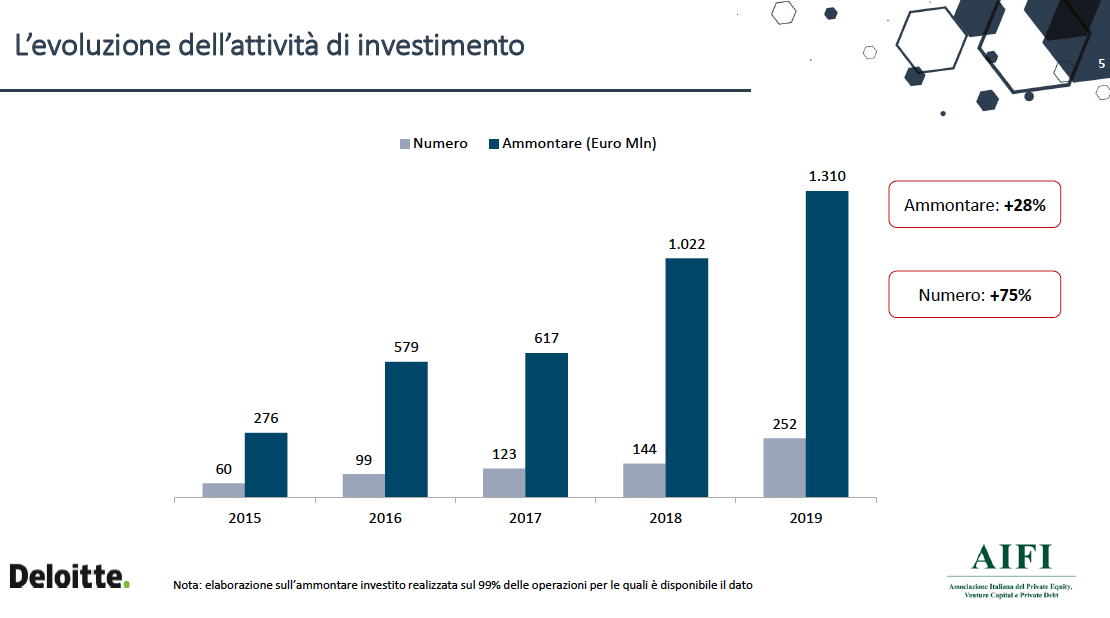

AIFI, the Italian association of investors in Private Equity, Venture Capital and Private Debt, submitted to the Italian Government its proposals for supporting the private capital sector and boost the real economy (See here a previous post by BeBeez). AIFI’s general manager Anna Gervasoni previously said to BeBeez that the association was working on the draft of plans for allowing private capital investors to support the Italian midmarket companies. Tax incentives for the Eltif funds and the reduction of the least threshold for investing in alternative funds are some of the suggestions of AIFI. Innocenzo Cipolletta (the president of Aifi), Gervasoni, and Antonio Solinas, EMEA Financial Advisory Leader at Deloitte, said in a conference call on 31 March, Tuesday, that in 2019 the investments of private debt funds in Italy amounted to 1.3 billion euros (+ 28% yoy), while the fundraising dropped at 385 million (-24% yoy) (see here a previous post by BeBeez and here the report of AIFI and Deloitte). The BeBeez Fundraising Report about the fundraising of private capital investors in the last two years (available for the subscribers to BeBeez News Premium) said that private debt and direct lending funds announced final closings for as much as 345 million euros in the period and that since early 2018 the private debt operators announced several partial closings on other funds for 785 million. Gervasoni and Cipolletta said that such resources are much less than those available to private equity funds, therefore AIFI suggested to the Italian Government to implement tax incentives for increasing the size of Italian funds for private debt and direct lending. As for investments, as said before, data by AIFI-Deloitte said that the investments of private debt and direct lending funds amounted to 1.3 billions. However, such figures do not include the private debt and direct lending investments of banks, brokers, spvs or through fintech platforms. According to the BeBeez 2019 private debt and direct lending Report (available for the subscribers to BeBeez News Premium) says that in 2019 the investments in the debt of Italian companies amounted to 12.2 billion, while in 2018 they were worth 10.8 billion (see here the BeBeez private debt and direct lending Report 2018). Assogestioni, the Italian association of asset managers, proposed instead the launch of alternative investment funds for supporting SMEs (see here a previous post by BeBeez). Assogestioni said that the current investment funds are not the right tool for the SMEs as they have an investment constraint of 30,000 euros per year, up to a total of 0.15 million and a 10% concentration limit. Assogestioni suggests increasing the investment constraint for wealthy individuals that may lock up the holding for a longer period of time as it happens for the Eltif (who have a threshold of 0.15 million).

