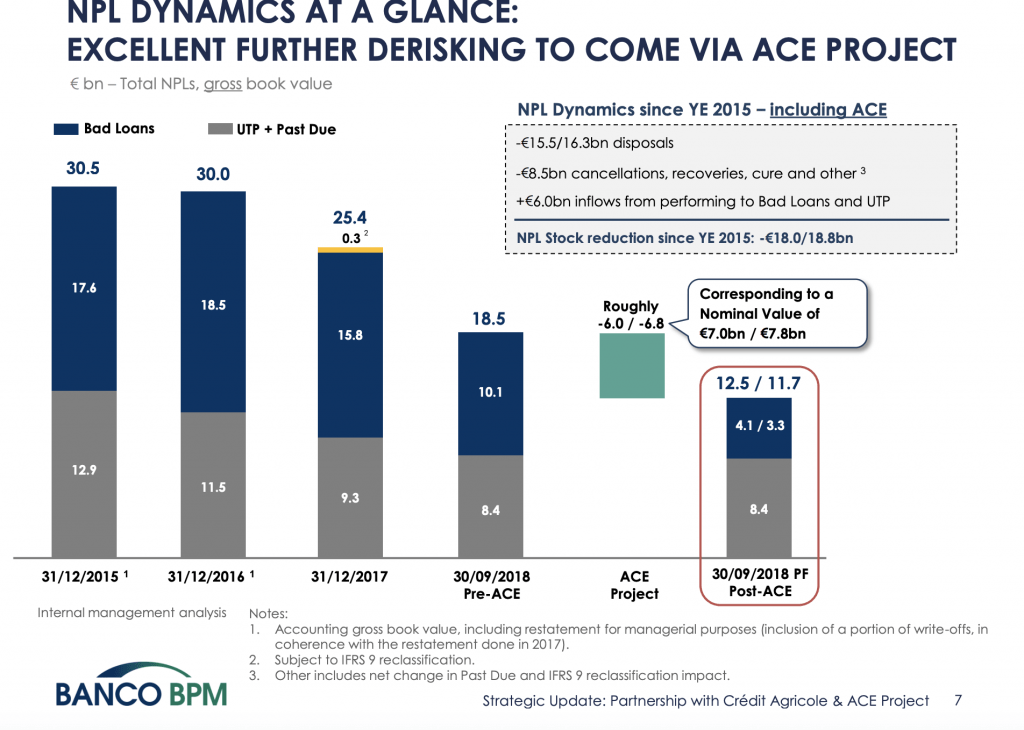

Banco Bpm will sell to Credito Fondiario and Elliott 7 to 7.8 billion of euros bad loans (Progetto ACE) as well as 70% of the platform for handling non performing exposures (see here a previous post by BeBeez). The firms aims to sign such a partnership in 1H19 once gained the regulators approval. Further bidders for the asset and the portfolio were doBank-Fortress-Illimity and Prelios-CRC. The portfolio will be securitized and Elliott will acquire the mezzanine and junior notes, while the senior tranches will benefit of the GACS scheme. Credito Fondiario will act as master servicer and corporate servicer. Credito Fondiario and Banco Bpm will sign a 70/30 joint venture and launch a platform for Npl servicing that will act as servicer for the portfolio that Elliott is to acquire, for the remaining amount of the Npls of Banco Bpm, and for 80% of the new problematic credits that Banco BPM may generate in the next 10 years. Credito Fondiario will launch a new capital increase for financing this transaction and Elliott will guarantee for it. Iacopo De Francisco said that this deal will strenghten the position of debt purchaser and debt servicer for Italian banks. Guido Lombardo, Chief Investment Officer and board member of Credito Fondiario, said that the firm aims to relaunch troubled companies through the injection of new capitals.

A group of undisclosed entrepreneurs invested 10 million of euros in New Credit Management (NCM), a credit servicer that Pietro Calderaro, Mauro Di Vita and ceo Mirko Tramontano founded (see here a previous post by BeBeez). These investors will subscribe the securitization of secured Npl that NCM acquired on the secondary market.

Delta Group signed the closing for selling Arcade Portfolio to Cerberus through a securitization of NPLs with a gross value of 2.1 billion of euros (See here a previous post by BeBeez). Delta Group belongs to Cassa di Risparmio della Repubblica di San Marino and Domenico Trombone is its ceo.

Axactor, an Oslo listed credits management firm, acquired from the main Italian banks a portfolio of consumer unsecured Npls worth in the region of 70 million of euros (see here a previous post by BeBeez). Endre Rangnes is the ceo of Axactor Group.

The Dedica Anthology, the luxury hotels chain under which Värde Partners, grouped Boscolo’s five stars hotels, refinanced its debt through the issuance of a secured senior bond worth 337 million of euros (see here a previous post byBeBeez). Blackstone Real Estate Debt Strategies entirely subscribed this Vienna-listed bond. Francisco Milone, partner and head of European real estate unit of Värde Partners, said that Ingrid Hotels spa, the company that owns the European luxury hotels of Dedica, is ready to grow and invest further. Stephen Alden and Alessandro Grassivaro are the ceo and the cfo of Ingrid Hotels.