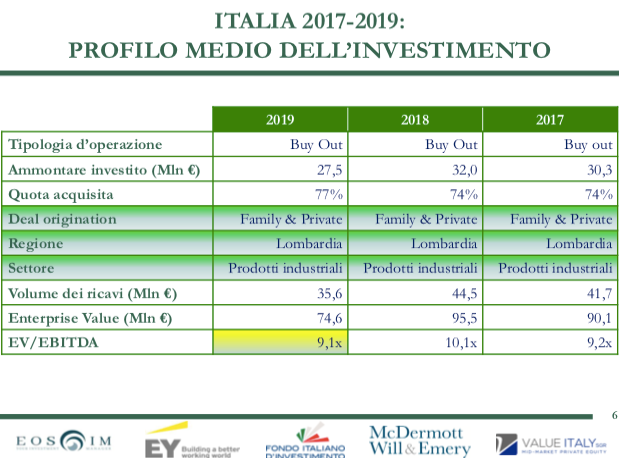

In 2019, the median multiples of private equity deals in Italy decreased, said a report of EOS IM, EY, Fondo Italiano d’Investimento, McDermott Will&Emery, Value Italy, and Osservatorio Private Equity Monitor (Pem) of Liuc Business School (see here a previous post by BeBeez). The median EV/ebitda ratio in 2019 amounted to 9.1x (10.1x in 2018), with a median Enterprise Value of the targets of 75 million (95 million). Enrico Silva, private equity leader Mediterranean area of EY, expects multiples to decrease further. In the first half of this year, the PEM Observatory recorded 93 investment transactions, in line with the same period of 2019, with the PEM Index which recovered in Q2 2020 and returned to 500 points. The PEM index measures the number of investments in the quarter compared to the number of investments made in Q1 2000, considered as a base=100. The index had reached its all-time high in Q4 2019, when it reached 650 points, compared to a total of 221 private equity investments mapped in the full year 2019. BeBeez Private Data, BeBeez’s private capital database, mapped instead 131 transactions in H1 (see here BeBeez’s Report on 6 months of private equity in 2020, available for subscribers to BeBeez News Premium and BeBeez Private Data). However, BeBeez Private Data considers private equity in a broad sense and therefore not only the operations made by private equity funds, but also by investment holding companies, SPACs and club deals of private investors. Of this total, 58 were add-ons on Italian targets and other 6 were add-ons on foreign targets (i.e. made on foreign targets by Italian companies controlled or invested by private equity funds), while direct private equity operations on Italian companies were only 35. In addition, the 131 deals also include divestments that saw parties other than funds as counterparties.

In 2019, the median multiples of private equity deals in Italy decreased, said a report of EOS IM, EY, Fondo Italiano d’Investimento, McDermott Will&Emery, Value Italy, and Osservatorio Private Equity Monitor (Pem) of Liuc Business School (see here a previous post by BeBeez). The median EV/ebitda ratio in 2019 amounted to 9.1x (10.1x in 2018), with a median Enterprise Value of the targets of 75 million (95 million). Enrico Silva, private equity leader Mediterranean area of EY, expects multiples to decrease further. In the first half of this year, the PEM Observatory recorded 93 investment transactions, in line with the same period of 2019, with the PEM Index which recovered in Q2 2020 and returned to 500 points. The PEM index measures the number of investments in the quarter compared to the number of investments made in Q1 2000, considered as a base=100. The index had reached its all-time high in Q4 2019, when it reached 650 points, compared to a total of 221 private equity investments mapped in the full year 2019. BeBeez Private Data, BeBeez’s private capital database, mapped instead 131 transactions in H1 (see here BeBeez’s Report on 6 months of private equity in 2020, available for subscribers to BeBeez News Premium and BeBeez Private Data). However, BeBeez Private Data considers private equity in a broad sense and therefore not only the operations made by private equity funds, but also by investment holding companies, SPACs and club deals of private investors. Of this total, 58 were add-ons on Italian targets and other 6 were add-ons on foreign targets (i.e. made on foreign targets by Italian companies controlled or invested by private equity funds), while direct private equity operations on Italian companies were only 35. In addition, the 131 deals also include divestments that saw parties other than funds as counterparties.

One Equity Partners is launching today its public tender offer on Milan-listed IT company Techedge. The offer will close on October 23rd (see here a previous post by BeBeez). The private equity fund will pay 5,40 euros per share or 113 million euros for delisting Techedge. The company has sales of above 206 million (+11.1%) with an ebitda of 23.5 million. Techedge enterprise value amounts to 138 million of 6.7X ebitda. The fund will finance such a public offer through the issuance of a senior secured bond of 120 million (it could increase to up to 215 million) due to mature in 2025 and with a floating rate coupon (floor to zero) with a cash margin.

