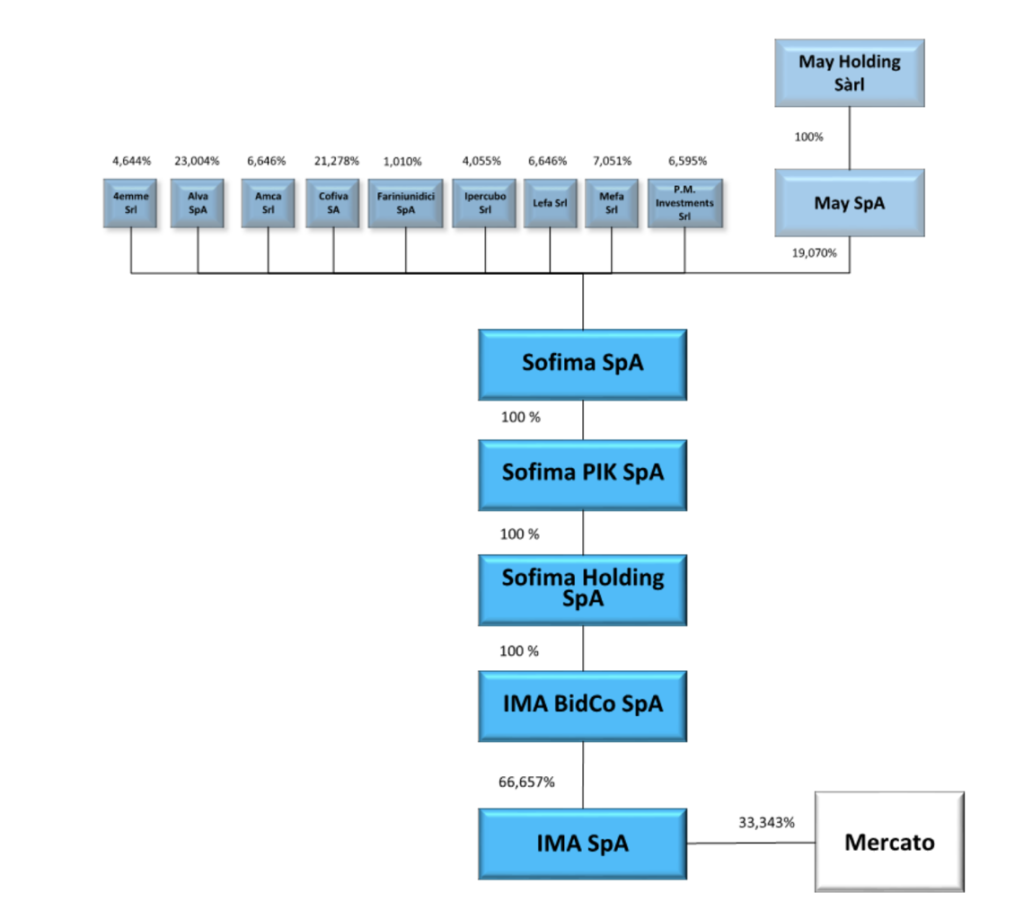

The tender offer by IMA BidCo spa (100% indirectly controlled by Sofima spa) on IMA spa started on Dec 14th. IMA is a Milan-listed group active in the design and production of automatic machines for the packaging of pharmaceutical, food, beverage and cosmetic products. The offer at 68 euros per share will close on 14 January 2021 (see here a previous post by BeBeez). The compulsory takeover bid is due to the fact that last November shareholders of Sofima spa (since last November the parent company of IMA) sold some shares to paneuropean private equity firm BC Partners as was previously announced at the end of July. The offer period will end on 14 January 2021. BCPartners could increase to up 45% its stake in Sofima while the Vacchi Family has a 55% stake. IMA’s equity value amounts to 2.93 billion euros.

On 16 December, Wednesday, Milan-listed OVS said it tabled a binding bid for troubled Italian fashion firm Stefanel (see here a previous post by BeBeez). Tamburi Investments Partners (TIP) previously said that it was ready to support OVS for m&a. OVS may invest up to 80 million out of its own resources. Stefanel has a net debt of 96.5 million.

