The Dutch tech industry has been a hotbed of innovation and growth. However, the recent slowdown in the sector’s progress presents a startling contrast to its former glory.

The annual State of Dutch Tech report by Techleap reveals that “the growth of the Dutch tech sector has stagnated in the past year.”

Dutch startups are growing at a slower pace due to longer investment cycles compared to European countries such as the UK and France.

Let’s take a look at the key takeaways from the report:

Decline in VC investment

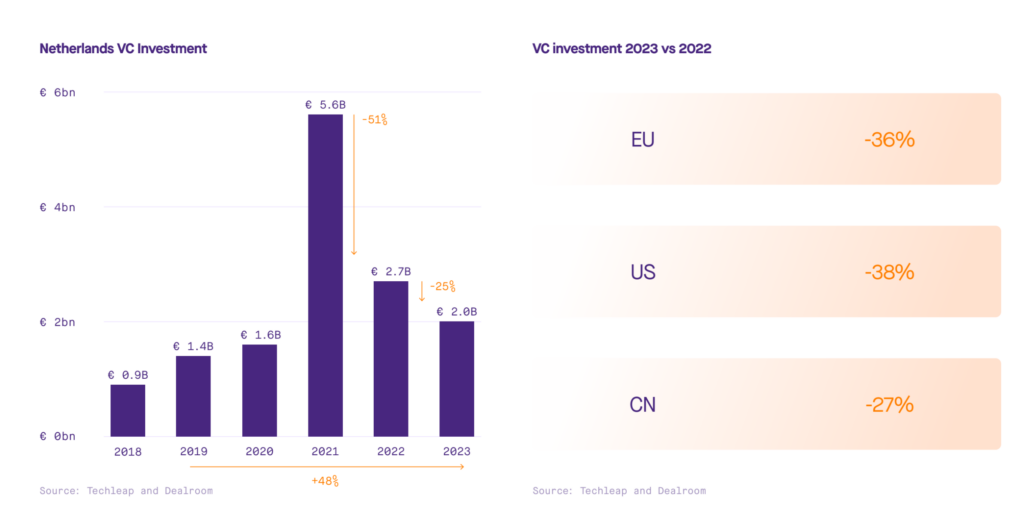

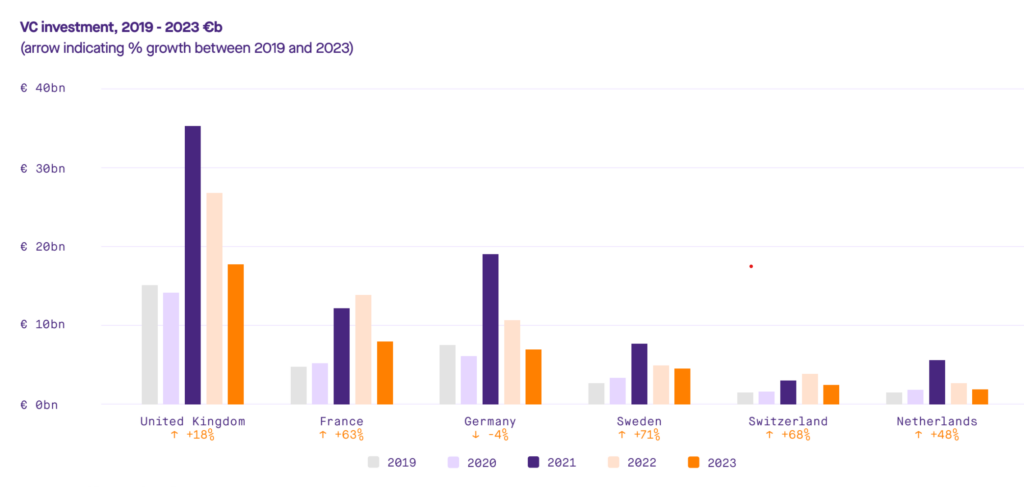

According to the report, the VC investment dropped by 25% in the Netherlands in 2023, compared to 37% globally and 36% in Europe.

