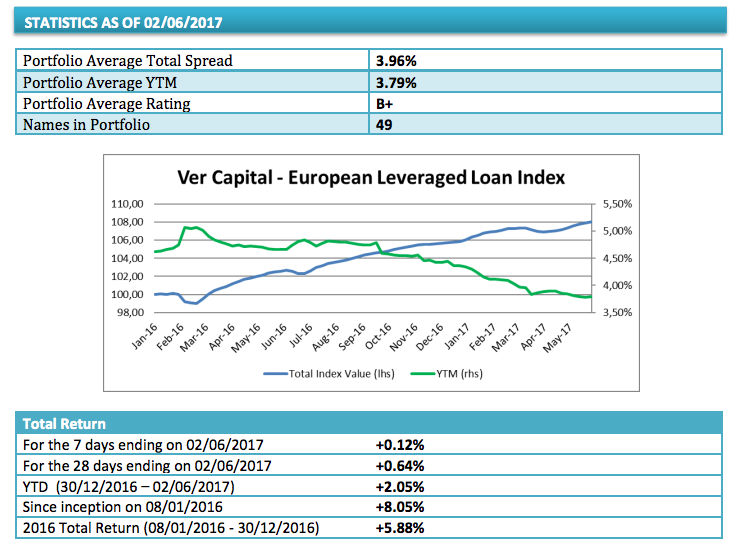

A euro-denominated leveraged loan issued in support of a leveraged buyout by a private equity firm with a 5-7 years’ maturity paid a 3.79% yield on June 2nd (slightly up from 3.78% one week before but well down from 5.0% one year ago) and a 2.05% year-to-date total return (from 5.88% in the whole 2016). These are the figures that emerge reading the Ver Capital Leveraged Loan Index, an index that Ver Capital sgr has specifically built for BeBeez and that will be updated weekly.

The Ver Capital Leveraged Loan Index has 49 member loans (all senior secured performing loans with a B+ average rating) well diversified among a series of sectors as showed in the information memorandum.

The whole Lbo Index portfolio recorded a +0.12% total return in the week. The best performer loan on a weekly total return basis was the one relating to M5X International (+0.84%), a technological services provider to automotive industry which was recently bought out by Bain Capital.

The wrost weekly performance was instead the one relating to NEP (-0.37%), a US group serving the world’s leading content producers and owners, providing services vital to the broadcast of live sports and entertainment events. All that after a flat weekley total return performance of the whole portfolio.