Euronext-Cdp Equity and Intesa Sanpaolo are holding exclusive talks with London Stock Exchange Group (LSEG) for the acquisition of Borsa Italiana (see here a previous post by BeBeez). The vendors pointed out that the sale of Borsa Italian is one of the conditions for their merger with Refinitiv as for EU Competition Authorities. The buyers will finance the acquisition with their own resources, debt and a capital increase that Intesa Sanpaolo and CDP will subscribe. Borsa Italiana reportedly also attracted the binding offers of Deutsche Borse and Six. On 31 July, Friday, London Stock Exchange said it was considering the sale of the whole Borsa Italiana (worth 3.3-4 billion) or 62.5% of its subsidiary MTS, the platform for bond trading (600 million).

Azimut Libera Impresa (Ali) is holding talks with Italian ceramics producer Sicer (see here a previous post by BeBeez). Gianfranco Padovani is the chairman of Sicer in which Isabella Seragnoli invested in 2016. Sicer has sales of 44.64 million euros with an ebitda of 6.36 million.

Aksìa Group is close to acquiring Nappi, a producer of ingredients for sweets and ice creams, from the eponymous family (see here a previous post by BeBeez). Houlihan Lokey is reportedly advising the vendors. The company attracted the interest of Riverside, Stirling Square and Bluegem Capital Partners. Nappi has sales of 38.5 million euros, an ebitda of 5.48 million and net cash of 2.5 million.

Ibla Capital, a turnaround investor, acquired the Oil & Marine unit of Manuli Hydraulics from Manuli Rubber Industries (MRI) (see here a previous post by BeBeez). The target’s managers will keep their roles. Vertus advised the vendors. Manuli Hydraulics has sales of 23.9 million euros with an ebitda of minus 5.7 million.

Made in Italy Fund (MIIF), a private equity vehicle that Quadrivio Group and Pambianco launched, acquired 60% of Rosantica, an Italian producer of luxury apparels and accessories (see here a previous post by BeBeez). MIIF acquired the asset through Fine Sun, the vehicle that controls 120%lino whose ceo Mauro Grange will also head Rosantica. MIIF has a fundraising target of 200 million euros.

Italian listed contractor Astaldi, a company in receivership, foresees to generate revenues of 1.5 billion euros, an adjusted ebitda of above 5% and net cash of more 300 million (See here a previous post by BeBeez). In 1H20, the company posted sales of 656.8 million with an ebitda of 42 million and equity of minus 1.574,6 million. Astaldi is reportedly holding talks for selling a majority stake to Webuild and becoming part of Progetto Italia, a plan that aims to create a big Italian contractor.

Genextra, a biotech investor that Francesco Micheli founded in 2004 with Umberto Veronesi, diluted to 12.1% its 16.7% stake in Nasdaq-listed Intercept Pharmaceuticals as it sold 1.5 million shares at about 47 US Dollars per share (see here a previous post by BeBeez). Genextra raised 71 million while earlier in May, the company sold more than 595,000 shares of Intercept at 84,6 US Dollars each (for a total of 50.3 million) and diluted its 20.5% holding to 16.7%. Roberto Pellicciari founded Intercept Pharmaceuticals. Genextra invested 75 million in four rounds of Intercept between 2006 and 2012. Intercept listed on Nasdaq in 2012 and one year later Genextra started to sell its shares in the company.

Quinta Capital (QC fka Quinta Capital Partners) acquired real estate asset manager Garnell (see here a previous post by BeBeez). QC will target the market of institutional investors with the role of an independent multi-manager operator. QC, a company that Luca Turco founded, has assets under management of above one billion euros.

Mir, an Italian medtech company, is holding talks with three undisclosed potential investors (see here a previous post by BeBeez). Mir reportedly hired Mediobanca for selling a 70% stake on the ground of an enterprise value of 30 – 40 million euros or 8-12X ebitda. Mir belongs to Siro Brugnoli and Paolo Boschetti, generates sales of 15 million with an ebitda of 4 million and aims to sell a stake for growing through acquisitions.

Oakley Capital sold Casa.it, the portal for real estate advertising (see here a previous post by BeBeez). Earlier in September, EQT paid 1.3 billion for acquiring idealista, an online platform for real estate advertising that operates in Spain, Italy and Portugal. Luca Rossetto is the ceo of Casa.it that Oakley Capital acquired in December 2016 together with Luxembourg portal atHome and Rea Group. Federico Quitadamo is the managing director and head of EQT Italy. EQT is one of the private capital investors that BeBeez Private Data monitors. Find out here how to subscribe to the Combo version that includes BeBeez News Premium

The European Antitrust Authority aims to block the merger of Tim and Open Fiber as it would create a dominant network for the broadband (See here a previous post by BeBeez). However, the Italian Ministry of Economy denied such a rumour.

Salcef, a company that listed on Milan market in November 2019 after the business combination with Industrial Stars of Italy 3, paid 36.14 million US Dollars (or in the region of 30.5 million euros) for 90% of US Competitor Delta Railroad Construction (see here a previous post by BeBeez). The LaurelloFamily sold its interest in the target but will keep a management role in Delta. Salcef Usa paid the acquisition with its own resources and a 23.91 million acquisition loan of Unicredit for which Sace provided a warranty for 60% of its amount. Salcef is interested in further acquisitions.