In part, inflation, high-interest rates, and geopolitical uncertainty resulted in broader economic uncertainty, which created challenging conditions for tech companies.

Additionally, the report says Dutch tech companies typically lag one year behind the European average and two years behind the US average in advancing to the next funding round.

Gender pay disparity remains a pressing issue

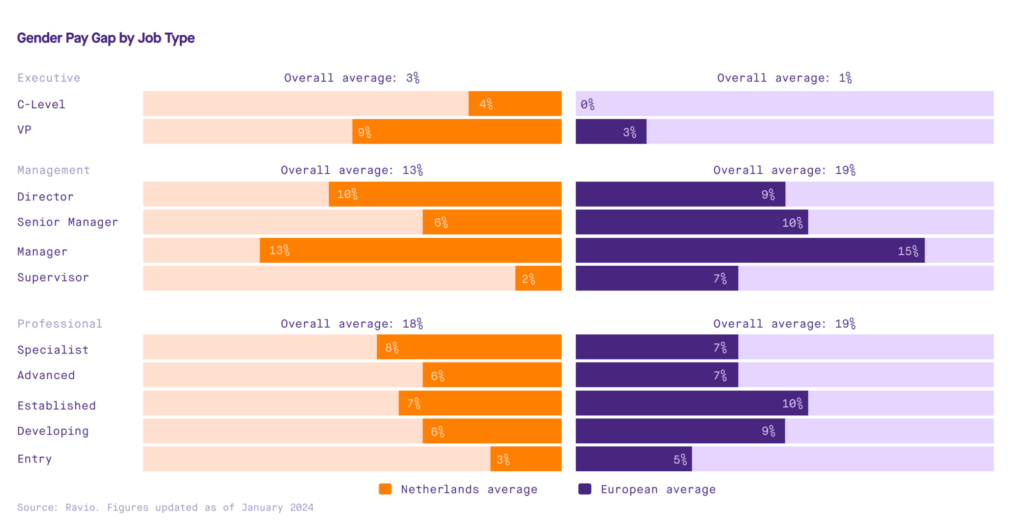

Across Europe, there is a 25% gender pay gap (unadjusted, median). In the Netherlands, this gap is somewhat lower, standing at 22%, according to the report.

When examining the gender pay gap and the representation of women in engineering and commercial job families, the Netherlands is slightly ahead of the European average in terms of reducing the gender pay gap.