AIFI, the Italian association of investors in Private Equity, Venture Capital and Private Debt, submitted to the Italian Government its proposals for supporting the private capital sector and boost the real economy (See here a previous post by BeBeez). AIFI’s general manager Anna Gervasoni previously said to BeBeez that the association was working on the draft of plans for allowing private capital investors to support the Italian midmarket companies. Tax incentives for the Eltif funds and the reduction of the least threshold for investing in alternative funds are some of the suggestions of AIFI. Innocenzo Cipolletta (the president of Aifi), Gervasoni, and Antonio Solinas, EMEA Financial Advisory Leader at Deloitte, said in a conference call on 31 March, Tuesday, that in 2019 the investments of private debt funds in Italy amounted to 1.3 billion euros (+ 28% yoy), while the fundraising dropped at 385 million (-24% yoy) (see here a previous post by BeBeez and here the report of AIFI and Deloitte). The BeBeez Fundraising Report about the fundraising of private capital investors in the last two years (available for the subscribers to BeBeez News Premium) said that private debt and direct lending funds announced final closings for as much as 345 million euros in the period and that since early 2018 the private debt operators announced several partial closings on other funds for 785 million. Gervasoni and Cipolletta said that such resources are much less than those available to private equity funds, therefore AIFI suggested to the Italian Government to implement tax incentives for increasing the size of Italian funds for private debt and direct lending. As for investments, as said before, data by AIFI-Deloitte said that the investments of private debt and direct lending funds amounted to 1.3 billions. However, such figures do not include the private debt and direct lending investments of banks, brokers, spvs or through fintech platforms. According to the BeBeez 2019 private debt and direct lending Report (available for the subscribers to BeBeez News Premium) says that in 2019 the investments in the debt of Italian companies amounted to 12.2 billion, while in 2018 they were worth 10.8 billion (see here the BeBeez private debt and direct lending Report 2018). Assogestioni, the Italian association of asset managers, proposed instead the launch of alternative investment funds for supporting SMEs (see here a previous post by BeBeez). Assogestioni said that the current investment funds are not the right tool for the SMEs as they have an investment constraint of 30,000 euros per year, up to a total of 0.15 million and a 10% concentration limit. Assogestioni suggests increasing the investment constraint for wealthy individuals that may lock up the holding for a longer period of time as it happens for the Eltif (who have a threshold of 0.15 million).

In 2019, 71% (51% in 2018) of 250 European private equity funds said that 10% or more of their portfolio assets broken one or more of their debt covenants, said a report of PwC (see here a previous post by BeBeez). This is a risk for the high yield bonds and the leveraged loans that supported several leveraged buyouts. Despite the high number of the breach of covenants, 62% of the respondents to the survey said that they were satisfied with the development of their portfolio companies in 2019.

A report that Leanus published for BeBeez on 28 March said that the current issue for Italian companies is the payment of fixed costs without generating sales, said (see here a previous post by BeBeez). However, the aggregate Italian economic system is solid with 800,000 healthy businesses (6000 big companies that lead the production chains). The aggregate turnover of the companies is of 2.5 trillion euros with an ebitda in the region of 8% and the equity which is worth 1.4 trillion, or three times as much the banking debts of 500 billion. However, in 2021 the businesses may be short of cash.

Seci, the holding that controls Gruppo Maccaferri, sent its application for receivership to the Bologna Court (see here a previous post by BeBeez). Rothschild & Co, Long Term Partners, Bonelli Erede, Studio La Croce, and PwC assisted the company for drafting the restructuring plan on the ground of the proposals of Carlyle and its co-investors GLG and Stellex Capital Management (all grouped in AHG), who own 54% of the 190 million euros bond of Officine Maccaferri (5.75% coupon and maturity in 2021). Earlier in March, BeBeez reported the terms of the offer of AHG. The holding Seci is the controlling shareholder of Officine Maccaferri (environmental engineering), Manifatture Sigaro Toscano (tobacco), Sadam (food), Samp (mechanical engineering), Seci Real Estate, and Seci Energia. Gaetano Maccaferri is the chairman of Gruppo Maccaferri. According to the business plan 2020-2025, Seci will keep its interests in Officine Maccaferri and Samp and will gradually exit from the sectors of food, energy and real estate. The company will invest the proceeds of such disposals for wholly repaying its senior creditors and partially its unsecured creditors with a recovery rate of 16% and an earn out of up to 25%. Seci will not change its stake in Manifatture Sigaro Toscano, but could sell or refinance the asset in 2025. Seci will receive fresh resources for 10 million; Officine Maccaferri will get 60 million together with the bondholders of AHG; Samp will get 25 million with the support of a financial partner. Pierluigi De Angelis is the ceo of Seci, while Sergio Iasi is the Chief Restructuring Officer (CRO) of Officine Maccaferri, and previously had the same role for Trevi Finanziaria.

