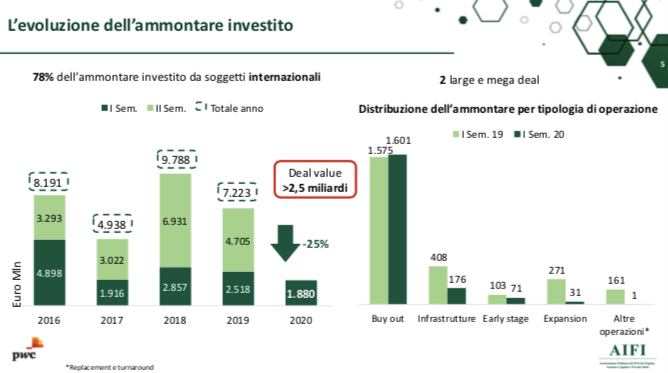

A report of AIFI and PwC Deals said that in 1H20 Italian private equity raised more resources but closed less transactions (see here a previous post by BeBeez). In detail, private equity funding in Italy more than doubled in the first half of 2020, reaching 960 million euros (+ 121%). The amount invested was instead only equal to 1.9 billion euros, down by 25% from 2.5 billion in the first half of 2019, while the number of transactions stood at 125, also down by 25%. Innocenzo Cipolletta, the chairman of AIFI, said that private equity funds deferred the closing of several transactions that could take place by year end. Francesco Giordano, a partner of PwC Deals, said that private equity firms have a solid deal pipeline. Such data are consistent with those of BeBeez Private Data, the private capital database by BeBeez, which recorded a resumption of activity at the turn of the Summer after a stop last Spring due to Covid-19 emergency: between July, August and the first days of September, private equity investors (not counting venture capital) actually announced about 60 transactions, which are added to the 131 private equity deals closed in the first half of the year, considering private equity in a broad sense and therefore not only the transactions made by funds, but also by investment holding companies, SPACs and private investors’ club deals and including 14 divestments (see here BeBeez Report on 6 months of private equity 2020, available for BeBeez News Premium subscribers and BeBeez Private Data subscribers, see here how to subscribe). As for the next few months, there are over 40 deals coming up (see here BeBeez’s Insight View on all the deals expected this Autumn, available for BeBeez News Premium subscribers and BeBeez Private Data subscribers, see here how to subscribe).

A report of AIFI and PwC Deals said that in 1H20 Italian private equity raised more resources but closed less transactions (see here a previous post by BeBeez). In detail, private equity funding in Italy more than doubled in the first half of 2020, reaching 960 million euros (+ 121%). The amount invested was instead only equal to 1.9 billion euros, down by 25% from 2.5 billion in the first half of 2019, while the number of transactions stood at 125, also down by 25%. Innocenzo Cipolletta, the chairman of AIFI, said that private equity funds deferred the closing of several transactions that could take place by year end. Francesco Giordano, a partner of PwC Deals, said that private equity firms have a solid deal pipeline. Such data are consistent with those of BeBeez Private Data, the private capital database by BeBeez, which recorded a resumption of activity at the turn of the Summer after a stop last Spring due to Covid-19 emergency: between July, August and the first days of September, private equity investors (not counting venture capital) actually announced about 60 transactions, which are added to the 131 private equity deals closed in the first half of the year, considering private equity in a broad sense and therefore not only the transactions made by funds, but also by investment holding companies, SPACs and private investors’ club deals and including 14 divestments (see here BeBeez Report on 6 months of private equity 2020, available for BeBeez News Premium subscribers and BeBeez Private Data subscribers, see here how to subscribe). As for the next few months, there are over 40 deals coming up (see here BeBeez’s Insight View on all the deals expected this Autumn, available for BeBeez News Premium subscribers and BeBeez Private Data subscribers, see here how to subscribe).

Private equity firms pay more and more attention to ESG issues when investing in Italy too, This was a very hot topic at the Private Capital Conference, an online event of AIFI, PwC and Linklaters which took place a few days ago (see here a previous post by BeBeez). Actually parameters of social and environmental sustainability are increasingly guiding the strategies of companies invested by private equity, as a recent AIFI survey also found (see here a previous article by BeBeez).

On 2 October, Friday, Tim signed the closing for the sale of 14.8% of Inwit to a consortium led by Ardian Infrastructure and the sale of an other 1.2% to a group of investors including Canson Capital Partners, Marco Patuano and an investment veichle gatherd by Azimut Group (see here a previous post by BeBeez). Buyers will not have to launch a public offers for the remaining shares. Tim received 1.35 billion from the buyers and will hold 51% of Inwit with Vodafone Europe having te ramaining 49%