Pedrollo, an Italian group that operates in the sectors of water handling, energy transformation and applied technology, as well as a well-known manufacturer of electric pumps, has acquired 70% of the US company Superior Pump, thus strengthening its leadership in hydraulic pump technology , with a direct presence on the North American market(see here a previous post by BeBeez). The operation was conducted through the US holding Pedrollo Group Inc. and was financed with credit lines made available by Bnl Bnp Paribas and Bank of the West (Bnp Paribas group). According to BeBeez. the value of the acquisition was over 40 million euros and the leverage was around 50%.

Alcedo acquired 80% of Friulair from Rita Micheli and the founder and ceo Luigi Vaccaro who will hold 20% of the company (see here a previous post by BeBeez). Anthilia Capital Partners and Banca Finint financed the transaction. Alcedo aims to raise 215 million euros by 1H21.

Finanziaria Trentina is selling 3% – 5% (out of its 11.9%) in Dolomiti Energia (see here a previous post by BeBeez). Equita is the vendor’s advisor. Dolomiti Energia belongs to FinDolomiti Energia (47.8%), Finanziaria Trentina, Fondazione Caritro (5.3%), Trento Municipality (5.8%), Rovereto Municipality (4.3%), Isa (4.2%) and other local utilities. Dolomiti Energia has sales of 1.4 billion euros with an ebitda of 217 million and in February 2018 issued a Dublin-listed subordinated bond of 5 million due to mature on 10 August 2022.

Peninsula Capital and Azimut Libera Impresa acquired 75% of pet’s products retail chain Isola dei Tesori (see here a previous post by BeBeez). The company has sales of 135.28 million euros with an ebitda of 11.91 million and net profits of 5.59 million.

Aussafer Due a leader in the sheet metal working sector, specializing in precision laser cutting, attracted the investment of 21 Invest (see here a previous post by BeBeez). The Italian mid-market fund will support siblings Luisa and Claudio Citoussi whose son Giacomo will act as ceo. Aussafer has sales in the region of 30 million euros (25% abroad). The company aims to grow domestically and abroad through m&a..

Ceo, a company of Spanish private equity Portobello Capital, acquired Poligof Holding from 21 Invest and the Gatti family (see here a previous post by BeBeez). Poligof sold a majority stake to 21 Invest in 2015. Poligof has sales of 120 million euros. Portobello Capital is a Madrid-based mid-market investor with more than1,3 billion of assets under management.

The Rovati family ,through its investment veichle Fidim srl, acquired 90.55% of Copenaghen-listed Athena Investments (fka Greentech) with the aim of delisting it (see here a previous post by BeBeez). Before the public offer, Athena belonged to GWM Renewable Energy II srl, controlled by the Rovati family (50.73%) and to SDP RAIF (29.10%), managed by Sdp Capital Management owned by Sigieri Diaz Pallavicini. The offer ended on 10 December and its price was of 3.7 Danish crowns per share of 370 million Danish Crowns (in the region of 50 million euros).

EF Solare, a company of F2i, won the call for tender that Milan-listed Terna launched for the electrochemical storage of Fast Reserve, a photovoltaic project based in Apulia, (See here a previous post by BeBeez). Andrea Ghiselli is the ceo of EF Solare.

Idea Agro, part of Dea Capital Alternative Funds, and Cleon Capital acquired a 51% stake of GIAS frozen meals unit sources said to BeBeez (see here a previous post by BeBeez). Gloria Tenuta will keep her role as the target’s chairwoman and ceo. GIAS has sales of 50 million euros (30% generated abroad).

Banca Intermobiliare (Bim), a portfolio asset of UK-based Attestor Capital, will hold exclusive talks until mid January 2021 for acquiring Banca Consulia (fka Banca IPIBI Financial Advisory) (see here a previous post by BeBeez). Banca Consulia’s shareholders will get in exchange a 15% of Bim. In June 2017, Magnetar Capital acquired 9.98% of Banca Consulia which has assets under management for 2.5 billion euros. Cesaro Castelbarco Albani and Antonio Marangi are the company’s chairman and ceo. In 2017, Attestor acquired 68.807% of Bim from Veneto Banca and signed an option for buying a further 2.606%.

Amazon invested in 26 renewable energy projects for a total of 3.4 GW power (see here a previous post by BeBeez). The projects are based in Italy, Australia, France, Germany, South Africa, Sweden, The UK and USA. The Italian photovoltaic plants are based in the South and have a power of 66 MW.

Margot, the platform that Mandarin Capital Partners (MCP) created in 2019 together with Marco Vecellio for aggregating fashion firms, acquired Alce (see here a previous post by BeBeez). The target has sales of 18.6 million euros, an ebitda of 4 million and a net cash of 13.8 million.

