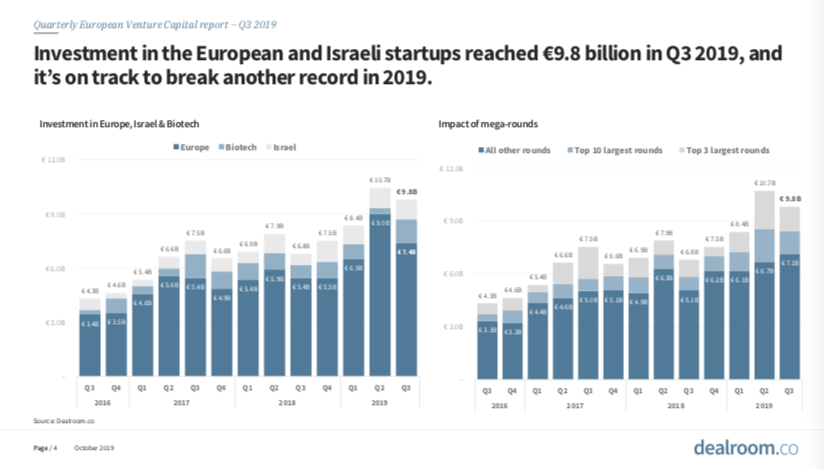

Year-to-date 28 billion euros were invested by venture capital funds in Europe and Israel, compared to 21 billions in the same period of 2018 and 29 billions in the whole of 2018. Investments in European and Israeli startups have reached 9.8 billion euros in Q3 2019 and could touch new records at the end of the year. This is revealed by the Quarterly European Venture Capital Report for Q3 2019 of Dealroom, which also states that Italy is in ninth place in Europe for venture capital, both in terms of investments (200 million euros) and number of rounds (21) (see here a previous post by BeBeez).

Year-to-date 28 billion euros were invested by venture capital funds in Europe and Israel, compared to 21 billions in the same period of 2018 and 29 billions in the whole of 2018. Investments in European and Israeli startups have reached 9.8 billion euros in Q3 2019 and could touch new records at the end of the year. This is revealed by the Quarterly European Venture Capital Report for Q3 2019 of Dealroom, which also states that Italy is in ninth place in Europe for venture capital, both in terms of investments (200 million euros) and number of rounds (21) (see here a previous post by BeBeez).

VeNetWork, an Italian fintech company, sold to Sardex 63% of commercial credit swap platform Venetex (see here a previous post by BeBeez). Carlo Mancosu, Gabriele and Giuseppe Littera, and Franco Contu founded Sardex in 2009.

Italian digital native fashion brand Lirecento sold a minority stake to German fund Global Founders Capital (GFC) for 1.2 million euros from (see here a previous post by BeBeez). Lirecento’s founders are Carlo Battaglino (ceo) and Luca Labbadini.

ArteOlio, an Italian startup that produces extra-virgin olive oil, closed a capital increase for 5.5 million euros that the company’s founder Augusto Lippi, ceo Riccardo Schiatti and Verteq Capital subscribed (see here a previous post by BeBeez). ArteOlio, was born in August 2019

WaterView, an Italian startup operating in the weather analysis and forecasting sector, raised 870k euros from Progress Tech Transfer (720k euros) and Liftt (150k euros), an investor in hi-tech company of Turin Polytecnhic University and Compagnia di San Paolo (see here a previous post by BeBeez). WaterView will invest these proceeds in its organic development in Italy and abroad. Paola Allamano, Paolo Cavagnero, and Alberto Croci founded WaterView in 2015.

I3b, the Italian startup that produces hydro-jet motor DeepSpeed, launched an equity crowdfunding campaign on Crowdfundme, and set a fundraising target of 180k-460k euros on the ground of a pre-money value of 5 million euros (see here a previous post by BeBeez). William Gobbo founded I3b, who previously raised funds form a pool of business angels like Maurizio Di Robilant and Francois De Brabant.

Italian law firm GIM Legal and real estate equity crowdfunding platform House4Crowd signed a partnership for enlarging the investors community (see here a previous post by BeBeez). House4Crowd’s ceo is Francesco Chechile, who founded the business together with his sister Rosaria Chechile (coo).