Milan-listed paytech Nexi will acquire and merge Sia, a company of which Cdp Equity has a controlling stake. The move was widely expected but now it is official (see here a previous post by BeBeez). Nexi will have a dominant role and the newco will have a publicly traded equity of 40%. The merged companies could have a market capitalization of above 15 billion euros. Paolo Bertoluzzo will be the ceo of the new group. Sia’s shareholders will get 1,5761 shares of Nexi for each of their share for a total 30% of the new group. The current shareholders of Nexi will hold 70%. Cdp will then have more than 25% of the new business, while Advent International, Bain Capital and Clessidra, the owners of Nexi, will dilute their stake to 14% after they sold a 13.4% stake on the market in an accelerated bookbuiklg procedure last Oct 7th for a total consideration of 1.3 billion euros. So fund now currently have a 20% of Nexi (see here a previous post by BeBeez). Nexi is a company monitored by BeBeez Private Data (find out how to subscribe for only 110 euros a month)

Milan-listed infrastructure group Atlantia’s advisors Bofa Merrill Lynch, Mediobanca and JPMorgan received the first expressions of interest for Autostrade per l’Italia (ASPI) (see here a previous post by BeBeez). The list of potential buyers includes Astm (a company of Gavio in which Ardian Infrastructures invested), Toto Group – Apollo Global Management and the Dogliani Family with the support of Circuitus. Italy’s F2i may table a bid together with Singapore’s GIC or PSP Investments. Previous press reports said that the asset could attract the interest of Blackstone, KKR, Macquarie, Ifm, Stone Peack, Sixth Street, Pggm, Australian Super, and Temasek. As already reported last week, Atlantia’s Board od Directos voted official on the launch a dual track procedure for selling the company’s 88.06% stake in ASPI (see here a previous post by BeBeez). As reported in the previous months, Atlantia is talks with Cassa Depositi e Prestiti, but talks are quite difficult so the group is exploring other options that are either a spin-off and an ipo of ASPI or the sale of ASPI through a competitive auction. Atlantia said that buyers will have to acquire the whole of ASPI if Allianz Capital Partners, EDF Invest, DIF, and Silk Road Fund will exercise their right to sell their stake.

Italian utility Sorgenia is close to sell to F2i and Asterion Industrial Partners, the investment vehicle that Jesus Olmos leads (see here a previous post by BeBeez). F2i will acquire a 72.4% of Sorgenia and Asterion a 27.6% from Nuova Sorgenia Holding, the vehicle that controls the target and that belongs to Banco BPM (33.2%), Intesa Sanpaolo, Mps, Ubi Banca, and Unicredit (16.67% each). These banks converted their credits in equity and replaced CIR and Verbund. Rumours say that Sorgenia has an enterprise value of 1 billion euros. The asset reportedly attracted the interest of Blackstone, Riverstone, Cvc, Energy Capital, Iren, Acea, Contourglobal, A2A–Eph.

Dainese, a company of Bahrein’s fund Investcorp, acquired TCX from Keyhaven Capital Partners (See here a previous post by BeBeez). The Zanatta Family sold 30% of the asset. In 2006, the family sold 70% of Jolly and 70% of Daines to Novation, a company that Aksìa Capital (74%) and State Street Global Investment (26%) acquired from Nike in 2004. In January 2014, Novation went in receivership and sold TCX to Keyhaven in 2017. Minerva-Robusto acquired Jolly in 2016. The ceo of TCX is Andrea Nalesso. The company has sales of 20.6 million euros, an ebitda of 1.64 million and net cash of 0.946 million.

Marbles, a company that belongs to Asterion Industrial Partners Sgeic, acquired 24.1% of Milan-listed Retelit (see here a previous post by BeBeez). Axxion and Frankfurter sold their 9.99% and 0.24% of Retelit. Marbles also paid 49.7 million for acquiring Fiber 4.0, the owner of 13.86% of Retelit, from Athena Capital Fund, Oak Tree and Pilota. In October 2019, Retelit acquired Partners Associates (Pa) Group from Ennio Baracetti, Roberto Cella, RiverRock Italian Hybrid Capital Fund, and FVS.

COC Farmaceutici, a portfolio company of Aksìa Group, acquired Tubilux Pharma (See here a previous post by BeBeez). Tubilux Pharma has sales of above 30 million euros. Enrico Folchini will be the ceo of the group born out of such a transaction. The two companies will generate aggregate sales of 80 million. COC Farmaceutici is part of Lameplast COC, a company that Aksìa acquired in April 2016. In October 2016, Equita private debt subscribed the first tranche of 5 million of a minibond that the company issues. In July 2019, Aksìa sold Lameplast to US Tekni-Plex, but kept COC Farmaceutici which has sales of 42 million.

APP Italy, the Italian subsidiary of US-based APP, a company of Armstrong Global Holdings, acquired Agri Energia Istia Società Cooperativa (see here a previous post by BeBeez) Terrae sold the asset and the deal included the refinancing of a 0.99 MW biomasses plant through a non recourse project financing facility with a senior line, resources for the working capital and debt services that Banco Bpm provided.

