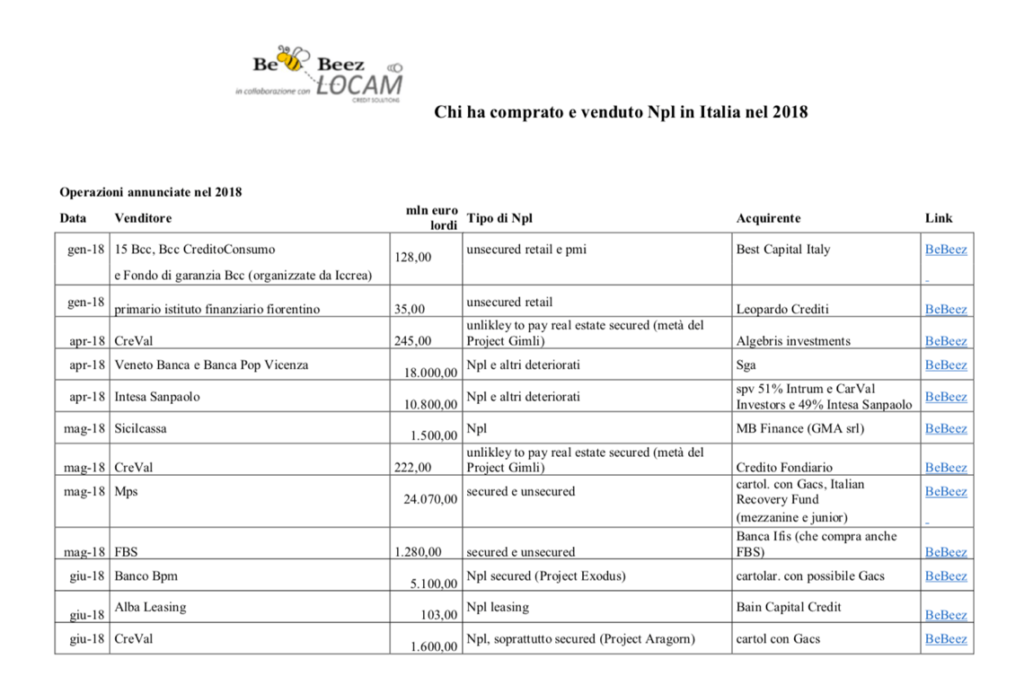

Participants to the NPLs and private debt markets expect the autumn to come to be hot (see here a previous post by BeBeez). According to BeBeez database, Non performing exposure portfolios worth above 73 billion euros have been traded since the beginning of the year. By the end of 2018, further portfolios worth 33 billion may be sold. So transactions in 2018 may amount to 100 billion or above (46 billion in 2017). According to BeBeez database, six securitisations of portfolios with a gross value of 8.2 billion may come to market with the warranty of the Italian Government (Gacs). Crédit Agricole‘s Investment banking division may sell on the secondary market a portfolio of gross Italian NPLs worth 6 billion. Financial firms Christofferson, Robb & Company (CRC) and Bayview may also sell on the secondary market Beyond the Clouds, a portfolio of secured NPLs with a gross value of 2 billion, that acquired from Intesa Sanpaolo.

Participants to the NPLs and private debt markets expect the autumn to come to be hot (see here a previous post by BeBeez). According to BeBeez database, Non performing exposure portfolios worth above 73 billion euros have been traded since the beginning of the year. By the end of 2018, further portfolios worth 33 billion may be sold. So transactions in 2018 may amount to 100 billion or above (46 billion in 2017). According to BeBeez database, six securitisations of portfolios with a gross value of 8.2 billion may come to market with the warranty of the Italian Government (Gacs). Crédit Agricole‘s Investment banking division may sell on the secondary market a portfolio of gross Italian NPLs worth 6 billion. Financial firms Christofferson, Robb & Company (CRC) and Bayview may also sell on the secondary market Beyond the Clouds, a portfolio of secured NPLs with a gross value of 2 billion, that acquired from Intesa Sanpaolo.

Intesa Sanpaolo shortlisted the bidders for Progetto Luce, a portfolio of 250 million euros worth of NPLs for photovoltaic plants (see here a previous post by BeBeez). Deloitte, the advisor in charge of the sale, allowed to the second round of the auction only renewable energy firms such as Tages Capital-Credito Fondiario and WRM Group of Raffaele Mincione. Intesa Sanpaolo is also working on the sale of Progetto Levante, an UTPs portfolio worth 250 million.

Axactor Capital Italy, controlled by the Oslo-listed credit management firm Gruppo Axactor, closed its first securitisation of problematic credits through the issuance of floating rate or partly paid asset-backed securities (see here a previous post by BeBeez). Last year in July, Axactor signed three up to 12-months forward-flow agreements with three Italian financial firms for the purchase of unsecured consumer credits worth 140 million of euros and about 28,000 positions.

Negotiations between Milan-listed Trevi Finanziaria Industriale (Trefin) and Bain Capital Credit came to a stalemate (see here aprevious post by BeBeez). Trefin also belongs to Cdp Equity (16.85%) and the Trevisani Family (32.73%). The company said that it didn’t accept Bain Capital Credit’s offer for subscribing a capital increase and restructuring the company’s banking debt.

MBCredit Solutions, part of Mediobanca Group, acquired a portfolio of gross problematic credits worth 665.3 million of euros for 40,000 positions (see here a previous post by BeBeez). CRC Bayview and Balbec sold on the secondary market to MBC portfolios of NPEs worth 425 million and 217 million. ViVi Banca sold a portfolio of 12 million, while Consel sold a portfolio of consumer credits worth 11.3 million. After such acquisition, MBC owns a portfolio of gross NPLs for about 5 billion and more than 600,000 positions.

The Apulia Region‘s financial firm Puglia Sviluppo aims to launch a minibond fund of 100 million for financing the local SMEs, said Antonio Nunziante, the Region’s assessor for Economic Development (see here a previous post by BeBeez). Institutional investors will also support this project. The Apulia Region will warranty 80% of the firm’s losses and will support the SME’s expenses for issuing minibonds that this fund will subscribe. Any issuance will be worth up to 3 million euros.