DoBank, a leading Italian banking group specialized in managing non performing loans (former UniCredit Credit Management Bank or Uccmb, see here a previous post by BeBeez) controlled by Fortress Investments Group), is accelerating its path toward listing on the Italian Stock Exchange by mid-2017, MF Milano Finanza wrote last Saturday December 14th adding that a listing might happen also on the London Stock Exchange in line with DoBank strategy to growth on an international basis. Sources close to the company said however previously today that listing in London is not a concrete option.

DoBank, a leading Italian banking group specialized in managing non performing loans (former UniCredit Credit Management Bank or Uccmb, see here a previous post by BeBeez) controlled by Fortress Investments Group), is accelerating its path toward listing on the Italian Stock Exchange by mid-2017, MF Milano Finanza wrote last Saturday December 14th adding that a listing might happen also on the London Stock Exchange in line with DoBank strategy to growth on an international basis. Sources close to the company said however previously today that listing in London is not a concrete option.

Chaired by Giovanni Castellaneta and led by ceo Andrea Mangoni, doBank is said to have mandated Rothschild as its financial advisor for the ipo, DealReporter wrote, while the global coordinator banks are expected to be selected by this week with Mediobanca among them.

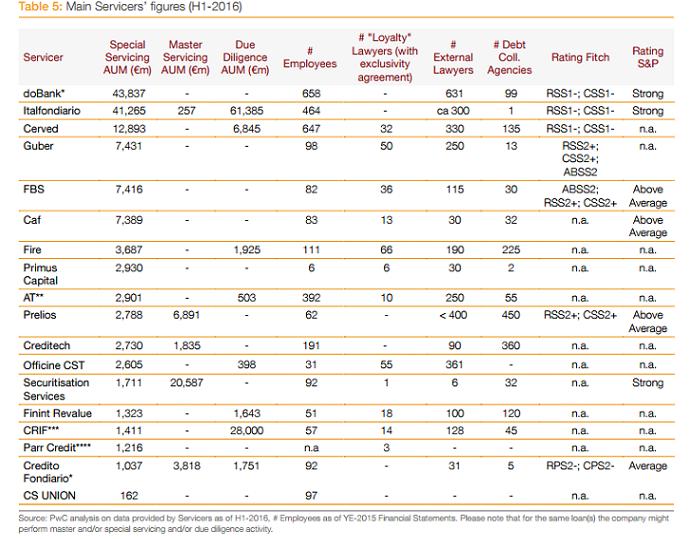

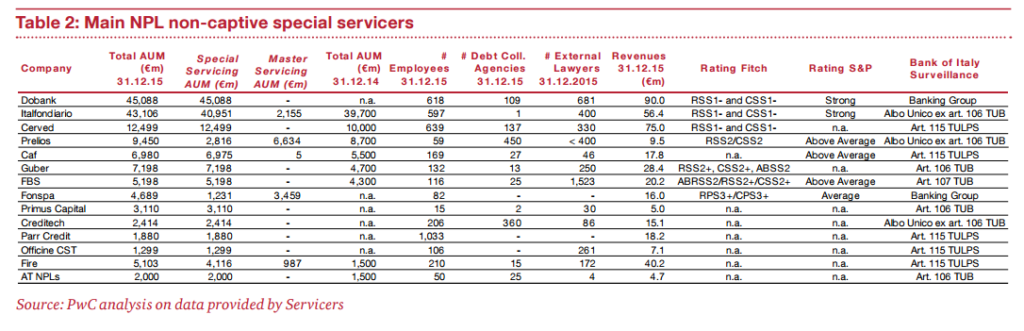

DoBank bought Italfondiario, the second independent credit servicer in Italy, last July. Sellers had been funds managed by Fortress itself (who owned an 88.75% stake in Italfondiario after having invested in August 2000 in the company for the first time) and Intesa Sanpaolo bank, owning the remaining 11.25% stake. The value of the deal had not been disclosed but doBank reported 90 million euros in revenues in 2015 while Italfondiario reported 56.4 millions, PwC wrote in a report last June (see here an article by MF Milano Finanza).

The deal gave birth to the biggest independent credit servicing group in Italy as far as doBank and Italfondiario were, respectively, number one and number two in PwC’s league table for assets under management on June 30th 2016. Both companies have the highest rating from Fitch (RSS1 and CSS1) and S&P’s (strong). The two companies will remain separated but will benefit from synergies.

Npls transactions in Italy are growing in number in the last few months so servicing activity is more and more asked for both by selling banks and by potential investors. One of the major issues in buying an italia Npl portfolio is still a lack of information about the portfolio loans which translates often in a high discount in the price asked by the investor.

On this topic see this episode of Npl ClassCnbc tv show on air every Tuesday night at 9pm on Sky 507 channel: click on this link for the first part of the show and on this link for the second part of the show).