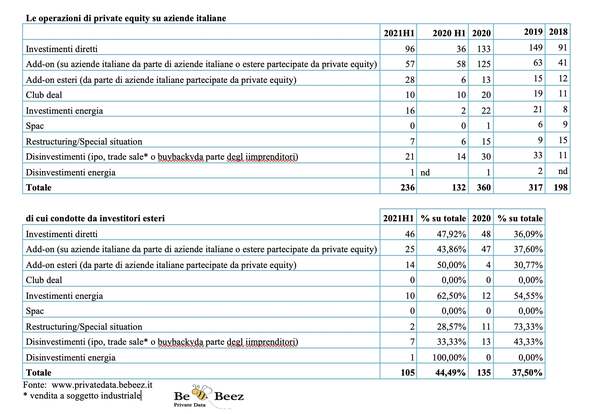

After the recovery of the second half of 2020, the m&a activity of private equity investors on Italian companies continued at full pace in the first half of 2021, so much so that at the end of June, a number of transactions equal to 64% of the whole of 2020 had already been closed, i.e. 236 deals compared to 360 for the whole of last year and 131 deals in the first six months of 2020. These are the major take aways from the BeBeez Private Equity Report for 1H21 (available for the subscribers to BeBeez News Premium and to BeBeez Private Data). A similar trend has been shown by the biannual Private Equity Confidence Survey of Deloitte Private and AIFI, which said that in 1H21, the Italian private equity sector generated pre-Covid volumes as the confidence of market participants increased (see here a previous post by BeBeez).

After the recovery of the second half of 2020, the m&a activity of private equity investors on Italian companies continued at full pace in the first half of 2021, so much so that at the end of June, a number of transactions equal to 64% of the whole of 2020 had already been closed, i.e. 236 deals compared to 360 for the whole of last year and 131 deals in the first six months of 2020. These are the major take aways from the BeBeez Private Equity Report for 1H21 (available for the subscribers to BeBeez News Premium and to BeBeez Private Data). A similar trend has been shown by the biannual Private Equity Confidence Survey of Deloitte Private and AIFI, which said that in 1H21, the Italian private equity sector generated pre-Covid volumes as the confidence of market participants increased (see here a previous post by BeBeez).

On 14 July, Wednesday, VAM Investments Spac started its placement on Euronext Amsterdam for raising 225 million euros by today 16 July (see here a previous post by BeBeez). Private equity VAM Investments Group (VIG) sponsored the Spac. VIG belongs to Francesco Trapani (50.1%), Tages Holding (24.95%) and ceo Marco Piana (24.95%). The Spac is placing 20-22.5 million shares at 10 euros each while VAM Investments could invest up to 10.25 million euros. The Spac will target companies based in Europe, Switzerland, or the UK.

Aliante Partners, a private equity holding that Paolo Righetto and Niccolò Fischer founded, attracted a 160 million euros from secondary market investor Pomona Capital which poured two preferred equity lines (see here a previous post by BeBeez). One line will provide the current Aliante’s shareholders with liquidity and the other will provide the resources for add-on buys of the fund’s portfolio companies. In 2013, Aliante raised 250 million.

EQT sold Igenomix, a Spanish biotechnology company, to Swedish listed Vitrolife (see here a previous post by BeBeez). Igienomics value amounts to 1.25 billion euros. In March 2019, Charme Capital Partners sold Igenomix to EQT on the ground of an enterprise value of 400 million and reinvested for a 15% stake in the business for a 4.3x return on investment a further earn-out upside. EQT and Charme will reinvest in the new group for a 6.6% stake and signed a lock-up agreement of 90 days.

Eni acquired the portfolio of Italian onshore Aeolian farms of Glennmont Partners and of PGGM Infrastructure Fund (see here a previous post by BeBeez). The transaction is worth 500 million euros. The power of the plants is of 315 MW.

Kaleyra, a NYSE-listed provider of messaging services for banks, acquired Bandyer, a provider of cloud-based communication services (see here a previous post by BeBeez). In November 2019, Kaleyra listed after having carried on a business combination with the US Spac GigCapital. Filippo Rocca, Simone Mazzoni, Francesco Durighetto, Dario Frigerio, and Roberto Nicastro sold Bandyer. Kaleyra has sales of 147.5 million US Dollars (+14% yoy), net losses of 26.8 million (5.5 million), an adjusted ebitda of 7.5 million (11.1 million), and cash of 33 million.

Elisabetta Fabri, the chairwoman, ceo and 55% owner of Starhotels, acquired 45% of the company from his brother Francis Edward (see here a previous post by BeBeez). Mrs. Fabri is now the sole owner of Starhotels which has sales of 48.82 million euros, an ebitda of minus 11.4 million and net losses of 34.6 million.