C&G Capital, a B2B lender, launched a basket bond of 100 million euros for Veneto-based SMEs with sales of at least 30 million and 50 workers (See here a previous post by BeBeez). The issued bonds will have the same maturity and yield. Furthermore, C&G Capital will help smaller companies with different issuances. C&G Capital is acting as global coordinator for helping Cividac and Eurodecori for the issuance of minibonds that will not be part of the basket. Cividac is planning three revolving issuances of one million and another mid to long-term bond of 3 million for supporting its organic development. Cividac is a producer of industrial machinery and has sales of 5.87 million with an ebitda of 0.411 million. Eurodecori is a producer of moulds for several industrial sectors and has sales of 8.3 million with an ebitda of 0.381 million.

Zenith Service launched its Portfolio & Asset Management unit for monitoring the performance of the portfolios of distressed credits that the company securitised (See here a previous post by BeBeez). Diego Bortot will head the unit and the real estate asset management activities. Bortot is a seasoned professional in the field of NPLs that previously worked as managing director for the debt advisory unit of Duff & Phelps REAG, ceo of Unicredit Credit Management Immobiliare, and as coo of IES (ISC). Umberto Rasori is the ceo of Zenith Service which is part of Arrow Global since December 2016 and manages more than 150 spvs for the securitization of credits and more than 30 billion of credits for all the asset classes.

Ledoga, a producer of vegetal tannin that is part of Gruppo Silvateam, issued a minibond of 10 million euros within the frame of the programme Intesa Sanpaolo Basket Bond that the bank launched together with Elite, a subsidiary of London Stock Exchange Group (See here a previous post by BeBeez). Intesa Sanpaolo will subscribe to the bond. In October 2019, Gruppo Illiria, Sigma, Gruppo Cittadini dell’Ordine, and M-Cube, an Italian provider of audiovisual marketing solutions that belongs to HLD Europe, joined the basket bond programme. In December 2019, Ledoga issued a short-term bond of 0.15 million that is due to mature in June 2020 and pays a 4.3% coupon. Andrea Battaglia, the ceo of Ledoga which has sales of 58.1 million, an ebitda of 10.9 million, and net financial debt of 28.3 million. See here a roundup of BeBeez latest news about basket bonds.

Italian iconic publisher Utet Grandi Opere, part of Cose Belle d’Italia (Cbi), applied for receivership on 24 March, (See here a previous post by BeBeez). Utet losses of 1.7 million euros while sales amount to 5 million. The ceo Marco Castelluzzo, Gabriele Galateri di Genola, the chairman of Assicurazioni Generali, and Marco Weigmann have a minority of Utet.

In light of the emergency related to the coronavirus emergency, Main Capital changed its plans for its 250 million euros fundraising plan for a direct lending fund (See here a previous post by BeBeez). The firm will launch a fund for Utps corporate that currently belong to banks. The European Investment Fund is currently conducting due diligence for pouring resources in Main Capital. The fund aims to purchase from banks Utps with a gross value of 200-250 million and tickets of 1 – 10 million. The fund’s team members are the managing director Vincenzo Macaione, chairman Massimo De Dominicis, cio Francesco Carobbi, and Fulvio Pelargonio. Macaione and De Dominicis said to BeBeez that this fund will be further support for SMEs.

EnVent, a mid-market financial advisor, received the listing agent status for the MTF (Multilateral Trading Facility) market of Vienna (See here a previous post by BeBeez). Direct Market and Direct Market Plus, the prime segments of MTF, allow SMEs to raise capitals from institutional investors. Several Italian SMEs listed their minibonds on Vienna market. Franco Gaudenti is the chairman of EnVent Capital Markets and Paolo Verna is the firm’s Head of Markets. EnVent Capital Markets also received the authorization from London’s Financial conduct authority.

Italian fashion firm Conbipel, an asset of Oaktree Capital Management,applied for receivership (See here a previous post by BeBeez). The Massa Family sold the company to turnaround investor Oaktree in 2007. In June 2014, Conbipel restructured its debt but Oaktree didn’t manage to sell it in 2015. The company has sales of 198 million euros and an ebitda of minus 5.3 million

Prelios, the Italian real estate and distressed credit investor, appointed Gaetano Miccichè, the chairman of Banca Imi, as board member and Vice – Chairman (See here a previous post by BeBeez). Miccichè is also part of the board of RCS, the strategic advisory board of Neuberger Berman/NB Renaissance Partners, the scientific board of Milan Polytechnic University and of ANSPC (a research centre about the credit market). Since May 2018, Prelios entirely belongs to Davidson Kempner Capital Management, which acquired 44.86% of the company in December 2017 at 0.116 euros per share from Pirelli, Intesa SanPaolo, UniCredit, and Fenice and launched a public offer for delisting the company. Fabrizio Palenzona and Riccardo Serrini are the company’s chairman and ceo.

