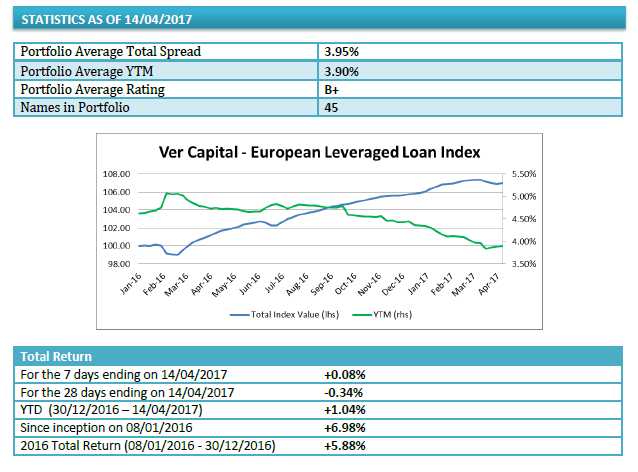

A euro-denominated leveraged loan issued in support of a leveraged buyout by a private equity firm with a 5-7 years’ maturity paid a 3.90% yield on April 14 (slightly up from 3.87% one week before but well down from 5.0% one year ago) and a 1.04% year-to-date total return (from 5.88% in the whole 2016). These are the figures that emerge reading the Ver Capital Leveraged Loan Index, an index that Ver Capital sgr has specifically built for BeBeez and that will be updated weekly.

The Ver Capital Leveraged Loan Index has 45 member loans (all senior secured performing loans with a B+ avarage rating) well diversified among a series of sectors as showed in the information memorandum.

The whole Lbo Index portfolio recorded a +0.08% total return in the week. The best performer loan on a weekly total return basis was the one relating to Constantia Flexibles (+0.22%), one of the world’s leading manufacturers of flexible packaging products and labels, which was bought by French listed private equity firm Wendel in June 2015 with a 2.3 billion euros valuation. Constantia Flexibles just bought Italy’s leading dairy lidding company TR Alucap srl last March (see here the press release). Sellers were Gradiente I fund managed by Gradiente sgr, La Finanziaria Trentina and TR Alucap’s ceo Luigi D’Auria,who had bought out the company in 2014 (see here a previous post by BeBeez).

The wrost weekly performance was instead the one relating to Median Kliniken (-0.47%), a German clinic operator of hospitals and rehabilitation facilities controlled by Waterland Private Equity.