Increase in acquisitions, no IPOs

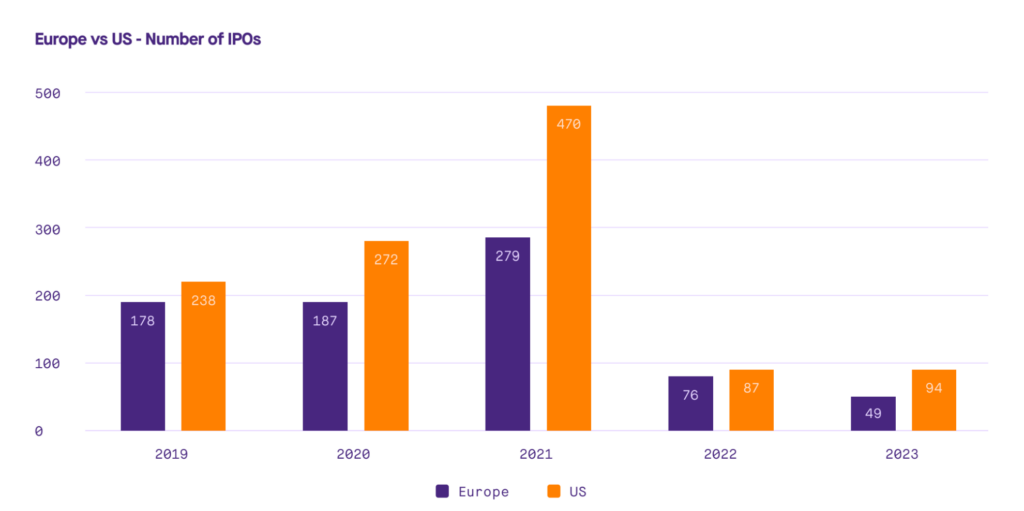

The report states that 2023 saw an increase in acquisitions and no IPOs. 66% of Dutch startups and scaleups were acquired by non-Dutch companies or PE funds between 2019-2023, with the largest acquisitions in 2023 being PayU €550M and SynAffix €100M.

Dutch tech IPOs peaked in 2021, with seven companies going public, from just three the year before, but there has been a listings drought over the past two years.

More capital in the health and semiconductor sectors

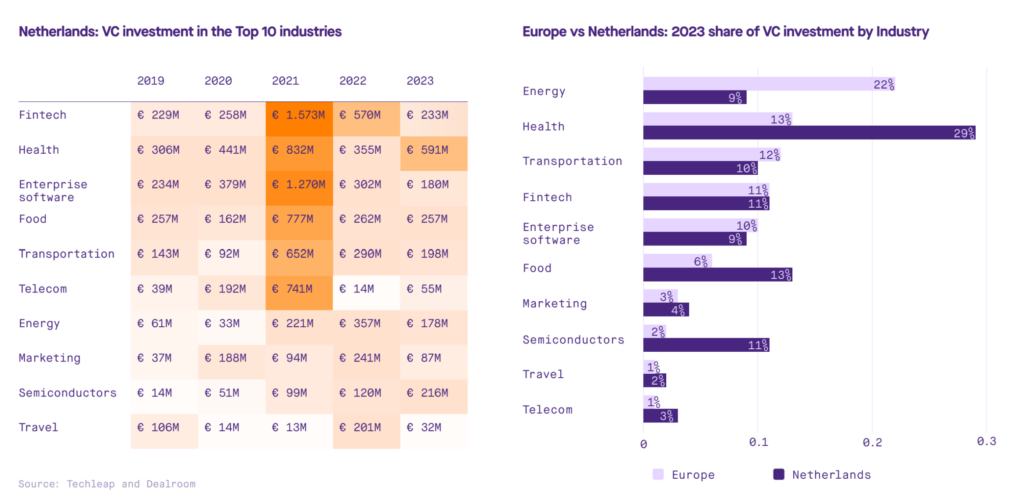

Combined, investment into health, food, and fintech sectors made up around €1B in 2023, representing over 50% of total Dutch VC investment.

Health has seen the greatest increase in investment from 2019, adds the report.

This shift was driven by increases in investments in medical devices, growing by 141%, and pharmaceuticals with a 148% rise.

The Netherlands has attracted a higher investment share than the European average in food (13% v. 6%) health sectors (29% v. 13%), and semiconductors (11% v. 2%).

