Potential bidders for RTR Rete Rinnovabile, one of the leading solar photovoltaic operators in Italy and among the largest in Europe, are lining up. The business has 330 MW of installed capacity across 130 production sites in Italy, is controlled by Terra Firma private equity fund and has been on sale since the end of 2016 (see here a previous post by BeBeez). The sale process, which is managed by Terra Firma’s financial advisors Unicredit, JPMorgan and Jefferies, seems finally to have accelerated.

Potential bidders for RTR Rete Rinnovabile, one of the leading solar photovoltaic operators in Italy and among the largest in Europe, are lining up. The business has 330 MW of installed capacity across 130 production sites in Italy, is controlled by Terra Firma private equity fund and has been on sale since the end of 2016 (see here a previous post by BeBeez). The sale process, which is managed by Terra Firma’s financial advisors Unicredit, JPMorgan and Jefferies, seems finally to have accelerated.

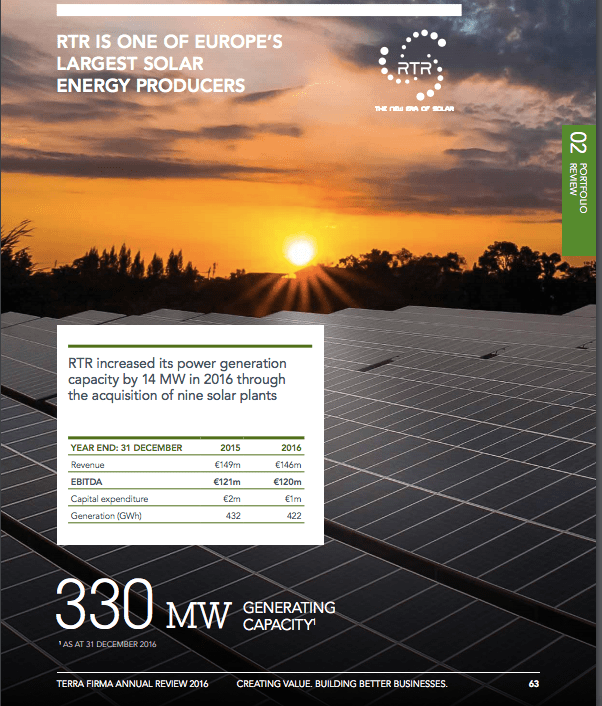

Terra Firma’s FY 2016 annual review says that RTR reache 146 million euros in revenues in 2016 with 120 millions in ebitda, while the company is said to have about 900 million euros in net financial debt and is valued in a range of 1-1.2 billion euros.

Terra Firma bought RTR in 2011 from Italy’s utility Terna, when the company just had a 144MW installed capacity, for an enterprise value of 755 million euros, of which 641 millions of equity value (see here the press release).

At a press conference about FY 2017 accounts, Milan-Listed utility A2A‘s ceo Valerio Camerano, speaking about the RTR dossier said: “There is an interest and we are evaluating the opportunity. In the next few weeks we will be able to have more precise idea about the futher steps to go”.

A clear interest has been declared also by Italy’s utility giant Enel together with infrastructure asset manager F2i sgr. Enel’s ceo Francesco Starace said last February that “when an auction will start, we will be surely interested. We will run through the joint venture that we have with the F2i fund”. The latter being EF Solare Italia, a 50-50 jv between Enel Green Power and F2i, with 120 solar plants and 393 Mw installed capacity, that at the end of 2016 bought Etrion spa or the Italian activities of Etrion Corporation. Etrion spa issued a 35 million euros minibond which was entirely subscribed by Scor Infrastructure Loans fund (see altro articolo di BeBeez).

Ready to study a deal on RTR are also said to be Tages Helios (see here a previous post by BeBeez), Quercus Investment Partners and Milan-listed oil&energy company Erg. Edoardo Garrone, Erg’s chairman, actually said some months ago that Erg’s strategy is to “keep on growing in the renewable energy sector both in Italy and abroad”. Erg has piled up a lot of cash i the last months as it has sold its stake in petrol stations network TotalErg for 273 million euros (see here a previous post by BeBeez). Last November Erg entered in the solar production sector buying ForVei srl, with 89 MW installed capacity in Italy. The seller was Vei Green srl, an investment company owned by Palladio Finanziaria Holding spa and by a minority of Italian institutional investors (see here the press release).