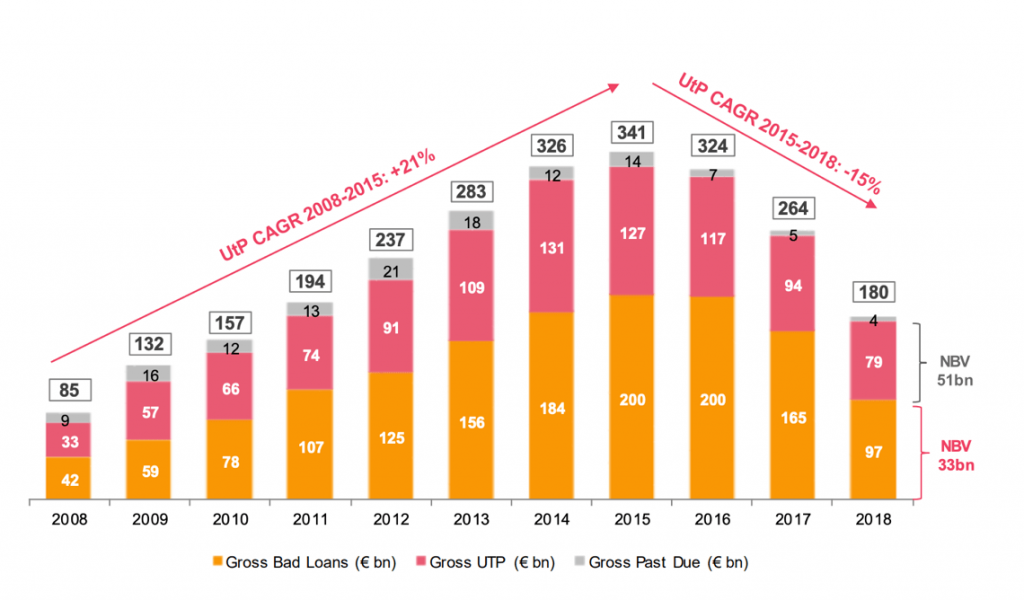

A report of PwC says that between 2015 and 2018 the transactions of Italian NPEs (non-performing exposure) amounted to 190 billion euros, while at the end of 2018 Italian banks had on their books distressed credits worth 180 billions (341 billion in 2015) of which UTPs amounted to 79 billion (127 billion 2015) (see here a previous post byBeBeez). The net value of these UTPs is of 51 billions. In 2019 transactions in the distressed credit market amount to 15 billion and further deals worth at least a total of 36 billions are coming to market this year, BeBeez database says (see here the NPL Report of BeBeez for May 2019 available for BeBeez News Premium 12 months, see here how to subscribe for just 20 euros per month). The face value of announced sales in 2018 was of 101 billion euros (see here BeBeez NPL Report Npl for 2018). The newsletter of TMA Italia, the Italian association of turnaround managers, edited by BeBeez, also released such data adding a focus on how the specific warning signs will be managed by italian companies in the framework of the new Italian Insolvency Code, which will enter into force next year (see here a previous post byBeBeez).

A report of PwC says that between 2015 and 2018 the transactions of Italian NPEs (non-performing exposure) amounted to 190 billion euros, while at the end of 2018 Italian banks had on their books distressed credits worth 180 billions (341 billion in 2015) of which UTPs amounted to 79 billion (127 billion 2015) (see here a previous post byBeBeez). The net value of these UTPs is of 51 billions. In 2019 transactions in the distressed credit market amount to 15 billion and further deals worth at least a total of 36 billions are coming to market this year, BeBeez database says (see here the NPL Report of BeBeez for May 2019 available for BeBeez News Premium 12 months, see here how to subscribe for just 20 euros per month). The face value of announced sales in 2018 was of 101 billion euros (see here BeBeez NPL Report Npl for 2018). The newsletter of TMA Italia, the Italian association of turnaround managers, edited by BeBeez, also released such data adding a focus on how the specific warning signs will be managed by italian companies in the framework of the new Italian Insolvency Code, which will enter into force next year (see here a previous post byBeBeez).