No unicorns in the Netherlands

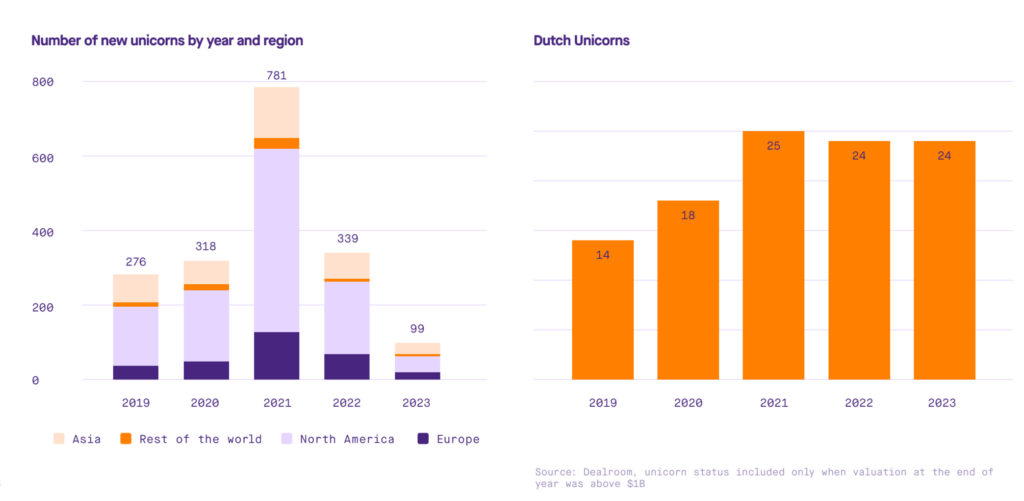

The world is in a unicorn winter, with only 99 born in 2023, states the report.

Europe is particularly affected, with only 16 new billion-dollar companies. It represents a sharp decline from 126 created in 2021. Half of the new unicorns originated in North America in 2023.

The Netherlands is home to 30 companies that reached unicorn status, of those 6 are currently valued below $1B.

In 2023, no new unicorns were created in the Netherlands, discloses the report.

Dutch tech companies funding

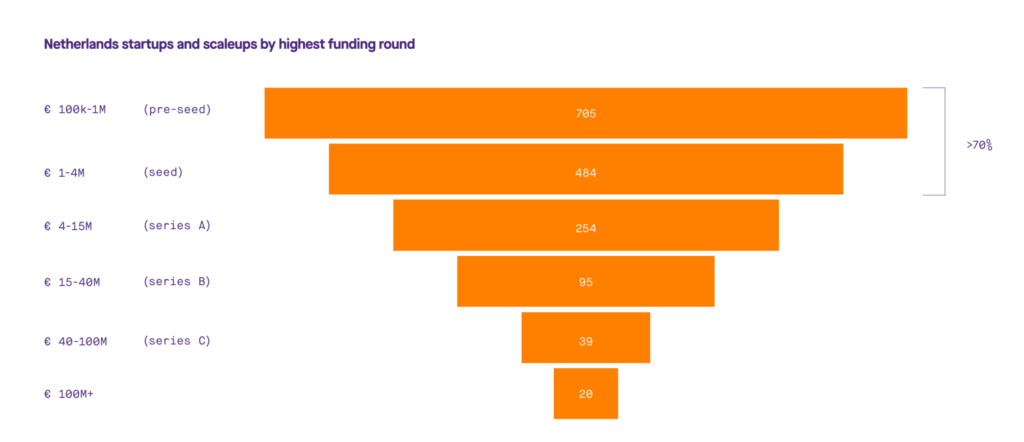

As per the report, around 70% of Dutch tech companies fail to raise beyond seed investment.

In the Netherlands, only 1.3% of companies have raised Growth equity (€100m+ investments), compared to 2.8% in the German tech ecosystem.

Dutch startups experience a protracted path to late-stage funding, taking around 6 years to reach Series B, the slowest growth rate among top countries by VC investment in Europe.

Dutch tech companies typically lag one year behind the European average, and two years behind the US average in advancing to the next funding round.

Financing growth

Investments: Despite the Dutch tech sector still being one of the best-performing in Europe, investments declined by 25% in the past year.

The scarcity of mega-rounds is the main factor in declining Dutch investment in 2023.

In the first three quarters of 2023, the Netherlands witnessed a complete absence of investment rounds over €100M.

During Q4, the situation improved when a substantial round was secured by VectorY Therapeutics (€129 million).

VC Investments: The Netherlands has seen 48% VC investment growth comparing 2023 to 2019, topping the European average of 33%. However, Sweden is leading the way in Europe, with an impressive 71% growth compared to the period before the pandemic.

14% of Dutch tech businesses have been co-founded by women, and 9.2% of VC investment was raised by these teams in the past five years, illustrating an under-representation of investment in women-led tech businesses

Dutch investors: In 2023, Dutch investors participated in 834 investment rounds, of which 330 were rounds in companies headquartered in the Netherlands.

