Carige, presenting yesterday the consolidated results for the nine months 2018 and the capitalization measures of the group, announced that last Nov 9th the bank had signed the closing for the sale of a portfolio of UTP positions for 366 million euros GBV, while the securitization with public guarantee (GACS) of a bad loans portfolio worth one billion euros is to be closed soon (see the press release here).

The press note did not specify the name of the buyer of the UTPs, but last October the bank itself had announced that the Board of Directors had mandated the ceo, Fabio Innocenzi, to sign the final agreement with Bain Capital Credit for the sale of a unlikley to pay loans portfolio of up to 380 million euros (see here a previous post by BeBeez).

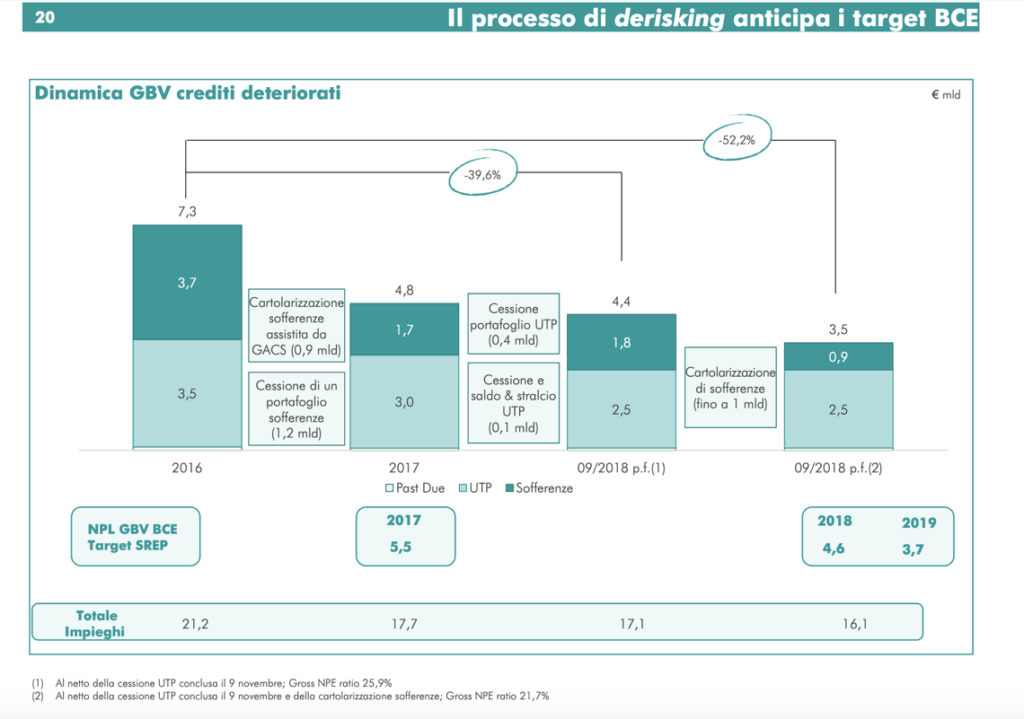

In the presentation of the nine months results, it is clarified that net of the sale of UTPs, the NPE gross ratio for the bank at the end of September fell to 25.9%, while considering also the one billion euro securitization, that ratio would have fallen to 21 , 7%.

Already at the end of March, while presenting the quarterly accounts, Carige had announced that, within the UTPs portfolio, which at 31 December 2017 amounted to about 3 billion euro, the bank envisaged disposals and withdrawals of UTP positions for 500 million 2018 and an additional 200 millions in 2019 and that by the end of the year it would have concluded a securitization with GACS of one billion euro (see here a previous post by BeBeez).