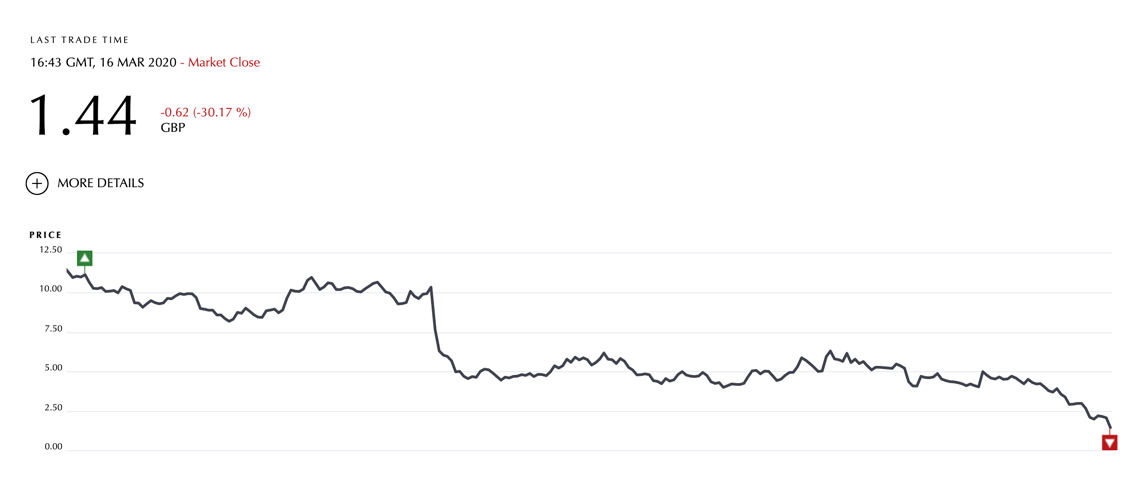

Aston Martin Lagonda, the British luxury car manufacturer participated by the Italian private equity firm Investindustrial, closed yesterday’s session on the Lonndon Stock Exchange with a 30% drop, to close at 1.44 pounds per share.

Aston Martin Lagonda, the British luxury car manufacturer participated by the Italian private equity firm Investindustrial, closed yesterday’s session on the Lonndon Stock Exchange with a 30% drop, to close at 1.44 pounds per share.

The sstock’s debacle occurred in a new black day for world stock exchanges, for fears of the negative effects of the coronavirus on economies around the planet, in which, however, the FTSE 100 lost only 4%.

The terrible performance of Aston Martin on the stock exchange owes to the recent communication that the expected capital increase will not be more than 500 million pounds at 400 pence per share, as announced last February (see here a previous article by BeBeez) but of 536 million pounds at a price of 225 pence per share (approximately 592 million euros, see the press release here and the Prospectus Supplement here). In the transaction Deutsche Bank is joint-global coordinator and bookrunner together with Morgan Stanley and Jp Morgan.

At the end of February, a consortium of investors (Yew Tree Consortium) led by Canadian businessman Lawrence Stroll was expected to subscribe 45.6 million newly issued shares, equal to a 16.7% stake in Aston Martin, at 4 pounds per share for a total of 182 million pounds while, at the time of the announcement of the 2019 financial statements, a further capital increase was expected for further 318 million pounds dedicated to all shareholders for a total injection of 500 million pounds of new money. All this in order to rebalance the group’s financial situation, weighed down by a net financial debt of around 800 million pounds, and to support the launch of the DBX luxury SUV on the market.

Now the sharp stop to the growth of the global economy, following the coronavirus contagion, has canceled the Geneva Motor Show, in which Aston Martin intended to present the new Vantage Roadster and V12 Speedster models, and has forced Mr. Stroll to redo the accounts.

