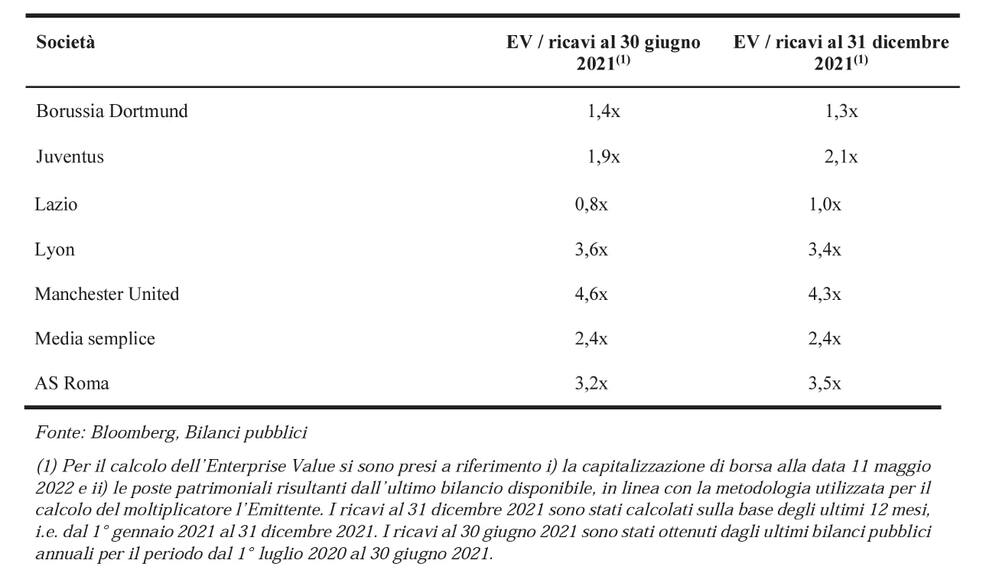

It could be the right time to see Italy’s soccer team AS Roma come off the Italian Stock Exchange. Actually Yadhesions to the voluntary takeover bid launched on the Serie A football club by the Friedkin family, which is ending today, nearly reached 13.9 million shares, equal to 21.96% of the offer, with the Texan entrepreneur who owns now a 93,94% stake and hopes to soon reach the 95% threshold necessary to delist the company (see here a previous post by BeBeez). At the time of the launch of the takeover bid, Friedkin owned about 90% of the capital, of which 83.28% through NEEP Roma Holding spa (the holding previously owned by the previous owner James Pallotta and his co-investors) and 6.71% through Romulus & Remus Investments, the subholding through which the takeover bid was launched. We recall that the previous mandatory tender offer in the fall of 2020, following the agreement with which the previous owner James Pallotta and his co-investors had sold approximately 86.6% of the team’s capital to Friedkin, had had very few adhesions.

It could be the right time to see Italy’s soccer team AS Roma come off the Italian Stock Exchange. Actually Yadhesions to the voluntary takeover bid launched on the Serie A football club by the Friedkin family, which is ending today, nearly reached 13.9 million shares, equal to 21.96% of the offer, with the Texan entrepreneur who owns now a 93,94% stake and hopes to soon reach the 95% threshold necessary to delist the company (see here a previous post by BeBeez). At the time of the launch of the takeover bid, Friedkin owned about 90% of the capital, of which 83.28% through NEEP Roma Holding spa (the holding previously owned by the previous owner James Pallotta and his co-investors) and 6.71% through Romulus & Remus Investments, the subholding through which the takeover bid was launched. We recall that the previous mandatory tender offer in the fall of 2020, following the agreement with which the previous owner James Pallotta and his co-investors had sold approximately 86.6% of the team’s capital to Friedkin, had had very few adhesions.

Italian fooball club Sampdoria attracted the interest of Redstone Capital, Cerberus Capital Management and of Qatar’s Al-Thani family (see here a previous post by BeBeez). At the moment no news has been leaked about the value of eventual offers, but we recall that at the beginning of 2021 EY had valued the club 182 million euros, while in a study on European clubs published in December last year, KPMG had evaluated the team 141 millions (approximately 6.2 million per player). An offer dating back to December 2020 by an investor, whose name had not been leaked, was said to be around 110 million euros but that deal was never closed.

Ita Airways attracted two binding offers from MSC-Lufthansa and Certares (see here a previous post by BeBeez). Air France and Delta Air Lines could join Certares if their bid was successful. MSC-Lufthansa previously tabled a non-binding offer of 1 billion euros for 80% of Ita. However, market observers think that the bid could now be lower. Earlier in May Certares offered 650 – 850 million.

