A weekly roundup of the activity of Italian business angels and incubators starts today in this English section of BeBeez. The release of similar roundups about the activity of private debt investors as well as of venture capital funds will take place on a weekly basis. Today’s release covers news for the the period starting last Jan 25th.

A weekly roundup of the activity of Italian business angels and incubators starts today in this English section of BeBeez. The release of similar roundups about the activity of private debt investors as well as of venture capital funds will take place on a weekly basis. Today’s release covers news for the the period starting last Jan 25th.

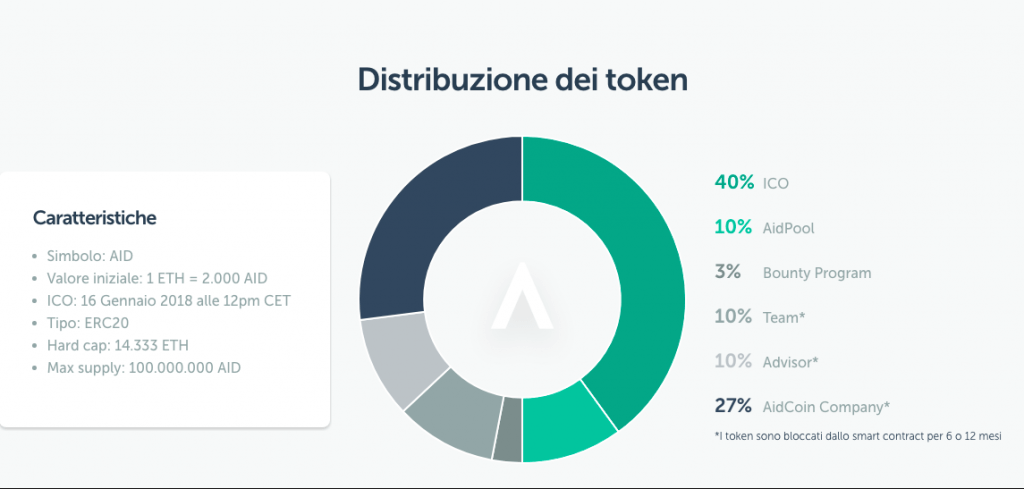

In just 90 minutes more than 1500 supporters invested 16 million of US Dollars in the ICO of AidCoin, an Italian cryptocurrency for financing charities that Francesco Nazari Fusetti, Manuela Ravalli and Domenico Gravagno built on the Ethereum blockchain and that it will be possible to trade on BitFinex (see here a previous post by BeBeez). The creators of AidCoin also founded CharityStars, an Italian platform for charities fundraising. “We are proud of this achievement; we had to give back oversubscriptions worth 6 million of US Dollars”, Nazari Fusetti said. AidCoin achieved the sale target of 14.333 Ether after it sold 8.333 Ether (worth almost 4 million of US Dollars) last year in November. “The blockchain technology will change many traditional sectors, including the non-profit”, Fusetti added. AidChain will allow tracking the flow of donations made in AidCoin for the projects listed on CharityStars, a platform that auctions meetings with celebrities or their belongings and that received financing from Rancilio Cube, IAG network, and 360 Capital Partners. According to CoinSchedule, in 2017 worldwide startups raised more than 3.7 billion of US Dollars through ICOs. Companies that raise funds with such processes issue tokens, or units of virtual currencies that one can exchange later on specific platforms.

However, also financing providers and investors showed remarkable activism and optimism. Since its foundation in 2011, AIM-listed Italian incubator Digital Magics directly invested 23 million of Euros in its 61 portfolio startups and raised for them 28 million of Euros, Digital Magics said during a presentation of 2017’s results some days ago (see here a previous post by BeBeez). StarTIP, a vehicle that belongs to Milan listed Tamburi Investment Partners, owns 23% of Digital Magics. This year the incubator aims to invest 3.5 million of Euros in 10-15 startups operating in the field of Artificial Intelligence and industry 4.0. A further objective of Digital Magics business plan is to sign international partnerships together with Talent Garden, a provider of coworking and networking services for startups. In 2017 the shares of Digital Magics posted a 230.3% total return, this figure also includes the warrants issued in the same period.

After having closed in December a financing round of 200k euros, SkinLabo srl, a Turin-based startup active in the cosmetics sector, summed investments worth 600k euros since its launch in October 2016 (see here a previous post by BeBeez). Angelo Muratore, a former marketing manager of FCA and angel investor in more than 10 startups, co-founded SkinLabo with Carlo Tafuri, which is also the chief operating officer and owner of Brandsdistribution.com, an online distributor of fashion items. SkinLabo is a Made in Italy producer of cosmetics with gluten-free botanical essences and ingredients. For 2018, the company targets to post sales of 1.2 million of Euros.

Renzo Rosso, Diesel’s founder, invested in U-Booker through Rosso Red Circle Investments, his Angel investments vehicle. U-Booker, a one-year-old startup, developed a web platform for fashion professionals can liaise with male and female models and book them for catwalks (see here a previous post by BeBeez). Fashion models Diana Gaertner and Claudia Wagner, together with Nicola Scagnolari, same sector entrepreneur, and business developer Andrea Losso founded U-Booker. Stefano Martinetto, founder and CEO of Tomorrow London Holding, a portfolio company Red Circle Investments, invested as well in U-Booker and will be part of the board. U-Booker retains 10% of models compensation, while traditional US agencies ask up to 30% and a 10% charge to fashion firms. Models are not bound by exclusivity. Red Circle Investments is also a relevant shareholder of YNAP, and its investments include stakes in H-Farm, Depop, a mobile app for online fashion shopping, and EcorNaturaSì , an Italian retailer of biologic food and products.

Milan’s chain of Japanese restaurants This is Not a Sushi Bar raised financing of 450k euros (see here a previous post by BeBeez). Nuvolab, an Italian business accelerator founded by Francesco Inguscio, arranged this round and acquired a stake in the company six months ago, when Matteo Pittarello, chairman and founder of the company, Armando Zappalà together with other investors acquired shares from other founders. Mega Holding and other angels active in the food sector, subscribed a capital increase with an investment worth 400,000 Euros further to 50,000 Euros of replacement capital. Last year This is Not a Sushi Bar generated sales of 1.4 million of Euros, the main engine of the company growth is its proprietary software for managing orders. The company said that it would invest these new injections of capital for consolidating its brand and technological infrastructure as well as in the opening new shops in Italy and abroad.

Startups are also conducting peer to peer m&a transactions. Moovenda, a food delivery startup operating in Rome, Viterbo, Naples and Turin, acquired Delivery Sardinia for 250k euros (see here a previous post by BeBeez). After such a transaction, Moovenda expanded its footage to Sardinia. Simone Ridolfi founded Moovenda two years ago with the Italian business incubator Luiss Enlabs and generated a turnover of 2.5 millions of Euros for its partner restaurants and became the leading Italian food delivery company since its foundation two years ago. In October 2017, the company started a fundraising round after it received 300k euros in March 2017 from a group of private investors that include Ciro Immobile, an Italian international footballer and the striker of listed Italian football team SS Lazio. In August 2016, Moovenda announced a financing round worth 150k euros from private investor Jacopo Paoletti and the listed Italian venture capital firm LVenture Group. Club degli Acceleratori invested 150k euros in the startup as a part of a financing round worth 535k euros held in December 2015.