An English version will be available soon

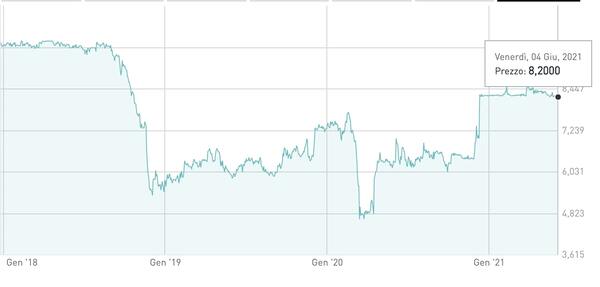

The tender offer by Investindustrial private equity firm on Guala Closures, the group specialized in the production of safety closures for spirits and wines listed on the Milan Stock Exchange, is ending tomorrow. We recall that the takeover bid, launched on 18 May at a price of 8.2 euros per share and 0.30 euros per warrant by the vehicle Special Packaging Solutions Investments sarl (SPSI) controlled by the Investindustrial 7 fund (see here a previous article by BeBeez) is aimed at delisting Guala Closures.

As of June 4, the Italian Stock Exchange session which closed on the takeover bid price at 8.2 euros for a market capitalization of over 572 millions, a total of 24,274,818 ordinary shares had been tendered for the takeover bid (representing approximately 75% of the ordinary shares object of the offer) and, therefore, the sum of the ordinary shares held by SPSI following a number of purchases on the market and the ordinary shares hitherto accepted in the takeover bid is equal to no. 58,861,498 ordinary shares, representing approximately 84% of the share capital (see the press release here).

The offer concerns up to 32,212,276 ordinary shares in addition to a maximum of 4,322,438 ordinary shares possibly resulting from the conversion of 4,322,438 special shares of category “B”. The offer is also subject to a maximum of 12,598,053 warrants. All for a maximum outlay of 265.4 million euros and considering that at the time of the launch of the takeover bid, SPSI had already acquired 47.829% of the share capital and 42.573% of the voting rights from a group of shareholders. In the meantime, however, SPSI has carried out a large series of purchases on the market, the latest of which were announced on Friday 4 June.

Guala Closures has been listed on Piazza Affari since August 2018, after the business combination with Spac Space 4 (see here a previous article by BeBeez). The company has over 4,850 employees and operates on 5 continents through 30 manufacturing plants and sells its products in over 100 countries. With over 17.3 billion closures sold in 2020, Guala Closures closed the 2020 consolidated financial statements with 572 million euros (-5.7% from 606.5 million in 2019), with a consolidated adjusted ebtida of 98 (-13 , 7% from 113.5 million) and a net financial debt which increased from 462.5 millions to 464.2 millions at 31 December 2020 (see the press release here), due to a series of extraordinary transactions. In particular, the acquisition of Closurelogic’s activities, both in Germany and Turkey, the acquisition of 20% of the British company Sharpend and the sale of the Italian company GCL Pharma (see here a previous article by BeBeez).