US asset manager Neuberger Berman announced yesterday that it signed the closing of the acquisition of the entire portfolio of direct holdings in Italian SMEs owned by Fondo Italiano d’Investimento sgr (see here the press release).

The deal, which was announced last June (see here a previous post by BeBeez), includes the acquisition of minority stakes in 21 Italian SMEs, with 2.3 billion euros in aggregated revenues and 82 million euros in ebitda. The portfolio has been said to be valued about 300 million euros.

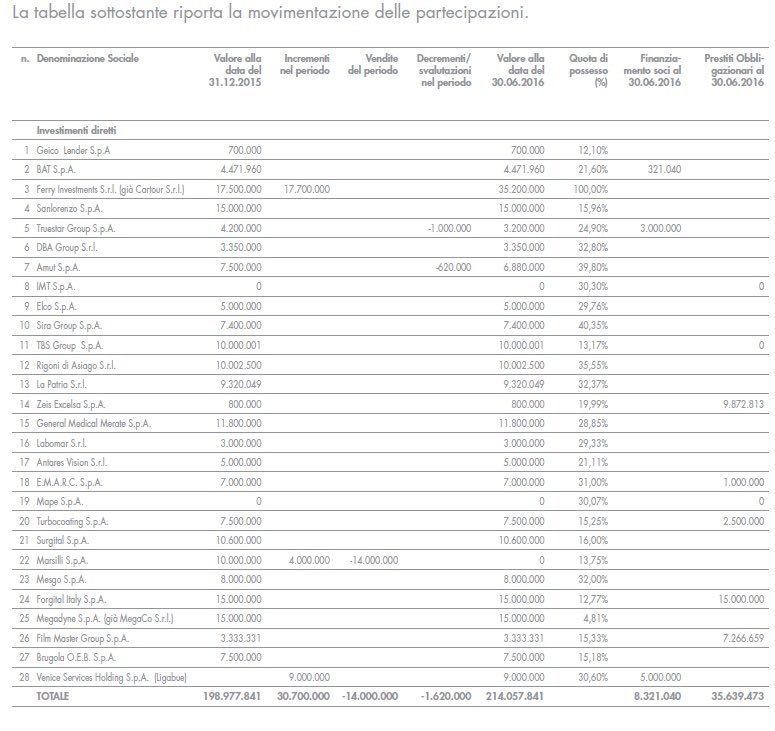

FII sgr’s H1 2016 statements actually said that the fund had stakes in 25 SMEs after Mape defaulted in 2014 and IMT entered in extraordinary administration in 2013 and after 8 exits (Farmol, Eco Eridania, Arioli, Angelantoni Test Technologies, quello parziale da Megadyne, Comecer, Marsilli and Caronte&Tourist). That portfolio was valued about 260 million euros (including shareholders loans and bonds). Since June 30th 2016 the fund sold also its stakes in Emarc and in Antares Vision; TBS, was delisted from Aim Italia after a tender offer by Pantheon Group (controlled by Permira); and DBA is to debut at Aim Italia in the next few days, after a capital increase and sale of FII’s fund stake to new investors.

The project to create Fondo Italiano d’Investimento sgr management company and to promote the fund was developed by a steering committee created in December 2009, including representatives from the Italian Ministry of Treasury and Finance, some sponsor banks (Unicredit, Intesa Sanpaolo, Banca Mps and Cassa Depositi e Prestiti), Confindustria (the Italian Industrial Association) and Associazione Bancaria Italiana (the Italian Banking Association).

In the second half of 2010 the first Fondo Italiano di Investimento was launched, a closed-end investment fund for qualified investors, investing in the risk capital (private equity) of SMEs that operate in various industrial, trade and services sectors to accompany them, coherently and professionally along their growth plans. The fund, whose total amount is 1.2 billion euro, operates through both direct investments and indirect investments as “fund of funds”.

However that first fund was splitted into three funds in 2016 (see here a previous post by BeBeez): Fondo Italiano di Investimento, investing in the risk capital (private equity) of SMEs; Fondo Italiano di Investimento Fondo di Fondi, a fund of private equity funds; and Fondo Italiano di Investimento FII Venture, a fund of venture capital funds (which joined in the job a first venture capital fund of funds launched in 2015).

The management of the new portfolio by Neuberger Berman will be manadated to 9 managers coming from Fondo Italiano d’ Investimento sgr.

More in detail, Cassa Depositi e Prestiti, Intesa Sanpaolo, Unicredit, Monte dei Paschi di Siena, Nexi, Banco Bpm, Bper, Credito Valtellinese, Banca Popolare di Cividale and Ubi Banca, as FII’s fund subscribers, sold their stakes in the fund to funds managed by Neuberger Berman, with NB Secondary Opportunities Fund IV among them. Neuberger Berman was supported for the deal by Gatti Pavesi Bianchi law firm.

The deal is to be read for NB as part of a more complex project that includes the launch of a new investment veichle to be listed on the Italian Stock Exchange and focused on investments in minority stakes of Italian no-listed SMEs in order to support their international growth and being compliant with Piani individuali di risparmio (Pir) investments criteria.

Neuberger Berman is active already in Italy with NB Reinassance, an investment veichle born from Intesa Sanpaolo’s private equity activities (see here a previous post by BeBeez). The FII’s portfolio will instead go to build a first asset base for the portfolio of a new fund which targets 500 million euros in fundraising and a one billion euros hard cap.

“We need to close the announced deal with Fondo Italiano di Investimento, which will bring us the a base portfolio for a new investment veichle focused on private Italian SMEs’ equity. After that we will list that veichle at the Italian Stock Exchange. We still need a few months to be oeprative with the project”, George Walker, chairman and chief executive officer of Neuberger Berman told MF Milano Finanza last October (see here a previous post by BeBeez).

Mr. Walker is quite proud of this deal: “It’s quite an interesting project as it is able to link both SMEs’ need for more equity and Italian new Pir (Piani individuali di risparmio or Individual saving plans) investment funds need for liquid assets where being invested while focusing on small&mid-cap companies”. Mr. Walker is also quite happy with this project because NB believes that “Italian private equity investments are able to deploy more value for investors than public equity investments”.

As for Fondo Italiano d’Investimento sgr, the portfolio sale stresses the timing of a new course for the management company which is now focusing its direct investments into growth and building up of groups of SMEs, including vertically integrated groups.

The company ha actually just launched two new funds: the FII Tech Growth fund, starting with 50 million euros subscribed by Cdp and targeting other 100 million euros from international investors; and FII Innovazione e Sviluppo fund, a private equity fund targeting 700 million euros in fundraising, and starting with 150 million euros by Cdp ( see here a previous post by BeBeez). Both funds will have a “hands on” approach with FII’s partners being committed to invest personally in the funds they manage and gaining carried interest as it is use in the private equity sector (but it did not work that way for them at the FII sgr since now).