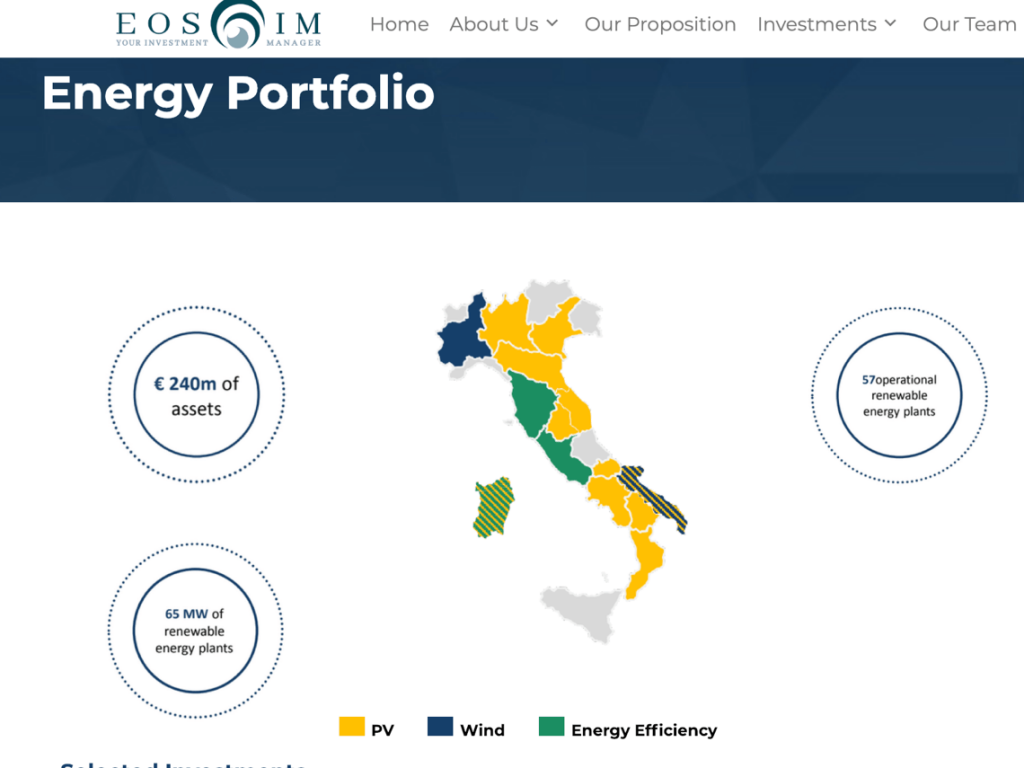

Italian private equity funds keep their activity at a steady level. Eos Investment Management, the UK investment firm that Ciro Mongillo founded, put the portfolio of it renewable energy fund Efesto 1 on sale with a 250 million of euros price tag (see here a previous post by BeBeez). Eos also set a 350 million target for the fundraising of Efesto 2 fund, a renewable energy investor that Giuseppe La Loggia heads.

Italian private equity funds keep their activity at a steady level. Eos Investment Management, the UK investment firm that Ciro Mongillo founded, put the portfolio of it renewable energy fund Efesto 1 on sale with a 250 million of euros price tag (see here a previous post by BeBeez). Eos also set a 350 million target for the fundraising of Efesto 2 fund, a renewable energy investor that Giuseppe La Loggia heads.

DentalPro, the Italian chain of dentist surgeries of which BCPartners owns 85% since May 2017, reached revenues in the region of 160 million of euros in 2018 and an ebitda in the region of 36 millions (see here a previous post by BeBeez). Michel Cohen, Samuele Baruch, and Paolo Tonveronachi founded the company in 2010 and hold 15% of it together with Vam Investments and Club degli Investitori. In December 2018, DentalPro acquired a majority stake of Swiss competitor Cliniodent.

In the first months of 2019 Lone Star aims to sound the interest of Italian and foreign private equity funds for vending machines company Evoca, fka N&W Global Vending, on the ground of an enterprise value of 1.5 billion of euros, the business ceo Andrea Zocchi confirmed (see here a previous post by BeBeez).Deutsche Bank is acting as financial advisor. In July 2018, Zocchi said on the sidelines of a BeBeez event that he would consider the launch of an ipo as well and pointed out that the company has sales of 462 million and an adjusted ebitda of 105.3 million. At the end of 2015, Lone Star acquired Evoca from Equistone (fca Barclays Private Equity) and Investcorp, that acquired the asset in 2008 from Argan Capital and Merrill Lynch Private Equity. These firms purchased Evoca in 2005 from Compass Partners International, which created the company after having acquired Italian Necta in 1999 from Electrolux-Zanussi and merged it with Danish Wittenborg.

Franco Maurizio Lagro, the extraordinary administrator of troubled Italian logistic company Artoni Group, accepted the binding offers of Fercam and Prelios, for the industrial activities and real estate assets of the asset in receivership (see here a previous post by BeBeez). Eduard Baumgartner founded Gruppo Fercam in 1949. Prelios controlling shareholder is Davidson Kempner. Lagro pointed out that it’s not yet possible to calculate the amount of reimbursements for Artoni’s creditors. Anna Maria Artoni used to head Artoni that in 2016 had sales in the region of 200 million of euros with debts of 210 million (113 million of financial debt). Cariparma has credits towards Artoni for 11.5 million. The list of the company’s lenders includeS Bper, Unicredit, Mediocredito Italiano. Artoni has debts with its suppliers for 75 million.

Objectway, an Italian publisher of software for the financial services industry, acquired Algorfin from Unione Fiduciaria (see here a previous post by BeBeez). Luigi Marciano is the ceo and founder of Objectway. UBI Banca and Unicredit financed the buyer. Filippo Cappio, coo of Unione Fiduciaria, said that after this sale, the company will focus on its core business and the growth through m&a.

Cedacri, the provider of IT services in outsourcing to financial firms that belongs to a pool of midsize banks and to FSI Mid-Market Growth Equity Fund, acquired Oasi, a supplier of banking compliance from, Nexi (fka Icbpi) (see here a previous post by BeBeez). Oasi’s enterprise value is of 151 million of euros or 10X ebitda (15 million). Alfredo Pallini, ceo of Oasi, will keep his role. Nexi belongs to private equity funds Advent International, Bain Capital,and Clessidra.

Dr. Vranjes Firenze, a Florence-based producer of luxury house fragrances of which BlueGem Capital Partners owns 70% since July 2017, rearranged its debt agreements with UBI Banca, Oldenburgische Landesbank Aktiengesellschaft, and Wilmington Trust (see here a previous post by BeBeez). Dr. Vranjes remaining 30% belongs to founder Paolo Vranjes and his wife Anna Maria. The company has revenues of 12.2 million, an ebitda of 4.2 milioni and net debt of 5 million.