Outside of the Netherlands, Dutch investors mainly participate in rounds together with foreign investors, 75% of the 504 rounds outside the Netherlands were co-investments with foreign investors.

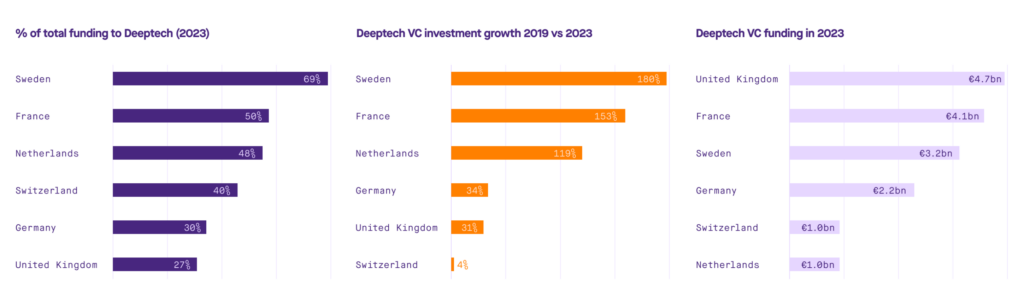

Deep tech ecosystem

In the Netherlands, almost half of the investments (48%) in the past year went to the deep tech sector. Consequently, the sector raised 15% more than in 2022. There has been significant investment in companies originating from universities, demonstrating the potential value of the Dutch academic world.

Dutch AI investment lags behind Europe’s frontrunners, the UK, France and Germany.

In the Netherlands, over 2,500 companies have been started by researchers and students since 1990. Over 1,200 have gone through the Knowledge Transfer Offices (KTOs) of 1 of 22 leading research institutes.

Of these 1,200 companies, more than 500 have an IP license agreement with a university. The 1,300 companies that didn’t go through a KTO are mainly student startups, often supported by incubators and accelerators.

Dutch research institutes focus on health, pharmaceutical, and biotech industries accounting for 64% of currently active research-based ventures as of 2023, says the report.

The report also says that life sciences and biotech companies receive the largest proportion of funding, accounting for 34% of all investment going to research-based ventures between 2019 to 2023.

Talent dynamics

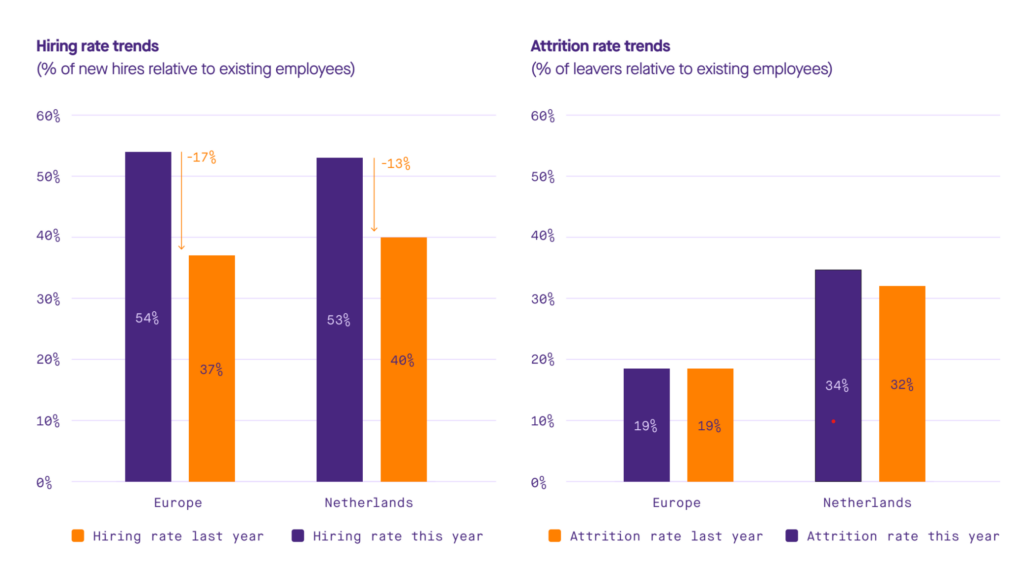

A slowdown in hiring rate was observed across the whole of Europe from 2022-2023, dropping by 17%. The Netherlands followed a similar trend, with the hiring rate falling slightly less, by 13%.