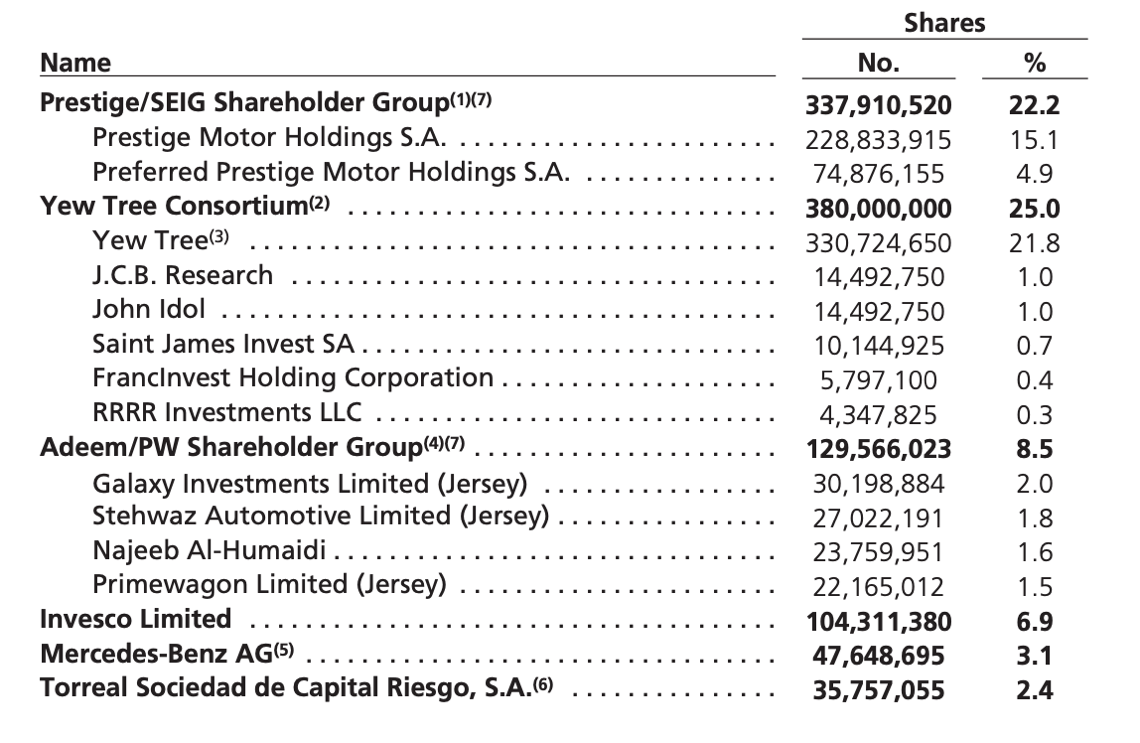

The consortium of investors will therefore buy a 25% share of the supercar-maker group in a reserved capital increase with an outlay of 171 million pounds for 76 millions newly issued shares at 2.25 pounds per share and that the subsequent capital increase in option to all shareholders will consist of the issue of approximately 1.2 billion new shares (from 153.2 million initially planned) on the basis of a ratio of 4 new shares per each old share held at the price of 30 pence for each new share, for a total of 364.8 million pounds. Overall, therefore, the whole operation will provide for 35.8 million pounds more to the group.

Not only. In early February, Yew Tree had already disbursed a 55.5 million pounds credit line to Aston Martin to support working capital, which has now been increased by an additional 20 million pounds to reach 75.5 millions overall.

