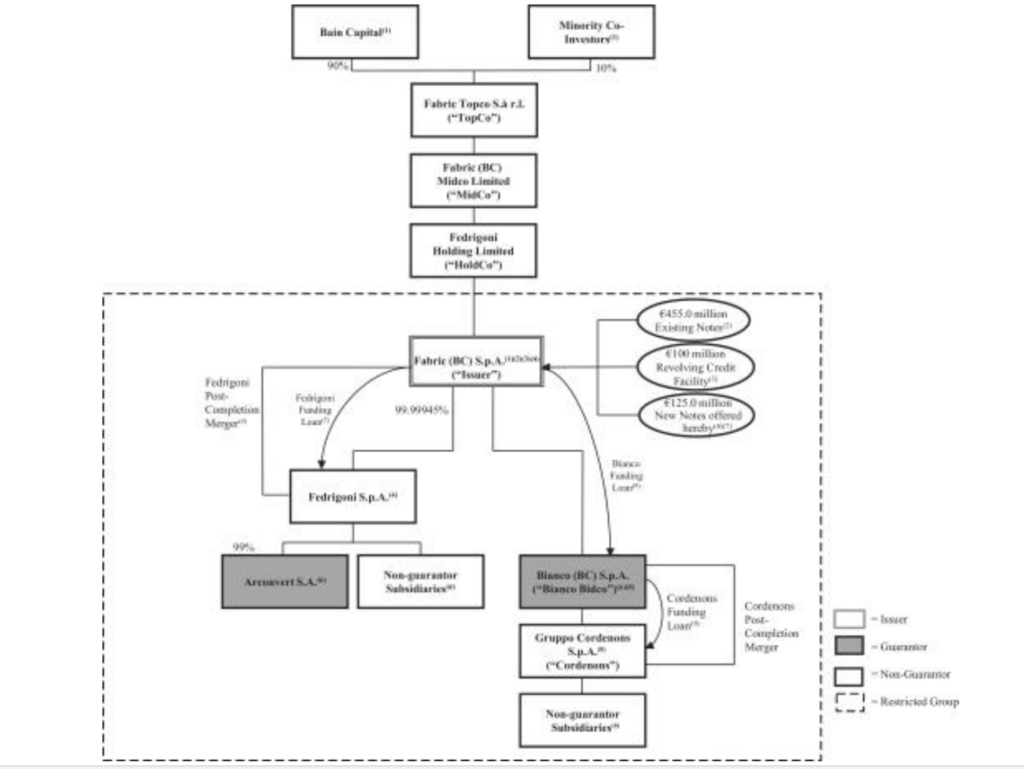

Fabric (BC) spa, the parent company of Fedrigoni group, tapped for 125 million euros its 455 mln euros bond issued last April. Proceeds from the bond will refinance debt issued to buy Cordenons, a special papers maker, in a deal announced last May. Bookrunner for the deal were Bnp Paribas, Hsbc, Kkr and UBI Banca.

Fabric (BC) spa, the parent company of Fedrigoni group, tapped for 125 million euros its 455 mln euros bond issued last April. Proceeds from the bond will refinance debt issued to buy Cordenons, a special papers maker, in a deal announced last May. Bookrunner for the deal were Bnp Paribas, Hsbc, Kkr and UBI Banca.

The bond issue, which now has a 580 mln euros size, matures in Novembre 2024, is callable after one year from issue, pays a floating rate equal to Euribor 3 months plus 412.5 basis points and is listed at the Irish Stock Exchange.

Latham & Watkins assisted Fabric as for Italian law issues, Kirkland & Ellis as for UK and New York State law issues, while Pirola Pennuto Zei & Associati was the fiscal advisor. Gattai Minoli Agostinelli & Partners and Milbank Tweed Hadley & McCloy law firms advised the bookrunners.

Bain Capital had bought control of Fedrigoni group in December 2017 pfor a 650 million euros enterprise value and issued the 455 mln euros bond last April to refinance the deal.

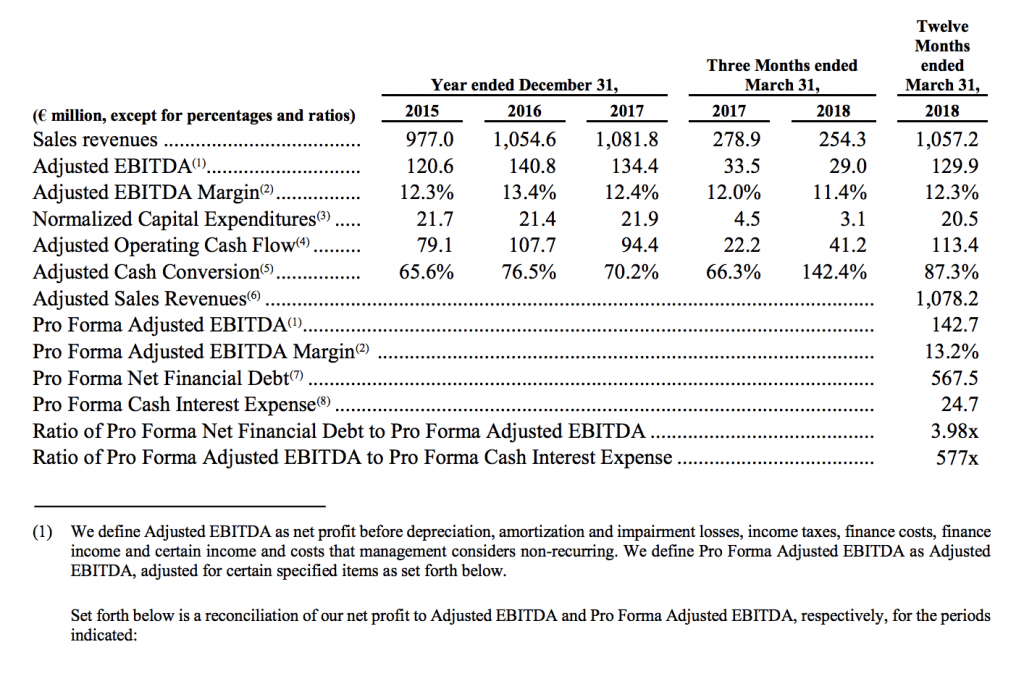

As the Offering Memorandum shows, Fedrigoni reached 1.081 billion euros in revenues in 2017, with 134.4 million euros in ajusted ebitda and 94 million euros in net financial debt, after 1.054 billion in revenbues in 2016, 140.8 millions in adjusted ebitda and 129 millions in net financial debt. The latter reached 567.5 million euros at the end of last March while adjusted ebitda for the last 12 months was 129.9 millions. However, if you tak in consideration Cordenons too, 12 months adjusted ebitda is 140 million euros pro-forma.

Founded in 1888 and based in Verona, Fedrigoni is now one of the major producer of value added paper on a global basis. It is also owner of the iconic brand Fabriano.