TPG signed a binding agreement for acquiring the majority of Italian pharma company DOC Generici, a portfolio asset of ICG and Mérieux Equity Partners (See here a previous post by BeBeez). Mediobanca, Morgan Stanley, Deutsche Bank, and Latham & Watkins assisted TPG. Barclays and BNP acted as financial advisors of DOC Generici which retained Gattai, Minoli, Partners for legal counsel. Previous press reports said that the enterprise value of DOC Generici amounts to 1.6 billion. The company has sales of 244.6 million, an ebitda of 103.4 million, net cash of 53 million, and debt of 470 million. ICG and Mérieux Equity Partners acquired the company in 2019 from CVC Capital Partners on the ground of an enterprise value of 1.1 billion. CVC purchased DOC from Charterhouse in 2016 for an enterprise value of 650-680 million. Charterhouse acquired the company in 2013 from Apotex, Chiesi Farmaceutici and Zambon for 320 – 340 million.

Plenitude (fka ENI Gas e Luce) a Milan-listed renewable energy company that belongs to ENI, and Norways oil firm HitecVision signed an agreement for expand the activities of their joint venture Vårgrønn in the offshore Aeolian sector (see here a previous post by BeBeez). Vårgrønn belongs to Eni (69.6%) and HitecVision (30.4%). Vårgrønn will acquire Plenitude’s 20% of UK’s Dogger Bank, the development project for an offshore aeolian plant that also belongs to SSE Renewables (40%) and Equinor (40%). HitecVision will increase its stake in Vårgrønn from 30.4% to 35%.

Lutech, an ICT firm that belongs to Apax Partners since March 2021, created Finwave, a sub-holding through which it merged Arcares, Liscor and Finance Evolution (see here a previous post by BeBeez). The three companies operate in the financial services sector and have aggregate revenues of 50 million euros. Lutech has sales of 441.7 million, an adjusted ebitda of 55 million and a net financial debt of 262.4 million.

OTK Kart Group, an Italian producer of go-kart vehicles, sold a 70% stake to clube deal platforms QCapital and BIC Capital (see here a previous post by BeBeez). The Robazzi family will keep a 30%, while Roberto Robazzi will maintain his role as chairman and ceo and his daughter Erica will still head the marketing department. KT Finance assisted OTK which has sales of 35 million euros and an ebitda of 6 million.

Silver Economy Fund, a vehicle that Quadrivio Group created in April 2021, invested in PureLabs, a netowrk of diagnostic laboratories (see here a previous post by BeBeez). The target’s founder Nino Lo Iacono will reinvest for a minority of the business with Michel Cohen and other private investors and family offices. PureLabs aims to grow through acquisitions. Silver Economy will acquire a majority stake of the firm through the subscription of a capital increase of more than 30 million euros.

Cloud Care, an Italian platform for online sales and marketing that belongs to Investcorp since 2021, acquired a stake in Affida, a digital consumer credit and mortgages broker (see here a previous post by BeBeez). Andrea Conte has a minority of Cloud Care. Stefano Grassi created Affida in 2018. The target has sales of 7.8 million euros, an ebitda in the region of 0.8 million and net cash of 0.5 million. Cloud Care aims to carry on further acquisitions.

Lynx, a system integrator and provider of tech solutions for blue chip companies, acquired 60% of PIC Servizi per l’Informatica. (see here a previous post by BeBeez). Marco Pisa, Cristina Quarleri, Claudio Bonissone, Maria Patrizia Marione, and other minority shareholders will keep a 40% of the target and their executive roles. PIC has sales of 18.8 million euros, an ebitda of 6.1 million and net cash of 2.8 million. In November 2021, Lynx sold a 49.99% stake to FSI, the fund that Maurizio Tamagnini heads. Lynx retained Mediolanum Investment Banking, Dla Piper and Kpmg as financial advisor, while Ethica Group assisted PIC. After such an acquisition, Lynx will have revenues of 100 million euros.

Itelyum, an Italian company active in the field of industrial waste management that belongs to Stirling Square and DBAG, acquired a 70% of SEA Service, Crismani Ecologia and Navigazioni Stoini, three Italian competitors from FCM – Finanziaria Commerciale Marittima, part of Crismani (See here a previous post by BeBeez). Osborne Clarke acted as legal advisor to Itelyum which has sales in the region of 500 million euros.

Dedalus, an IT company for the healthcare sector that Ardian acquired in 2016 and that in 2021 attracted the investment of Abu Dhabi Investment Authority (ADIA), announced the acquisition of the healthcare software unit of Gruppo Lutech, a firm that since 2021 belongs to Apax Partners (see here a previous post by BeBeez). Dedalus has sales in the region of 750 million euros and an ebitda of above 200 million. Previous press reports said that Ardian and ADIA are mulling for an exit from Dedalus which, according to Bain, could have an enterprise value of 5.4-6 billion.