Equinox acquired 80% of Clas, an Italian producer of ready sauces whose ceo is Alessandro Bettini who also invested in the company together with the fund (see here a previous post by BeBeez). Renato Bersano acquired 70% of the target in 2003 and sold 60% of the business. Cominter will own 10% of Clas.

Duisburger Hafen acquired 15% of Interporto di Trieste from Friulia that will keep the relative majority of the asset amounting to 31.99% (See here a previous post by BeBeez). Duisport will support the internationalization strategy of Interporto.

Procemsa, a packaging company that belongs to Investindustrial, acquired Officina Farmaceutica Italiana (OFI) from Alto Partners, which purchased 80% of the target in April 2019, and the Donati Family (see here a previous post by BeBeez). AlbertoDonati is Ofi’s second generation owner and chairman. The firm has sales of 18.5 million euros with an ebitda of 3.6 million and a net financial debt of 3.4 million. Alessandro Sertorio (ceo of Procemsa) and Filippo Sertorio will be the ceo and cfo of the group, while Alberto Donati will act as non executive chairman. Luca Testa and Cristina Donati will be the ceo and marketing manager of OFI. Procemsa sold a 70% stake to Investindustrial in June 2019 and has sales of 32.9 million euros, an ebitda of 5.8 million and a net financial debt of 5.7 million.

Menghi, a portfolio company of Lion Capital, acquired Grosso from the founder Paolo Grosso, while Matteo Iualé and Marco Maurizi reinvested for a 2% of the business (see here a previous post by BeBeez). Grosso has sales of 5.8 million euros.

Ergon Capital Partners acquired the majority of Millbo – BioNaturals (the owner of Millbo BioNaturals International and BioNaturals Europe) from Alessandro Boggiani, who owned 75% of the business and now will keep his ceo role (See here a previous post by BeBeez). Houlihan Lokey assisted the vendors, while rumours say that the transaction value amounted to 100 million euros. Millbo attracted the interest of BlueGem and Capvest. In 2019, Ergon Capital acquired the majority of Dolciaria Acquaviva. In 2010, Alessandro and Bruno Boggiani sold 80% of Millbo to Ersel Investment Club from which Boggiani acquired the majority in December 2017. Millbo has sales of 209 million, an ebitda of 3 million and a net financial debt of 1.7 million

Bravo Capital Partners acquired Mengoni & Nassini from Michele Nerucci, Gianni Mengoni and Massimiliano Andreani (see here a previous post by BeBeez). M&N has sales of 17.9 million euros, an ebitda of 3.35 million and net cash of 2.9 million.

Franchi Umberto Marmi (Fum), a Milan-listed company, acquired 50% of Ingegner Giulio Faggioni Carrara (IGFC) from Giulio Vanelli Marmi – La Civiltà del Marmo (GVM) (See here a previous post by BeBeez). FUM listed on Milan market after it closed a business combination with TheSpac earlier in October. The transaction value amounts to 67.411 million euros (7X ebitda). FUM could pay GVM a further earn-out of one million on the achievement of targets by 2023. GVM reinvested for a 9% of FUM through the subscription of a 29.4 million capital increase at 10 euros per share. GVM signed a 36 months lock-up agreement for these new shares that will not receive a dividend. GVM also committed to buy shares on the market for 1.5 million.

Belron Italia sold its body shops unit to CarSafe, a joint venture that the Mucciante and Lercari Families (see here a previous post by BeBeez). Belron group belongs to Clayton, Dubilier & Rice (40% acquired in 2018) and to D’Ieteren and the management (60%).

Equiter and Barone Costruzioni sold to A2A an Aeolan plant with a power of 20.4 GWh of power (see here a previous post by BeBeez). Renato Mazzoncini is the ceo of A2A.

FVS, a subsidiary of Veneto Sviluppo, acquired Comem in partnership with Faxolif Industries (se here a previous post by BeBeez). The buyers will invest 15 million euros. Abb Power Grids Italy, part of Hitachi Abb Power Grids, sold the asset. Comem generates abroad 90% of its 25 million euros sales and it’s the last acquisition of Fondo Sviluppo Pmi that invested all of its 50 million resources. Fondo Sviluppo Pmi is currently fundraising and set a target of 100 million, said Fabrizio Spagna, the chairman of Veneto Sviluppo.