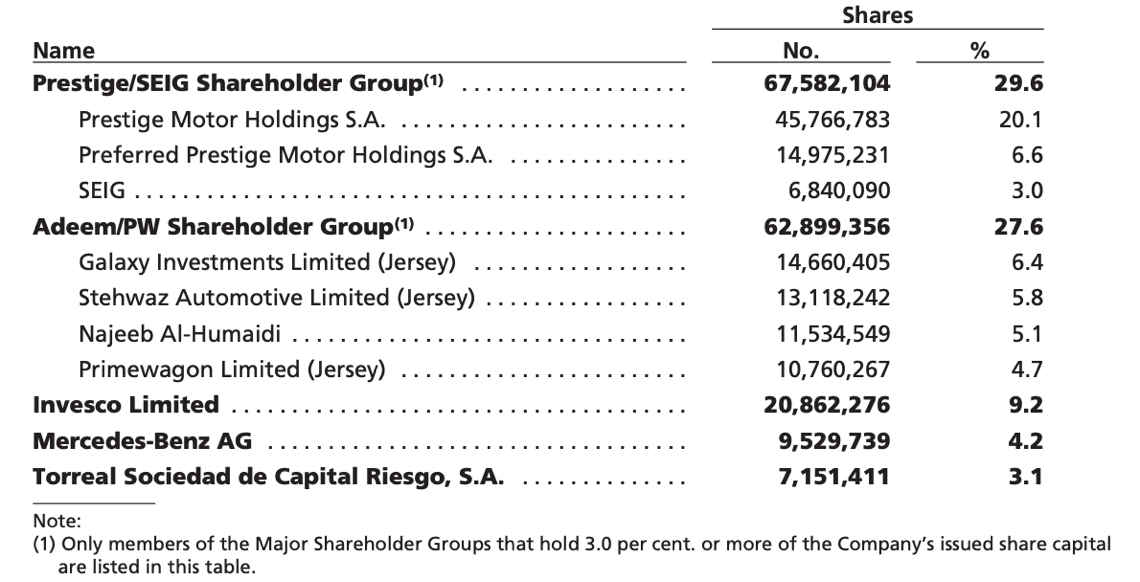

The main current shareholder of Aston Martin, i.e. Prestige / Strategic European Investment Group (which is headed by Investindustrial, with 29.6%) will subscribe to the capital increase, in addition to 100% of the rights due, also for further 16.7 million shares, bringing its post increase stake to 22.2%. On the other hand, what was the second largest shareholder so far, namely the Kuwaiti fund Adeem / Primewagon (with 27.2%), will only subscribe to the increase for 26.5% of its rights, thus diluting to 8.5 %. As for Yew Tree, it will subscribe the increase exactly in proportion to its rights, remaining at 25% of the capital, for a total outlay for the consortium in the two operations of 262 million pounds (against the 235 millions initially assumed).

Mr. Stroll explained: “There has been a significant change in the global market environment in which Aston Martin Lagonda operates. What has not changed is our commitment to provide the Company with the necessary funding it needs to manage through this period, to reset the business and to deliver on its long-term potential. Following recent moves in the share price and discussions with the Board, I and my consortium of investors, have agreed that we will now acquire 25% of the company and take up our rights in full in return for a long-term capital Investment of £262 million. In addition, we have agreed to advance a further £20 million in short term funding to support the company, bringing this total amount to £75.5 million. Whilst the immediate outlook looks increasingly challenging, I remain fully committed to the future of Aston Martin Lagonda and look forward to implementing our plans once the fundraising is complete”.

The consortium, which sees Stroll as lead investor, includes a number of private investors, including André Desmarais (former ceo of Power Corp. Canada), Michael de Picciotto (vice president of the Supervisory Board of Engel & Volkërs), Silas Chou ( Hong Kong fashion entrepreneur), John Idol (chairman and ceo of Capri Holding, formerly Michael Kors), Lord Anthony Bamford (president of JCB) and John McCaw (former shareholder of McCaw Cellular).

Mr. Stroll’s interest in the London-listed luxury supercar maker group controlled by the private equity fund Investindustrial led by Andrea Bonomi had already circulated earlier this year (see here a previous article by BeBeez), when Mr. Stroll was said he would be interested in buying a significant stake of the British auto maker. And in this regard, the ceo of Aston Martin Andy Palmer had commented: “We remain in discussion with potential strategic investors, who could also translate into an investment in capital”.

Aston Martin, which makes all its cars in the UK, also announced yesterday that its production is going ahead, without problems related to the supply chain interruption in China linked to COVID-19: “The supply is guaranteed up to in April and the company continues to monitor its suppliers and warehouse to mitigate any future disruption”.

At the beginning of January 2020 Aston Martin had issued a warning on the 2019 results: the ebitda estimates for the year had been reduced to 130-140 million pounds (the consensus was 200 millions and in 2018 the ebitda had been 247 millions), the margin on revenues had been cut from 20% to 12.5% -13.5% and sales had fallen by 7% to 5,809 units, compared to the 7,100-7,300 forecast at the beginning of last year. Aston Martin had already launched a profit margin warning in June 2019, when it warned that it would be only 20%. The company closed 2019 with: revenues of 997 million pounds, an adjusted ebitda of 134.2 million, sales of 5,862 units, a loss of 36.7 million and net debt of 876 million (see the press release here ).

Investindustrial’s entry into Aston Martin dates back to 2012. At the time Investindustrial had put 150 million pounds (then 190 million euros) on the plate for its share and had made available up to 80 millions (another 100 million euros), without being obliged to invest them, for further capital increases if they were necessary to finance the 500 million pounds investment plan for the development of new products and technology. The operation was concluded on the basis of an assessment of the entire group of 740 million pounds (then 940 million euros). In May 2015, Investindustrial and Tejara Capital announced a 200 million pounds capital increase for Aston Martin (see here a previous article by BeBeez). Then in 2018 there was the ipo.

On that occasion sellers had been Investindustrial (37.5% before the ipo), the Kuwaiti of Tajara Capital (ex Investment Dar) and Adeem Investments (which together controlled 54.5%), while Daimler had not sold its 4.9%, obtained in 2013 in exchange for the supply of engines and electronic components, which then reduced to 4.2%. Finally, we remind you that in July 2019 Investindustrial had submitted, through Strategic European Investment Group, a vehicle company headed by the Investindustrial VI fund, an offer to increase its stake in Aston Martin by 3%, paying 10 pounds per share for 6.84 million of shares, probably to try to raise the company’s prices (see here a previous article by BeBeez),