In the Netherlands, hiring among tech companies dropped to 14% trends with a 14% drop in hiring rate for commercial roles, compared to a 27% drop in engineering, and a 16% drop in product hiring rates.

Despite the slowdown in hiring, talent shortages are still seen as one of the three biggest risks to growth, says the report.

However, the highest number of jobs in the tech sector are in scaleups, accounting for nearly 42% of all tech employment, with 62.7k jobs in just 780 companies.

Out of that, the proportion of STEM graduates is lower in the Netherlands than in neighbouring countries but has steadily increased from 16.6% in 2017 to 19.3% in 2021.

Regional analysis

The report cites that the Netherlands is focusing on building a nationwide ecosystem through public initiatives that drive connections between key startup hubs.

North Holland, South Holland, and North Brabant represent the largest clusters of startups and scaleups, attracting 85% of total Dutch VC investment.

Notably, North Holland is home to 63k startup jobs, reflecting its size, and primacy in attracting VC investment.

Groningen: There is a strong focus on life sciences in the region, a sector that saw EV Biotech raise €4.5M in 2023. This sector is supported by initiatives led by the University Medical Centre Groningen (UMCG), in the vicinity of which Campus Groningen has created the Healthy Ageing Campus.

Friesland: In this region, VC investment in enterprise software, fintech and transportation increased in 2023 following a year of low investment in 2022, according to the report.

This region has three active support organisations: BD Friesland, Founded in Friesland, and Be Start, working to grow the local ecosystem. Around one-third of Dutch water technology exports are realised by companies in the Northern Netherlands, most of which are located in Friesland.

Noord Holland: A popular founding location, startups, and scaleups in this region raised about 50% of the total VC investment for 2023 and represented 41% of the startup jobs recorded in the Netherlands.

In 2023, 24% of VC investment originated from the US compared to domestic investment at 39%.

Fintech, health, and enterprise software were the top industries in 2023, representing 40% of total investment in the region.

Zuid Holland: South Holland is a hub for impact-focused startups. Several impact SDGs are covered, with a stronghold in energy transition (SDG7), circularity (SDG12), well-being (SDG3) as well as digitalisation (SDG9). 15% of startups are deeptech and 57% VC in deeptech.

In 2023 +4500% VC was raised in the semiconductors sector (€121M), which forms the core tech sector.

Noord Brabant: The region is a significant contributor to the Dutch deeptech ecosystem as the founding location of world-leading companies, like ASML, NXP, VDL, and Philips.

It ranks as the third largest by capital activity and number of startups. 47% of VC came from Dutch investors in 2023, versus 68% in 2022. €179.8M was raised for deeptech (52% of total 2023 funding in the region).

Gelderland: The startups in this region work towards SDG 3: Good Health and Well-being and SDG 7: Affordable and Clean Energy have deep talent pools from leading education institutions such as Wageningen University & Research Centre and Radboud University Nijmegen. There is a strong knowledge cluster in nutrition and health with bodies such as NIZO, One Planet, TNO, Top Institute Food & Nutrition, and RIVM.

Conclusion

According to the report, the Netherlands is well-positioned to be a tech leader. However, it has to address some key challenges such as:

- Increase available capital and stimulate international investment collaboration.

- Make the Netherlands a leading deeptech nation.

- Solve the pressing shortage of talent.

- Expect excellence in national coordination and collaboration

Read the orginal article: https://siliconcanals.com/news/state-of-dutch-tech-2024-report/