Italmatch Chemicals, an Italian leading global chemicals group that specializes in the manufacture and marketing of performance additives for lubricants, water treatment and oil & plastics, controlled by Ardian private equity firm, may change control by the end of this year, Reuters writes.

Italmatch Chemicals, an Italian leading global chemicals group that specializes in the manufacture and marketing of performance additives for lubricants, water treatment and oil & plastics, controlled by Ardian private equity firm, may change control by the end of this year, Reuters writes.

Ardian is actually said to have started talks with potential buyers and that a formal sale auction is going to be opened after Summer.

Ardian bought a majority stake in 2014 in Italmatch together with the management led by ceo Sergio Iorio (see here a previous post by BeBeez) on an enterprise value basis of about 220 million euros.

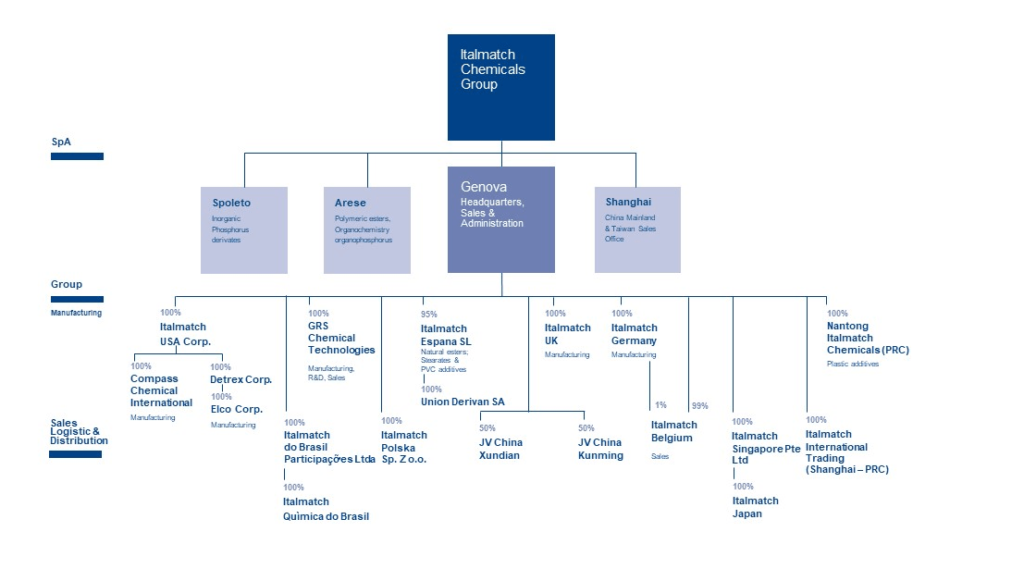

The group has been growing at a very fat pace in the last few years thanks to an aggressive m&a strategy. The last acquisition was announced last December and was relative to Detrex Corporation and its subsidiary Elco Corporation, both begin US companies active in the production of high-performance lubricating oils (see here a previous post by BeBeez).

Before that, Italmatch bought Sudamfos do Brasil, a major producer of phosphonates and other special chemicals in latin America (see here a previous post by BeBeez), and French startup Magpie Polymers which developed an advanced and patented selective filtration technology for the recovery of precious metals (see here a previous post by BeBeez).

In September 2016 Italmatch bought from Solvay group the Ionquest 290 and Octyl Phosphonic Acid product range business specialised in the production & marketing of phosphorus-based process additives for the mining, metalworking fluids, corrosion inhibition and pigmentation industries (see here the press release). From Solvay the group also had bought the desalination and phosphonates/phosphonic acid-based water additives business in January 2016 (see here a previous post by BeBeez). In June 2016 Italmatch finally bought 100% of the capital of Compass Chemical International, the largest independent manufacturer of organophosphonates in North America and provides products for water treatment, oil & gas and various other applications (see here a previous post by BeBeez).

In 2014 Ardian bought Italmatch from Mandarin Capital Partners (then owner of a 67.6% stake in the company) and from the Malacalza family. Italmatch’s top management maintained then a 12% stake in the company.

Mandarin and the Malacalza family had in turn bought their stakes in Italmatch Chemicals from Investindustrial in November 2010 on the basis of a 100 million euros enterprise value, when the company had posted 90 million euros in revenues and 22 millions in ebitda.

Investindustrial, joined by Iniziativa Piemonte, had originally financed in 1997 the management buyout of gruppo Saffa, after that renamed Italmach Chemicals, and supportted the management in the first pahse of international growth before selling its stake to Argos Soditic and Iniziative Piemonte in 2000. Investindustrial bought back Italmatch in 2004 and supported its first m&a campaign.

The group might be valued today about 8-9x ebitda or 560-630 million euros, as Italmatch posted 65 million euros in ebitda in 2017 (with 350 million euros in revenues) and is seen to reach 70 millions in 2018.

Italmatch reached 340 million euros in revenues in 2016, with a 49.5 million euros ebitda and a 105 million euros net financial debt, after having closed FY 2015 with 263 million euros in revenues, a 36 million euros ebitda and a net financial debt of 99 millions (see here an analysis by Leanus, after free registration and login).

Among potential buyers for Italmatch are said to be German company Lanxess and private equity firms Cinven, Rhone Capital and Platinum, who also were in the race for fire safety units and crude additives of Israele Chemicals which was then won by SK Capital last Deember for one billion dollars.