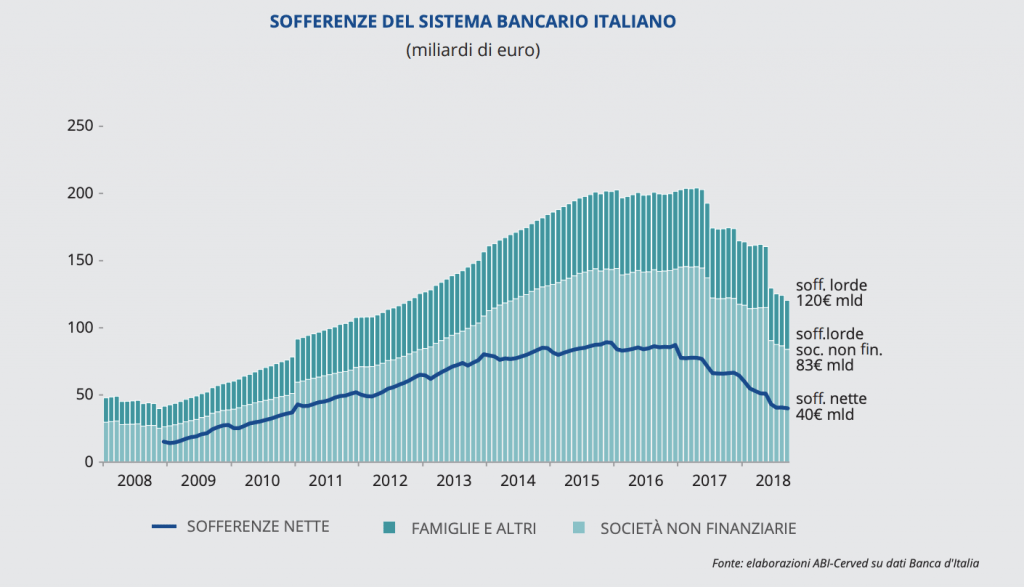

Italian economy’s landing didn’t impact the solidity of Italian companies Abi-Cerved data about credit say (see here a previous post byBeBeez). Italy’s GDP growth and a more selective credit policy decreased the change of credits into NPLs. Abi-Cerved econometric models forecasted that the growth rate of NPLs may decrease further in the next two years. In 2020, new NPLs will make 2.1% of credits. PwC last report about NPLs said that troubled credits reached a peak of 341 billion euros in 2015 and since then it reduced to 222 billion of euros in June 2018. However, if the BTP-Bund spread was to hit again a 300 bps value and a recession may come, NPL would increase in a relevant way.

Italian economy’s landing didn’t impact the solidity of Italian companies Abi-Cerved data about credit say (see here a previous post byBeBeez). Italy’s GDP growth and a more selective credit policy decreased the change of credits into NPLs. Abi-Cerved econometric models forecasted that the growth rate of NPLs may decrease further in the next two years. In 2020, new NPLs will make 2.1% of credits. PwC last report about NPLs said that troubled credits reached a peak of 341 billion euros in 2015 and since then it reduced to 222 billion of euros in June 2018. However, if the BTP-Bund spread was to hit again a 300 bps value and a recession may come, NPL would increase in a relevant way.

Axactor Italy acquired a portfolio of unsecured consumer Npl portfolio worth 145 million of euros (see here a previous post by BeBeez). Oddgeir Hansen, coo of Axactor Group and country manager of Axactor Italy said that the company plans a strong growth for 2019. The company will finance this deal with its own resources and bank loans

Marinedi acquired 60% of troubled Tigullio Shipping, the owner of the concession for the maintenance of Chiavari port (see here a previous post by BeBeez). Renato Marconi, ceo and founder of Marinedi, previously said that he aims to reach a leadership position in the Mediterranean area. Marinedi has sales of 6.7 million of euros and an ebitda of 1.1 million. Tigullio has losses of 5.4 million, equity of minus 1.5 million, gross debts of 27.5 million and cash of 80,000 euros.

Stefanel, the listed Italian casual fashion group, sent to Treviso Court an application for receivership (see here a previous post by BeBeez). Despite the investment of Oxy Capital-Attestor Capital for a 71% stake, Stefanel announced losses of 20.9 million of euros for 3Q18 and an equity value of 7.5 million (13.2 million yoy). The company hired Mediobanca to find buyers for its brand in Asia.

Prelios launched BlinkS, a digital marketplace for trading credits portfolios (see here a previous post by BeBeez). BlinkS will be operative by 1Q19 and will classify the portfolios in clusters of asset classes. Prelios ceo Riccardo Serrini said that market participants to NPL sector will soon focus on mid and small size portfolios.

TSW Industries, a producer of machinery for the packaging industry, issued an up to one million of euros minibond listed on Milan (see here a previous post by BeBeez). This bond will pay a 6% coupon and mature in December 2023 with an amortizing reimbursement and InnovFin warranty of the European Investment Fund. Cerved assigned a B2.1 rating to this issuance that Banca Sella entirely subscribed. The company will invest the proceeds of such a transaction in further developing the business. TSW plans to issue minibonds for a further value of 5 million. The company generates abroad 90% of its revenues of 8.2 million, has an adjusted ebitda of 1.6 million and net financial debt of 3.3 million.

Kirey Holding, part of Kirey Group, an IT consultancy firm with a focus on banking and insurance, issued a 7.5 million of euros minibond due to mature in 2023 that Tenax entirely subscribed (see here a previous post by BeBeez). Kirey belongs to Synergo and to the company’s manager Vittorio Lusvarghi and other executives. Kirey will invest such proceeds for achieving sales of 85 million and making acquisitions in Italy and Spain. The bond has the InnovFin warranty of the European Investment Fund.

Salvatore Bruno.