The club deal vehicle Project Sun acquired 20% of e-commerce for furniture Deghi for 10 million euros (see here a previous post by BeBeez). AM Capital, whose head is Massimo Vecchio, created Project Sun of which are also part Paolo Basilico, Roberto Condulmari Guido Maria Brera, and Micheli Associati, the firm of Francesco Micheli. Alberto Paglialunga founded Deghi in 2012. The company has sales of above 40 million euros.

Credemtel, a digital services company of Gruppo Credem, acquired 20% of Andxor, a provider of cryptography solutions, from G&G Investimenti (see here a previous post by BeBeez). Andxor has sales of 1 million euros, an ebitda of 0.372 million and net cash of 0.462 million.

Vam Investments acquired 80% of Demenego, a retailer of specs (see here a previous post by BeBeez). The De Menego Family sold the stake and reinvested for a 20% of the asset. Illimity Bank and direct lending fund Springrowth financed the acquisition. Demenego has sales of 23 million with an ebitda in the region of 6 million. Beppino De Menego, the company’s founder, is the honorary chairman of the company, while Alessandro Donadelli will act as ceo. Vam Investments is one of the private capital investors that BeBeez Private Data monitors. Find out here how to subscribe to the Combo version that includes BeBeez News Premium

Lifebrain, an Italian diagnostic company of which Investindustrial has a controlling stake, acquired the competitor Gruppo Caravelli (see here a previous post by BeBeez). The target has sales of 2 million euros with an ebitda of 0.222 million. Lifebrain is a Vienna-based company whose ceo is Michael Havel that sold a controlling stake to Investindustrial in 2018 which received the support of Springrowth. In November 2016, Lifebrain received a 90 million acquisition financing facility from Unicredit, Raiffeisen Bank International, and VTB Bank for supporting its robust M&A activity.

Claudio Antonioli acquired Belgium fashion brand Ann Demeulemeester from Anne Chapel (see here a previous post by BeBeez). Antonioli will have the right to use the a flagship store in Antwerp and a showroom in Paris. In 2016, Antonioli Marcelo Burlon and Davide De Giglio founded the platform for luxury fashion brands New Guards Group (NGG). In August 2019, UK e-commerce Farfetch acquired NGG for 675 million euros. The vendors reinvested in Farfetch.

Idea Taste of Italy (ITI) is holding talks for acquiring a stake in Ekaf Cellini, a producer of high-end coffee (see here a previous post by BeBeez). Amleto Pieri founded Cellini in 1946. In 1990 Cellini acquired Ekaf and merged it with Torrefazione Columbia. Ekaf Cellini has sales of 40.5 million euros.

On 10 September, Thursday, the shareholders of Italian Spac Spactiv appointed Stefano Greppi as commissioner for the firm’s liquidation (see here a previous post by BeBeez). Spactiv failed the business combination with Betty Blue, the fashion house of Elisabetta Franchi. On 29 July 2020, Borsa Italiana suspended from trading Spactiv’s shares.

Naturalia Tantum, a pole of cosmetic and nutraceuticals companies that belongs to Assietta Private Equity, Paolo Colonna and Istituto Atesino di Sviluppo, acquired the majority of Di-Va (see here a previous post by BeBeez). Massimo Gattini, a shareholder and executive of the target, will reinvest in Naturalia which owns Sanecovit, Bioearth and Effegilab. Di-va has sales of 10 million euros with an ebitda in the region of 2 million. After such an acquisition, Naturalia Tantum will generate sales of 26 million, an ebitda of 4.5, million and net financial debt of 1.5 million.

Belgium’s Gauder & Co. and an undisclosed financial investor manifested their interest in Sampsistemi and Sampsistemi Extrusion, two units of Samp which is a subsidiary of Gruppo Maccaferri, a company in receivership (see here a previous post by BeBeez). The bidders aim to create a relevant player in the fields of rotating machinery and extrusion. In April 2018, Gauder sold Setic and Pourtier to Sampsistemi which received financial support from Muzinich that subscribed a 25 million euros bond of the buyer.

Kairos, the Italian subsidiary of Swiss private bank Julius Bär, launched Renaissance Eltif (Kairos Alternative Investment Sicav Renaissance Eltif) (See here a previous post by BeBeez). Subscriptions will close on 31 March 2021. Renaissance Eltif aims to invest in unlisted and listed SMEs with a market capitalization of below 500 million euros. The fund will last 6-8 years and invest up to 25% of its resources in convertible bonds, warrants, club deal, pre-ipo, and private equity. Massimo Trabattoni, Head of Italian Equity, and Rocco Bove, Head of Fixed Income, will manage the fund.

In 1H20, Trevi Finanziaria Industriale (Trevifin), the troubled Milan-listed engineering company of which FSI Investimenti and Polaris Capital Management are the controlling shareholders, posted a recurring ebitda of 34.3 million euros (+43%) and net profits of 251.5 million (loss of 25.7 million in 1H19) (see here a previous post by BeBeez). Revenues have been of 238.4 million (-21%) with net financial debt of 251 million (735 million). For 2020, Trevi expects to generate sales of 489 million with an ebitda of 52 million. The improvement of the company’s financials is due to a successful capital increase of 280 million that the company launched earlier in May

EdiBeez srl