Italgen, a distributor of renewable energy that belongs to Italmobiliare, acquired Idroenergy, the owner of 8 mini-hydroelectric plants based in Italy (see here a previous post by BeBeez). Italgen owns plants with a power of 6MW while its sales amount to 30.2 million euros (34.4 million in 2019) with an ebitda of 3.4 million (13.9 million), net profits of 11.2 million (7.4 million), and a net financial debt of 10.2 million (20.1 million).

Milan-listed investment vehicle NB Aurora, part of Neuberger Berman, paid the Bernini family 36 million euros for a 30% of Comet, a producer of rubber components (see here a previous post by BeBeez). NB Aurora will invest its own resources. Comet has sales of 62.1 million, an ebitda of 14 million and net cash of 11.2 million.

On 12 July, Monday, NB Reinanssance (Neuberger Berman Group) raised 84.38099% of the shares of Milan-listed SICIT Group (see here a previous post by BeBeez). NB tabled a 16.80 euros per share offer for raising 95% of the company’s shares ahead of a delisting but could set a lower threshold. From 19 to 23 July, Monday to Friday, NB Renaissance will reiterate such an offer at 16,80 euros per share (See here a previous post by BeBeez).

Poste Vita and BancoPosta Fondi, two subsidiaries of Poste Italiane, announced the acquisition of a 40% stake in Eurizon Capital Real Asset sgr from Intesa Sanpaolo Vita and Eurizon Capital sgr (see here a previous post by BeBeez). At closing Poste Italiane and Intesa Sanpaolo Vita will own a 40% stake each (with 24.5% of voting rights each) while Eurizon Capital sgr will own a 20% stake (but 51% of voting rights).

Alpha Test, a publishing firm that belongs to White Bridge Investments, acquired Italian online tech academy Boolean from Fabio Forghieri and Roberto Marazzini, wheo reinvested for a minority (see here a previous post by BeBeez). Sources said to BeBeez that Alpha Test financed the transaction through a capital increase and financing facilities of Banco BPM and Banca Popolare di Sondrio. Boolean has sales of 2 million euros. After such an acquisition, Alpha Test expects to generate sales of 50 million in four years.

Virosac, an Italian producer fo plastic bags that belongs to a club deal of private investors organized by Orienta Capital Partners and Indigo Capital since October 2019, acquired Italy’s Rapid, a manufacturer of items for preserving food (see here a previous post by BeBeez). Giovanni Rossi and Aldo Pasini sold the business which has sales of 17.9 million euros. Virosac has a turnover of 42.5 million.

Zanzar, an Italian producer of mosquito nets, hired Mediobanca for finding an investor (see here a previous post by BeBeez). Zanzar belongs to Angelo L’Angellotti (95%) and Antonia De Felice (5%) and attracted the interest of 21 Invest. The company has sales of 44.5 million euros, an ebitda of 6.5 million and a net financial debt of 2.9 million. In&Out, the owner of the company, also has 76.13% of Croci Italia, a manufacturer of aluminium and steel security roller shutters and accessories for garage and shop fittings, that has a turnover of 5.6 million and 60% of Verelux, a producer of curtains with sales of 3.7 million.

Green Arrow Capital sgr’s advisors Cassiopea and Jefferies are auctioning Somacis, a producer of printed circuits for several industrial sectors (see here a previous post by BeBeez). In February 2016, Quadrivio Capital sgr, who later was sold to Green Arrow, who also took over the management of its funds, invested in Somacis on the ground of an enterprise value of 100 million euros. The company has sales of 146 million with an ebitda of 26 million for an enterprise value of 300 million.

Reno de’ Medici, a Milan-listed producer of paper that attracted a delisting offer from Apollo Global Management, acquired Dutch competitor Eska (see here a previous post by BeBeez). US holding Andlinger & Co. sold the asset on the ground of an enterprise value of 155 million euros of 6.3x its ebitda of 24.6 million. Andlinger acquired ESKA from H2 Equity Partners in November 2013 with the support of a mezzanine facility of Delta Lloyd Mezzanine Fund, ING and Rabobank.

Smart 4 Engineering, a French private equity investor for the ICT sector, acquired Top Network, a provider of services for digital transformation for corporates (see here a previous post by BeBeez). Top Network previously belonged to its ceo Franco Celletti (69.35%), CIN.MJD (16.38%) and to minority shareholders. The company has sales of 34.9 million euros.

Apollo Global Management is frontrunning for the acquisition of BIM Vita, the insurance joint venture that Unipol signed with Banca Intermobiliare (see here a previous post by BeBeez). Kpmg is handling the auction. The asset attracted the interest of Nobis Vita and Darag.

Progetto Grano, a company that the BenediniFamily controls, sold Italgrani Usa, a wheat trader, to Richardson International (see here a previous post by BeBeez). Progetto Grano acquired Italgrani Usa in 2006. The target has sales of 227 million euros with an ebitda of 12.8 million and a net financial debt of 81 million.

