Lindorff-Intrum Justitia, the European leading provider of credit management services, announced yesterday the acquisition of CAF spa, one of Italy’s major independent non performing loans servicers (see here the press release).

CAF has been controlled by private equity firm Lone Star since 2015 and Intrum has also acquired a 370 million euros GBV Npl portfolio which had been bought by Lone Star in 2015 from Cassa di Risparmio di Teramo (Tercas). The portfolio includes secured and unsecured loans versus retail and SMEs debtors.

The announcement came as a surprise as sale was still in the ongoing phase of an auction managed by Kpmg and a short list of names admitted to the second phase was expected in a few days in order to see binding offers by the end of the year (see here a previous post by BeBeez).

The whole deal has been valued 200 million euros, which includes an 80 million euros valuation for the Npl portfolio as far as BeBeez is concerned while the rest is the valuation for the servicer business or more than 10x CAF’s 2017 ebitda which is seen at around 10 million euros. Lone Star is then posting quite a good return as it is said to have paidCAF 20-30 million euros in 2015.

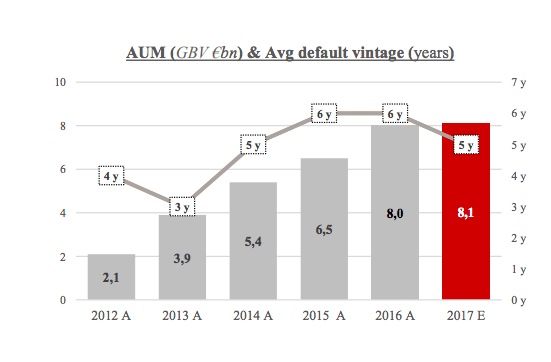

CAF is seen to post about 30 million euros in revenues in 2018 with about 11 million in ebitda, after having posted 19.1 million euros in revenues in 2016 and 6.3 millions in ebitda. The Italian servicer was founded in 2005 and it has nouìw 7.6 billion euros Npl loans under management and targeting 8.1 billions by the end of the year.

This is the third acquisition in Italy for Lindorff-Intrum after the one of Gextra last May, which was bought from Italfondiario and Gextra’s founder Francesca Carafa, who remained in the management team (see here a previopus post by BeBeez), and after the on of Cross Factor in Spring 2016.

Lindorff-Intrum Justitia, renamed Intrum, was born at the end of last June from a merger between Norway’s Lindorff (controlled by private equity firm Nordic Capital) and Sweden’s Intrum Justitia (see here a previous post by BeBeez). Antonella Pagano, who was Lindorff’s country manager in Italy, has been confirmed as managing director of Lindorff-Intrum Justitia in Italy (see here a previous post by BeBeez).