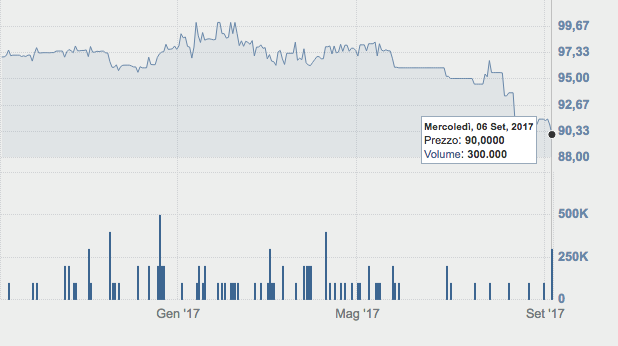

Trevi Finanziaria’s 50 million euros bond price listed at ExtraMot Pro from July 2014, dropped to 90 cents yesterday.

The bondholders’ meeting yesterday was desert so it will be called again next Sep 20 (see here the press release) in order to vote about a temporary suspension proposal regarding the early repayment of bondholders clause of the Regulation to allow negotiations between the company and the lending banks for the drawing up of standstill agreements and the restructuring of the financial debt (see here the press release).

The company of which Cdp Equity (former Fondo Strategico) owns a 16.9% stake, has been living a difficult situation for some months (see here a previous post by BeBeez). Trevi operates in the field of foundation engineering (special foundations), tunnel excavation, soil consolidations, recovery of polluted sites, in the design and marketing of relevant special technologies, in the drilling field (oil, gas and water)

Last May Trevi decided to submit its lending banks a standstill request in order to allow the company to focus on its strategic plan and reorganize the oil&gas business while define new conditions for its financial debt.