21 Invest, the investment holding owned by Alessandro Benetton, will subscribe a capital increase in iconic Italian wine maker Zonin 1821 for a 36% at a 65 million euros price, Il Sole 24 Ore wrote.

21 Invest, the investment holding owned by Alessandro Benetton, will subscribe a capital increase in iconic Italian wine maker Zonin 1821 for a 36% at a 65 million euros price, Il Sole 24 Ore wrote.

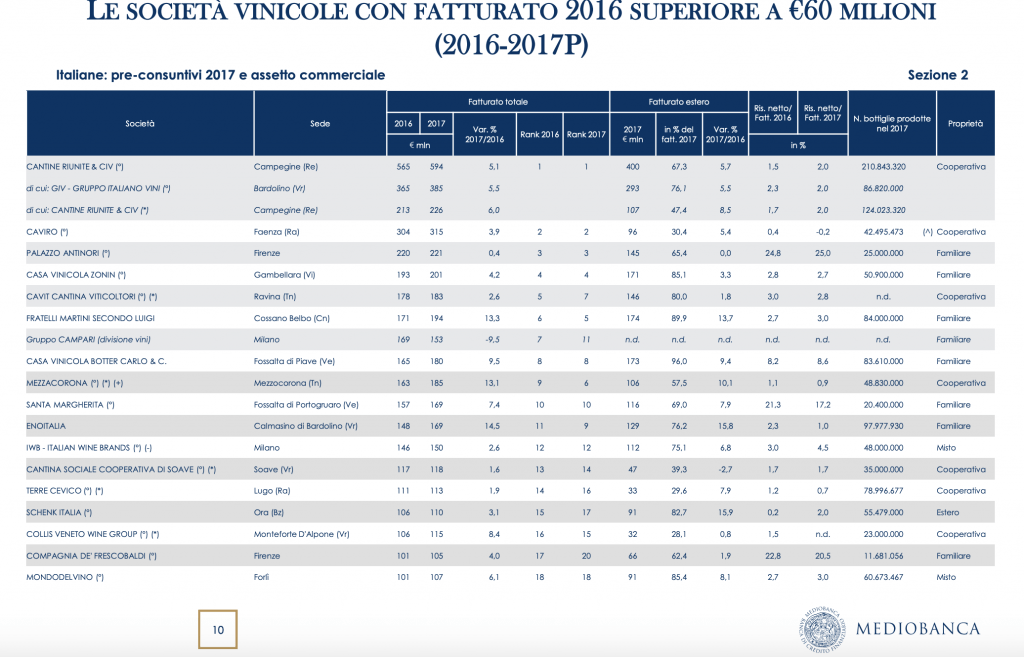

Zonin reached 201 million euros in revenues in 2017, being number four in the Italian wine makers ranking for revenues in 2017 made by Mediobanca, after Cantine Riunite (594 million euros), Caviro (315 mln) and Antinori (221 mln).

Zonin was advised by Mediobanca in the partner selection process while the new strategic plan, targeting 300 million euros of revenues in 5 years’ time and the listing at the Italian Stock Exchange, was prepared with the support of Bain & Co.

Zonin 1821, based in Gambellara (Vicenza), has been looking for a financial partner since last Spring in order to facilitate the generational change in the company finanziario after entrepreneur Gianni Zonin, who was also chairman of defaulted Banca Popolare di Vicenza, left the company to his children. In the meantime Mr. Zonin has been sent to trial with all other top managers of the bank (see here a previous post by BeBeez).

The deal attracted interest from many private equity firms, especially the ones with experience in the wine and agricultural sectors such as Idea Taste of Italy managed by Dea Capital Alternative Funds sgr aor French giant Unigrains, who invests in Italy through Fondo AgroAlimentare I and Cerea funds.

In Spring 2016 Mr. Zonin gave to his sons Domenico, Francesco and Michele a 26,9% stake of Gianni Zonin Vineyard sas di Giovanni Zonin & C. plus usufruct rights on another 23% stake. He also gave them a 38.5% of Zonin Giovanni sas, the holding company of the group.