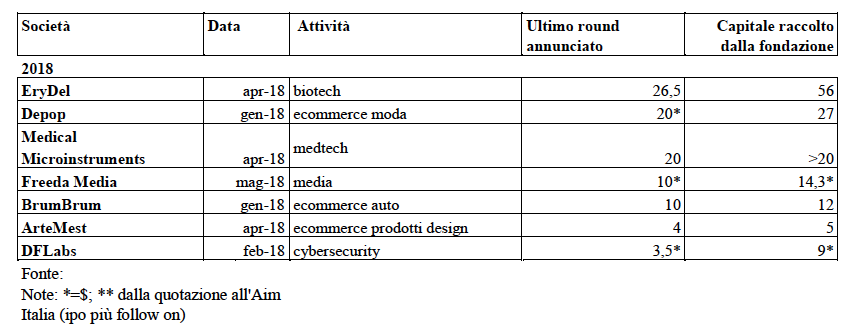

In less than 5 months venture capital funds financed seven Italian scaleups for a total of 90 million euros. Among them, 5 companies raised more than 10 mln euros each: EryDel, Depop, Medical Microinstruments, Freeda Media and BrumBrum.

In less than 5 months venture capital funds financed seven Italian scaleups for a total of 90 million euros. Among them, 5 companies raised more than 10 mln euros each: EryDel, Depop, Medical Microinstruments, Freeda Media and BrumBrum.

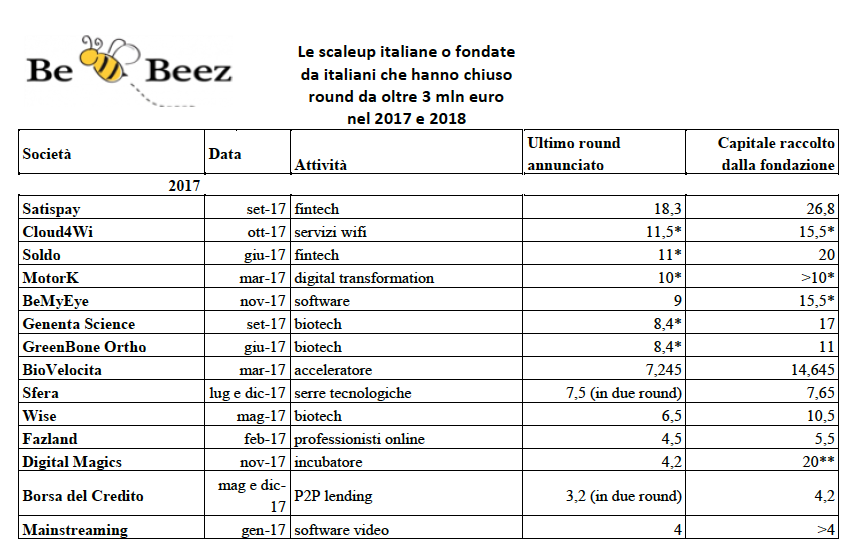

Last year venture capital deals of 3 million euros at least were 13 for a total of about 113 million euros, invested both by venture capital firms and other investors (see here the Venture Capital Report  2016 by BeBeez for P101).

2016 by BeBeez for P101).

Those deals were actually 14, if you consider also a capital increase by Digital Magics, a venture incubator listed at Aim Italia since 2013 which used to be one of Italy’s first startups focused on investments in the digital sector in 2004 of which StartTIP, an investment veichle focused on scaleups and innovation by Tamburi Investment Partners, has now a significant stake.

All data come from BeBeez’s database and have been published last Saturday by MF Milano Finanza.

These data show that a new trend was born in the venture capital market in Italy as more investors are focusing on the scaleup segment, aiming at supporting both former startups in their next stage of growths and SMEs which are developing a disruptive technology able to completely change their traditional business model.

This is also because Italian venture capital firms are now growing themselves. For example United Ventures announced a first closing at 75 million euros for its second fund some months ago targeting a final close at 120 million euros (see here a previous post by BeBeez), which is the same target for P102, the second fund launched by P101 sgr which raised 65 million euros in its first closing (see here aprevious post by BeBeez).

A special focus on scaleups has the FII Tech Growth fund, launched by Fondo Italiano d’Investimento sgr, with a 150 million euros target, where the Cassa Depositi e Prestiti is an anchor investor with 50 million euros of committements (see here a previous post by BeBeez). The new fund has already closed two investments, one in a scaleup last year (BeMyEye, see here a previous post by BeBeez) and one in a tech SME this year (Seco, see here a previous post by BeBeez). Fondo Italiano sgr also invested in Vertis Venture 2 Scaleup, launched by Vertis sgr, through its Venture Capital 2 fund of funds (see here a previous post by BeBeez). And Tamburi Investment Partners too announced last year the launch of a new investment veichle, StarTIP, with 100 million euros of dry powder to invest in scaleups (see here a previous post by BeBeez).

Among new firms in this scaleup market are also Capitol 1, by Marzotto Venture, aiming at raising 50 million euros (see here a previous post by BeBeez) and Milano Investment Partners sgr, which is raising a first fund with a 100 million euro target (see here a previous post by BeBeez).

As for potential exits or as an alternative to a new round by venture capitalist, Euronext Stock Exchange is proposing Italian scaleups or tech SMEs to consider a listing in Paris, as Euronext’s markets have a strong track record in raising capital for tech companies: at the end of Aprile there were 357 listed tech companies which have been raising more than 10 billion euros since 2013.

So Giovanni Vecchio, Euronext’s director and responsible for the Italian market, is starting in Italy the TechShare program, a tutorial program for selected scaleups or tech SMEs aiming at preparing those companies to the equity capital markets.