HLD, an international financial holding that Alessandro Papetti heads in Italy, acquired 60% of Security of the Third Millenium (S3K), a provider of integrated cybersecurity solutions from Antonino La Malfa and Pasquale Lavacca (see here a previous post by BeBeez). La Malfa is the company’s ceo and Lavacca the chairman. S3K has sales of 60 million euros with ab ebitda margin of 15%. Sources said to BeBeez that the transaction value amounted to 10-15X ebitda. Pricoa Private Capital financed the deal. HLD will support S3K also for acquisitions.

OCS, a provider of technology for financial services firms that belongs to Charme, is close to acquiring Risorsa/400, an Italian competitor, from the founder and ceo Lino Nardò, who will keep his role (see here a previous post by BeBeez). Risorsa/400 has sales in the region of 4 million euros. In March 2018, Charme acquired 80% of OCS which has sales of 27.2 million euros with an ebitda of 18 million and net profits of 16.8 million.

Biovalley Investments, an investor in life science, acquired 88% of Swiss Integrative Center for Human Health (SICHH), a Swiss research centre for innovative solutions and systems for medical technology, bioinformatics and biotechnology (see here a previous post by BeBeez). Fribourg University, Institut et Haute Ecole de la Santé, La Source of Lausanne, Université de Neuchâtel, Swiss Institute of Bioinformatics, HFR Fribourg – Hôpital cantonal, and Istituto Cardiocentro Ticino will keep a minority of SICHH. Diego Bravar and Giovanni Loser joined the target’s board of directors, while Lavinia Alberi Auber will be the coo for the Italian operations.

Finint launched Finint Equity for Growth (Finint E4G), a private equity vehicle that set a first fundraising target of 45 – 50 million euros ahead of a target of 120 million (see here a previous post by BeBeez). In March 2020, Mauro Sbroggiò, the ceo of Finint, said to BeBeez that the firm was mulling to set a private equity fund that would side the private debt activities. Finint aims to invest equity tickets of 7 – 15 million euros for 8-10 deals in 4-5 year.

Italian yachts producers Ferretti Group and Sanlorenzo said that the starting price of 62.5 million euros that insolvency administrator Franco Della Santa set for the assets of Perini Navi is too expensive (see here a previous post by BeBeez). The joint bidders said that the relaunch of Perini requires onerous investments. Perini Navi has sales of 55 million, an ebitda of minus 25 million, net losses of 35 – 40 million, and gross debts of 100 million.

Francesco Rigamonti (50% owner), Giovanni Fregnani (25%) and Giovanni Diana (25%) founded private equity Equor Capital Partners sgr (see here a previous post by BeBeez). Rigamonti is currently working for the secondary market investor Glendower Capital and CAM Alternatives.

Cloudcare, an Italian provider of digital sales and digital care tech-enabled services the belongs to Investcorp, acquired Spinup, a lead generation media tech company, from the founder Antonio Romano that will keep his ceo role (see here a previous post by BeBeez). Spinup has sales of 3.8 million euros with an ebitda in the region of 0.9 million (23.7% margin). CloudCare turnover amounts to 18.1 million, an ebitda of 3.5 million and net cash of 2.8 million.

The auction for Italian food company Antichi Sapori dell’Etna is coming to an end as Whitebridge is frontrunning for the acquisition of the asset (see here a previous post by BeBeez). In 2001, Nino Marino and Vincenzo Longhitano founded Antichi Sapori dell’Etna which also attracted the interest of Hyle Capital, Oaktree and Equinox. Vitale is advising the vendors. The company has sales of 60 million euros with an ebitda margin of 13%.

Vei Green II and Q-Energy, an investor in renewable energy that belongs to Spain’s private equity Qualitas Equity, signed an alliance for developing photovoltaic projects in grid-parity (see here a previous post by BeBeez). Q-Energy acquired from VEI Green II a 50% of VEI Greenfield. The two partners committed to invest 60 million euros and 120 million in the next two years.

Industrie Rolli Alimentari, an Italian producer of frozen food, aims to find a partner on the ground of an enterprise value of above 220 million euros (see here a previous post by BeBeez). Industrie Rolli attracted the interest of Pai Partners and Mitsui. The company has sales of 180 million with an ebitda of 22 million.

Seco, a Milan-listed producer of mini-computer in which Fondo Italiano d’Investimento (FII) invested, integrated Aidilab and Hopenly in the newco Seco Mind (See here a previous post by BeBeez). Adilab and Hopenly are the companies operating in the sectors of Artificial Intelligence, IoT and Big Data Analytics that Seco recently acquired. Seco has sales of 76.1 million euros, an adjusted ebitda of 15.9 million and a net adjusted financial debt of 11.4 million after having invested 4.9 million in acquisitions.

Dedagroup, an aggregation pole for providers of software As a Service (SaaS), acquired Pegaso 2000 from its ceo and fonuder Franco Cicogna (see here a previous post by BeBeez). Further to Pegaso, in the last 12 months, Dedagroup acquired Zedonk, Rad Informatica, Ifinet, and Everymake. Dedagroup has sales of 253.5 million euros, an ebitda of 28.2 million and net profits of 0.933 million.