The European Commission awarded the Italian Government with an extension for providing a warranty on banks’ NPLs (Gacs) (see here a previous post by BeBeez). The new warranty scheme will last 24 months after the EU approval, with the possibility for a 12 months extension. Only credits with a BBB or equivalent rating can have the Gacs.

Guber Banca acquired three portfolios of distressed credits amounting to a face value of above 350 million euros (See here a previous post by BeBeez). Federico Guarneri, cofounder of Guber Banca, said that the firm has acquired NPLs with a face value of above one billion. Francesco Guarneri and Gianluigi Bertini founded Guber in 1991 and sold a 33.3% stake to Värde Partners in March 2017.

Debitos, the German marketplace for secondaries sales of credits, appointed Francesco Paolo Bellopede as country manager for Italy (see here a previous post by BeBeez). Bellopede has previously been a partner of Flexagon Capital Solutions, a special opportunities and distressed assets investment firm, and previously worked as an investment banker for Unicredit, Stern Agee UK, and Kildare. Timur Peters, Debitos ceo, founded the company in 2010.

Unicredit is going to sell a portfolio of distressed credits worth 5 billion euros, press reports say (see here a previous post by BeBeez). Unicredit i is also reportedly selling three NPL portfolios totally worth 2.4 billion. In 1Q19, Uncredit’s distressed credits amounted to 37.6 billion (down from 38.2 billion at the end of 2018). The bank has a 7.6% ratio of gross distressed credits over the total credits, with a 61.8% coverage rate in 1Q19.

Intesa Sanpaolo could sell UTPs worth up to 5 billion euros to Prelios (see here a previous post by BeBeez). The Italian bank may appoint Prelios to handle further 5 billion of distressed credits. In March 2019, Intesa announced the signing of a non binding agreement with Prelios, the servicer that belongs to Davidson Kempner Capital Management.

Shernon Holding, the company that acquired 55 shops of distressed Italian furniture retailer Mercatone Uno, bankrupted (see here a previous post by BeBeez). Valdero Rigoni (ceo) and Michael Tahlmann founded Shernon Holding that belongs to Malta-based Star Alliance. In nine months, Shernon debt amounted to 90 million euros and Tahlmann and Rigoni may face an allegation of fraudulent bankruptcy. William Beozzo heads the Associazione Fornitori Mercatone Uno, which groups the company’s 500 suppliers that have to cash 250 million euros. The suppliers said to be interested in converting in equity their credits with Mercatone Uno.

Listed Italian contractor Salini Impregilo has to table by 15 July a white knight bid for listed troubled competitor Astaldi (see here a previous post by BeBeez). Salini expects to end negotiations with lending banks by the end of June and early July 2019.

Press reports say that Lucca Court accepted the application for receivership of Italian minor football club Lucchese Libertas (see here a previous post by BeBeez). The club needs 0.6-0.7 million euros for paying salaries and further 0.6-0.7 million for restructuring its financial and fiscal debts.

Italian food company Barilla has been the only bidder for the Muggia-based plant of troubled competitor Pasta Zara (see here a previous post by BeBeez). Treviso Court set the basic asking price for the assets at 119 million euros and 22 May as deadline for tabling bids and 23 May as the date for analysing the bids. Before the auction, Barilla had already put forward an 118 million euros offer for the asset and signed a five years co-packing agreement.

Italy’s super-luxury yachts maker Ferretti has to pay back the 211.7 million euros shareholder loan before launching an ipo (see here a previous post by BeBeez). Ferretti may issue a 250 million bond for reimbursing Chinese 86.2% shareholdercWeichai (Shandong Heavy Industry). Ferretti Group is worth in the region 750 million or 14x ebitda. The company’s net profit is of 31 million (+29% yoy), while the turnover is of 669 million (623 million) and the ebitda amounts to 53 million (59 million). Ferretti is one of the companies monitored BeBeez Private Data. Find out here how to subscribe to the Combo version, including Bebeez News Premium 12 months, for only 110 euros a month.

EdiBeez srl