Siderforgerossi Group, an Italian producer of industrial components that belongs to KPS Capital Partners, announced the acquisition of Grupo Euskal Forging, a Spanish competitor (see here a previous post by BeBeez). Inversiones Nider Lekim sold the asset. Siderforgerossi has sales of 169.2 million euros, an ebitda of 14.7 million and a net financial debt of 13.6 million.

AL-KO Vehicle Technology, a producer of components for trailers and caravan that is part of DexKo Global (a firm that belongs to Brookfield Asset Management), announced the acquisition of Gruppo Fluid Press, an Italian competitor (see here a previous post by BeBeez). PwC assisted the vendors. Fluid-Press has sales of 11.8 million euros, an ebitda of 2.4 million and net cash of 6.3 million.

Cooper Consumer Health, one of the leading European companies in the body and personal care sector, has sold Stardea, an Italian company in nutraceuticals, medical devices and dermocosmetics, to the French group EA Pharma based in Sophia Antipolis, which is located in hinterland of Antibes, on the French Riviera.(see here a previous post by BeBeez). Cooper Consumer Health is portfolio company of CVC Capital Partners while EAA Pharma is a portfolio company of Motion Equity Partners.

Casalasco, an Italian producer of canned tomato, acquired a 73.8% of Italian competitor Emiliana Conserve Società Agricola (see here a previous post by BeBeez). The buyer retained KPMG and Studio legale Gatti Pavesi Bianchi Ludovici as advisors, while Livia Giordani & Roberto Adornato and Studio Mutti assisted assisted Emiliana Conserve. In August 2021, QuattroR acquired 49% of Casalasco on the ground of an equity value of little above 200 million euros. Emiliana Conserve has sales of 102 million, an ebitda of 11.6 million and a net financial debt of 21 million.

Q-Energy, an investor in renewable energies that belongs to Spain’s private equity Qualitas Equity, signed a joint venture with L&P Holding, a company that Ludovico Lombardi created, for developing plants with a power of up to 1 GW (see here a previous post by BeBeez). Lexia Avvocati and MFZ assisted Q-Energy, which aims to raise 800 million euros.

Blue Elephant Energy (BEE), a German renewable energy company, acquired six photovoltaic plants in the Piedmont region with a total power of 4MW (See here a previous post by BeBeez). In addition, the buyer will revamp the plants acquired from a pool of entrepreneurs and update their technology. BEE retained Watson Farley & Williams as advisors.

2M Holdings signed for the acquisition of Bregaglio, a distributor of raw materials for cosmetics, from Zschimmer & Schwarz Finance, the Italian subsidiary of Germany’s Zschimmer & Schwarz (see here a previous post by BeBeez). Simmons & Simmons, Fiderconsult and UHY Audinet assisted 2M Holdings. The vendor retained advisors PwC TLS, PKF and BelluzzoMercanti. Bregaglio has sales of 6.5 million euros with an ebitda of 0.138 million and net cash of 0.341 million.

Tollegno 1900, an Italian textile company, sold its yarns unit to Indorama Ventures, a listed chemical company based in Thailand (see here a previous post by BeIBeez). The buyer will rebrand the asset as Filatura Tollegno 1900. The vendors retained as advisors Equita K Finance (Clairfield Italy), part of Equita Group, Pedersoli Studio Legale and Studio Cravero & Associati. Indorama hired PwC and PwC TLS Avvocati e Commercialisti. Giovanni Germanetti, the ceo of Tollegno 1900, will head Filatura Tollegno 1900. Tollegno 1900 has sales of 74.6 million, an ebitda of minus 1.4 million and a net debt of above 51 million.

Gyrus Capital acquired Consulcesi Group for building a digital paneuropean platform for marketing, data analysis and legale service for the healthcare sector (see here a previous post by BeBeez).Massimo Tortorella, the target’s founder, will reinvest for a minority. Consulcesi is based in Switzerland.

Apax Partners France, a Paris- based private equity , appointed Marco Conte as Head of Italy (see here a previous post by BeBeez). Conte previously worked for Trilantic Europe, Merrill Lynch and Jupiter Finance.

F&P4BIZ, a platform for structuring private equity club deals that Guglielmo Fiocchi and Maurizio Perroni founded in 2019, welcome as a new partner Andrea Lovato, a seasoned executive of large international companies (see here a previous post by BeBeez). Lovato, one of the founders of Jakala, worked as ceo of Takraf and Tenova, and worked at Techint, Fiat, Iveco, Pirelli Pneumatici, Mars, and Forster Wheeler.