Research by RepRisk reveals one in every four climate-related ESG risks globally was linked to greenwashing in the last twelve months and uncovers a connection between greenwashing and social washing in public companies

- Research from data science company, RepRisk, finds one in every four climate-related ESG risk incidents globally was tied to greenwashing, an increase from one in five in last year’s report.

- 31% of publicly listed companies linked to greenwashing from September 2018 to September 2023 were also linked to social washing.

- RepRisk finds the banking and financial services sectors saw a 70% increase in the number of climate-related greenwashing incidents in the last twelve months.

ZURICH–(BUSINESS WIRE)–#duediligence—New research from RepRisk, the world’s largest ESG data science company, shows an increase of greenwashing risk, with one in four climate-related ESG risk incidents globally linked to greenwashing. Greenwashing and social washing are often linked, RepRisk’s data shows that nearly one in three public companies linked to greenwashing are also associated with social washing.

“The expectation of competitive advantage derived from an image of sustainability has opened the door to green and social washing. A lack of accountability around a rapidly evolving landscape of corporate sustainability has helped keep this door open for a long time. Despite this, in recent years symbolic sustainability has backfired for many as the media, public, and regulators criticize unfounded claims. Banks, asset managers, investors, and other market participants need transparent data on adverse impacts to assess a company’s true business conduct and mitigate green and social washing risk in their portfolios and supply chains,” commented Dr Philipp Aeby, CEO and Co-Founder of RepRisk.

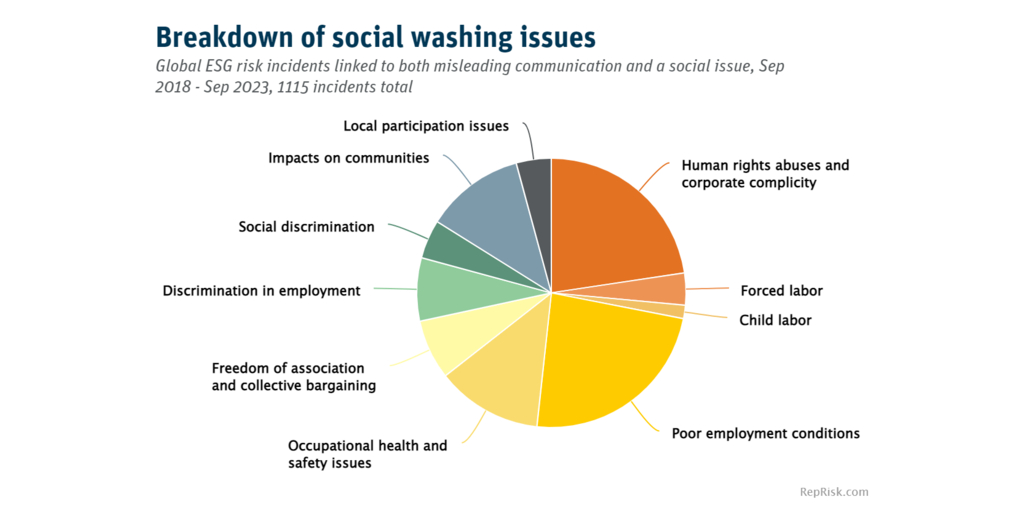

Social washing takes place when companies make misleading claims about their social responsibility, painting themselves in a positive light while obscuring an underlying social issue. While most current research on social washing focuses on themes of diversity, social washing is found across a spectrum of issues (per figure 1). According to RepRisk’s findings, the most common social washing issue in both the UK and US is human rights abuses and corporate complicity, which accounts for 26% and 25% of each nation’s incidents respectively. That said, diversity is still a key issue – in the US 18% of social washing incidents are linked to either social discrimination or discrimination in employment – compared to 11% in the UK. Green and social washing are often connected, with 55% of greenwashing risk incidents globally having a social component. In the US, 44% of public companies linked to greenwashing also have a record of social washing, compared to 39% in the UK and 31% globally.

While greenwashing incidents have accelerated globally, the practice has experienced significant growth in Europe and the Americas (per figure 2), particularly in the banking and financial services sectors. In the past year, the banking and financial services sectors saw a 70% increase in the number of climate-related greenwashing incidents. Over 50% of these climate-specific greenwashing risk incidents either mentioned fossil fuels or linked a financial institution to an oil and gas company. These incidents are not happening in isolation and regulators are increasingly aware of the scale of the problem. In May 2023, the European Banking Authority utilized RepRisk data on greenwashing to categorize misleading communication in the banking sector and measure the rise in its prevalence in the European Union over time.

The structure of greenwashing has evolved and become more complex, even since last year’s report. Greenwashing now goes beyond directly misleading consumers – its scope extends to include pledges, certifications, and commitments. The lack of accountability helps to further obscure greenwashing, making it possible for companies to benefit from setting future goals, without addressing issues head on.

About RepRisk

Founded in 1998 and headquartered in Switzerland, RepRisk is a pioneer in the research and analysis of business conduct risks that leverages the combination of AI and machine learning with human intelligence to systematically analyze public information and identify material business conduct risks. RepRisk maintains the world’s largest and most comprehensive due diligence database on ESG and business conduct risks, with expertise in 23 languages and coverage of 240,000+ public and private companies and 65,000+ infrastructure projects. For more than a decade, the world’s leading financial institutions and corporations have trusted RepRisk for due diligence and risk management across their operations, business relationships, and investments. Find out more on reprisk.com.

Notes to Editors

RepRisk captures greenwashing through the intersection of two criteria: (1) misleading communication and (2) an environmental issue such as local pollution or impacts on landscapes, ecosystems, and biodiversity. ESG risk incidents in this scope may include criticism of an advertising campaign deceiving consumers on environmental impacts, research findings revealing that a company is overstating the impact of an initiative, or coverage of company actions in direct contrast to climate commitments.

RepRisk defines social washing as a contradiction between a company’s positive image and a social issue in their business conduct, by capturing overlapping issues of (1) misleading communication and (2) a social issue such as human rights abuse and corporate complicity, child labor, or impacts on communities.

By excluding company self-disclosures in its data generation, RepRisk illuminates business conduct risks that could otherwise be obscured and could materialize into adverse impacts. RepRisk updates its data daily to empower efficient decisions, analyzes public sources in 23 languages to catch risk early and at the local level, and includes more than 100 ESG risk factors in its research scope. Depth and speed of RepRisk’s data are enabled by human intelligence and AI – more than seventeen years of human-labeled data trains its machine learning models.

Contacts

Gina Walser

Head of Marketing and Communications

+41 43 300 54 40

Read the orginal article: https://siliconcanals.com/news/business-wire/reprisk-data-shows-increase-in-greenwashing-with-one-in-three-greenwashing-public-companies-also-linked-to-social-washing/