Cassa depositi e prestiti’s Italian turnaround fund QuattroR, whose head is Francesco Conte, is holding talks for acquiring a stake in Burgo, an Italian paper producer (See here a previous post by BeBeez). The company could launch a capital increase in the region of 70 million euros that the fund may subscribe together with the Marchi Family, that currently have 50.59% of the business. The refinancing of the company’s 500 million debt is part of the deal. Talks are at an advanced stage despite the coronavirus emergency. Burgo also belongs to Mediobanca (22.12%), Unicredit (3.83%), Generali Financial Holdings (11.68%) and Italmobiliare (11.68%). At the end of 2015 Pillarstone Italy acquired from Unicredit and Intesa Sanpaolo hybrid instruments for Burgo amounting to 200 million.

Troubled Italian shipping company Tirrenia-Cin could restart soon its activities (See here a previous post by BeBeez). Rome Court blocked the company’s activity for raising 55 million euros that are necessary for paying part of its debt. Gerardo Longobardi, Beniamino Caravita di Toritto, and Stefano Ambrosini, the extraordinary commissioners of Tirrenia (the bad company that belongs to the Italian Government after the privatization of 2012) asked the Court to block the activity of Tirrenia – Cin as it still owes 180 million to the Italian Government as the payment for a 60% stake that in 2012 did not belong yet to Moby, another troubled Italian shipping company that belongs to the Onorato Family. Moby is still discussing the restructuring of its debt with Ad Hoc Group, the association of hedge funds that invested in the company’s debt. The list of Moby’s bondholders includes hedge funds Soundpoint Capital, Cheyenne Capital, and York Capital. The firms acquired more than 50% of Moby’s Luxembourg-listed bond. In 3Q19, Moby’s cash was worth 56.2 million (89 million in 2Q19, 125.5 million in 3Q18).

The current emergency related to the coronavirus is an issue for the bonds of Selecta, the Swiss vending machines company of KKR that in 2017 acquired Italy’s Argenta (See here a previous post by BeBeez). In November 2019, Selecta issued a 100 million euros senior secured bond (maturity in 2024 with 5.875% coupon). In March 2018, the company issued a 765 million bond listed on Berlin market and a 50 million floating-rate senior bond due to mature in 2024, (previously issued in March 2018 for 325 million). In March 2018, Selecta refinanced its 1.3 billion bonds in three tranches, these two issuances, and another of 250 million CHF. The current lockdown created expectations. Everest Research said that Selecta has enough cash for handling the current situation, but it will have to reduce its long-term debt for avoiding a restructuring. The current capitalization of Selecta’s bond implies an enterprise value of 3.6 X ebitda expected for 2021 and 3.2 X ebitda 2019.

Generalfinance, a provider of factoring services for distressed companies, posted net profits of 4.2 million euros in 2019 (+43% yoy) (See here a previous post by BeBeez). The company will pay dividends for 2.1 million euros, with a dividend yield of about 14%. Generalfinance is reportedly interested in launching an IPO or a trade sale. The company belongs to GGH (almost 53%), and Credito Valtellinese, which acquired its stake in June 2017 from the company’s ceo Massimo Gianolli. The firm’s board members are Gianolli (chairman and ceo), Leonardo Etro, Alberto Angelo Landoni, Bruno Messina, and Alessio Poi. The auditing board directors are Paolo Lazzati (head), Federica Casalvolone and Andrea Di Giuseppe Cafà.

Consorzio Casalasco del Pomodoro (CCP), an asset of Simest (Gruppo Cdp), borrowed 160 million euros from a pool of banks (See here a previous post by BeBeez). Unicredit acted as leading agent bank and Cassa Depositi e Prestiti as arranger. CCP generated abroad 66% of its sales of 310 million for 2019. In 2018, the company posted a turnover in the region of 265 million with an ebitda of 5.9 million and a net financial debt of 162.3 million. CCP will invest the proceeds of this loan in its organic development and in its international expansion.

The readers of BeBeez News Premium have access to the BeBeez Reports and Insight Views. The monthly subscription fee is 20 euros per month plus VAT (or 240 euros per year plus VAT). The subscription to BeBeez Private Data Combo grants access to BeBeez Private Data, a database that includes the financials of more than 1700 Italian companies that belong to private equity, venture capital and private debt investors, and allows to access BeBeez News Premium for a monthly fee of 110 euros plus VAT (or 1320 euros plus VAT per year). Students can subscribe to BeBeez News Premium for 15 euros (VAT included) for the first month and renew the subscription monthly. Please click here or write to info@edibeez.it for further information about the subscription procedure.