Neuberger Berman and Fondo Agroalimentare Italiano, a vehicle of Unigrains Developpement, acquired Logistica 2 through Trasporti Romagna, an asset that the funds acquired in December 2016 and in which Intesa Sanpaolo invested together with Simone Romagna (See here a previous post by BeBeez). Giorgio and Giuseppe Ghezzi, Remo Joris, and Mauro Zancanella sold Logistica 2. Intesa Sanpaolo and Crédit Agricole supported the buyers. Logistica 2 has sales of 34.6 million euros, an ebitda of 0.986 million and net cash of 0.159 million

On 5 October, Monday, Franchi Umberto Marmi listed on Milan market after the business combination with TheSpac (See here a previous post by BeBeez). Franchi has sales of 65.2 million euros, an adjusted ebitda of 27 million (or 41.3%) and net profits of 16.6 million. Marco Galateri di Genola e Suniglia, Vitaliano Borromeo Arese, Giovanni Lega, Luciano Di Fazio, and Gianluca Cedro launched TheSpac in 2018 and raised 60 million and invested 10 million of their own resources.

Investindustrial, China Investment Corporation (CIC) and Unicredit launched CIICF (China-Italy Industrial Cooperation Fund), a 600 million euros mid-market fund that would target Italian companies (see here a previous post by BeBeez). The fund may raise further resources, while Investindustrial will manage its operations. On another hand, Investindustrial and CIICF acquired CSM Ingredients from CSM Bakery Solutions and CSM Group, two companies of Rhône Capital (See here a previous post by BeBeez). CSM Bakery will invest the proceeds of such a sale in a 50 million recapitalization of the business that earlier in August received a Caa2 Moody’s rating from Caa3. Investindustrial is also holding exclusive talks for acquiring Comprital, a producer of ingredients for the ice creams productions with sales of 26 million and an ebitda of 4 million. Investindustrial is one of the private capital investors that BeBeez Private Data monitors. Find out here how to subscribe to the Combo version that includes BeBeez News Premium

Bracchi, a company of Igi Private Equity, Siparex, the Annoni Family and its managers, acquired Peterlini from Nerella Peterlini and Cristian and Enrico Mavilla, who will keep their executive roles (see here a previous post by BeBeez). Peterlini has sales of 3.25 million euros, an ebitda of 0.573 million and bet cash of 0.629 million. Igi acquired 64% of Bracchi in May 2016 while Siparex purchased 26%. The Annoni family and the managers diluted their stake to 10%, while Arner Private Equity sold all of its holding. Bracchi has sales of 140 million.

On 5 October, Monday, Labomar, an Italian nutraceutical company, listed on Milan’s Aim (See here a previous post by BeBeez). Labomar raised 29.9 million euros (3.9 million through the greenshoe option) for a 19.86% publicly traded equity and a market capitalization of 110.9 million. In January 2019, Walter Bertin acquired the whole company as he purchased the stake of Neuberger Berman, who managed a 29.33% stake that FII paid 3 million in 2012. Labomar will invest the proceeds of its IPO in its organic growth and M&A.

Consob, the Italian stock market authority, approved the public offer that The Friedkin Group launched on Milan-listed football team AS Roma (see here a previous post by BeBeez). The buyer will pay cash 0,1165 euros per share or 9.83 million between 9 October, Friday and 29 October, Thursday, for a 13.4% stake of AS Roma. The Friedkin Group previously acquired 86.6% of the target from James Pallotta for 591 million euros. In January 2020, Friedkin tabled a 750 million bid for AS Roma (including a debt of 272 million and a capital increase of up to 150 million).

Green Arrow Capital set a fundraising target of 400 million for Green Arrow Private Equity, a mid-market vehicle, and hired Jody Vender and Massimo Massari (See here a previous post by BeBeez). Vender will act as senior advisor and chairman of the comitee private equity investment. Massari will act as managing director of the private equity division for which Francesca Gennaro act as investment director.

Recordati finalised the sale to CVC Capital Partners (see here a previous post by BeBeez). CVC already acquired in 2018 a 51.82% of Recordati together with PSP Investments, Stepstone and Alpinvest.

Sdp Finanziaria acquired a minority of Estrima, an Italian e-mobility company (see here a previous post by BeBeez). Estrima has sales of 7.5 million euros. Ermes Fornasier is the chairman of Sdp Finanziaria. In June 2020, Estrima swapped a 7.5% stake with a 3% of Mobility Up, who invested in MiMoto, Washout (a company of which Telepass is a shareholder) and 2hire, a startup that attracted the resources of P101, Linkem, Blackrock, Invitalia Ventures, LVenture Group, and Boost Heroes

Seci, the holding that owns the troubled Italian diversified industrial company Gruppo Maccaferri, attracted an offer of Piero Gnudi and Luca Montezemolo (see here a previous post by BeBeez). Gnudi and Montezemolo would acquire Seci for 1 euro, invest 40 – 50 million euros in a recapitalization of the business and pay 10-15% its debt. Gnudi and Montezemolo have a minority of Manifatture Sigaro Toscano, an asset of Seci, and subscribed part of the 90 million bond it subscribed. On 6 October, Tuesday, the board of directors of Seci accepted the offer of Carlyle and its coinvestors that may pour resources of 45 million with the support of Muzinich. Officine Maccaferri also received a bid from Vinci, Bonfiglioli Riduttori, Emag, an undisclosed English-Chinese group, and Gauder & Co.