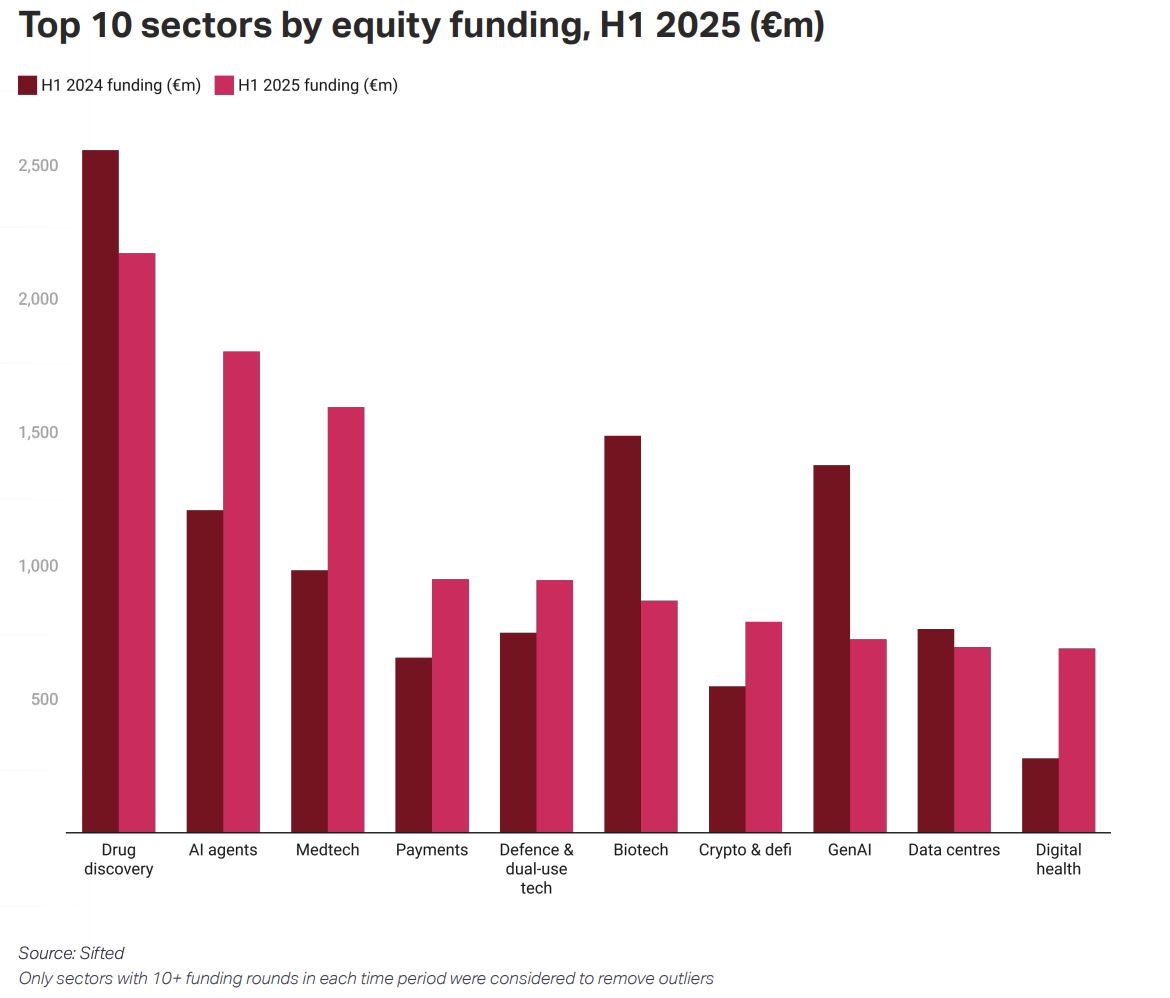

As geopolitical tensions between Russia, the US and elsewhere ratcheted up in recent years, investors are increasingly taking out their chequebooks. According to new Sifted data for the first half of 2025 (H1), VCs funnelled €946.3m into defence startups — a hefty 26% increase from the same period in 2024, making it one of the top five best-funded sectors for the first time.

The overall number of defence tech deals also skyrocketed, up 54%. Most of those deals — 31 of 36 — were early stage.

German AI defence tech Helsing raised the lion’s share of the funding (and the largest deal of H1) with its €600m Series C in June led by Spotify cofounder Daniel Ek’s investment firm Prima Materia. The fundraise gave the four-year-old startup, which makes AI battlefield software, autonomous strike drones and underwater surveillance systems, a €12bn valuation — making it one of Europe’s most valuable startups.

Two other drone makers also had big fundraises this year: German autonomous surveillance drone startup Quantum Systems and Portuguese drone maker Tekever both raised unicorn-making rounds in May, which valued them at €1bn or more.

Thanks to Helsing but also other drone and robotics makers, Germany raked in the vast majority of the funding in H1, with €805m — which includes Munich-based autonomous unmanned ground systems maker ARX Robotics’ €31m Series A in April.

The “ecosystem is booming,” says Jack Wang, partner at Berlin-based VC Project A (which has backed ARX Robotics and Quantum Systems). He says that there are “more funds in defence tech than ever,” with “pressure [and] guidance from LPs seeing outcomes like Helsing, Quantum Systems, etc. reaching $1bn+ and asking their GPs to invest in defence tech.”

He believes there are more European VCs making their first defence investments than ever before.

“Deals are moving slower than they should be, but pace is getting a bit better,” says Nicholas Nelson, a general partner at Archangel, an Estonian fund which invests in early-stage defence tech across Europe.

‘Defence-first is becoming less contrarian’

While defence may be catching on, many investors still only invest in non-lethal technology and dual use startups — meaning those with both military and commercial applications.

However, although it may take some time to see a lot of weapons tech deals in the data, some investors believe VCs are getting more comfortable backing tech that can attack or is focused primarily on defence applications.

“Defence-first is becoming less contrarian, but many investors lack conviction,” says Nelson.

Some investors are nonetheless taking a step in that direction — particularly in the Baltics, where proximity to Russia has stoked increased concerns. “Estonia, Finland and Poland all feel a sense of urgency about innovating in defence that you simply do not see in Madrid or London,” Federico Fini, an investor at Join Capital, recently told Sifted.

So far this year, investors like Estonian state-backed fund SmartCap and Estonia-based VC Darkstar have dedicated funds to backing weapons. SmartCap announced a €100m defence fund in January to invest in both VCs and startups, with the caveat that they must be allowed to invest in weapons. Meanwhile Darkstar, an Estonian coalition of founders and investors, has closed €15m of a new €25m fund to exclusively invest in startups working on military applications, including weapons, across Europe.

More generally, there are a number of new first-time defence tech funds with a first or final close so far in 2025.

Trends to watch

Drones are still big — much to some investors’ chagrin.

There are “still too many founders skating to where the puck is, rather than where it is going — e.g., yet another drone company, mine detection,” argues Nelson.

Wang estimates about one in four founders his firm is speaking with are building some kind of aerial drones — some autonomous, some not. “Some players have very strong traction with non-autonomous drones largely due to Ukraine,” he adds. “We also see strong domestic military purchasing for these starting to happen, especially from startups in their own country.”

One area Wang is watching: interception drones, or counter-missiles. Those are still “largely unsolved despite the increase in investment.”

Another area Wang says the firm is spending more time: spacetech focused on defence. He says that very few startups in this area derive revenue from European ministries of defence (MoDs) or big defence contractors, relying instead largely on the European Space Agency (ESA). “Ironically most space-facing startups catering for a dual-use defence use cases are speaking with the US Space Force more than any European MoDs; we hope this will change soon.”

Other investors have been eyeing maritime technology to protect against rising concerns of underwater cable sabotage.

Read the orginal article: https://sifted.eu/articles/europe-defence-tech-h1-2025/