Merger between Italy’s gaming companies Snai and Cogemat is scheduled to be effective as of and from November 1, 2016, pursuant to an irrevocable deed of merger executed last October 18.

Merger between Italy’s gaming companies Snai and Cogemat is scheduled to be effective as of and from November 1, 2016, pursuant to an irrevocable deed of merger executed last October 18.

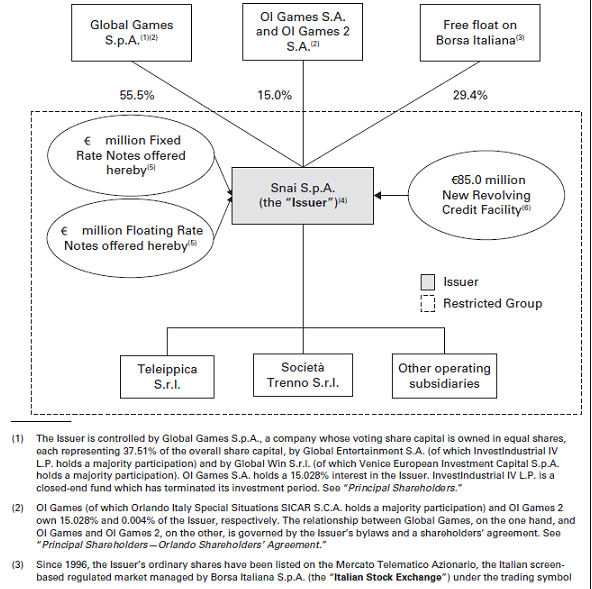

The merger comes one year after a deal had been signed to integrate the activities of the two companies (see here a previous post by BeBeez). Both Snai and Cogemat are both controlled by private equity firm Investindustrial, while Vei Capital is a co-investor (through Global Games spa) in Snai and Orlando Italy is a co-investor in Cogemat (through OI Games sa and OI Games 2 sa).

The new Snai group is now then controlled with a 55.5% stake by Global Games spa, a company whose voting share capital is owned in equal shares, each representing 37.51% of the overall share capital, by Global Entertainment sa (of which Investindustrial IV fund holds a majority participation) and by Global Win srl (of which Vei Capital spa holds a majority participation). OI Games sa holds a 15.028% stake in Snai while the remaing capital is free float on the Italian Stock Exchange.

In the meantime the new group Snai will bring to market a new bond senior secured for 570 million euros in two tranches both maturing in 2021, one paying a fix rate coupon and the other being a floater (see here the Preliminary Offering Memorandum). Bond proceeds will be used to finance a tender offer on Snai’s existing bonds maturing in 2018 and paying rather high coupons: 320 million euros of senior bonds 7.625%, 160 million euros of senior subordinated bonds 12% and 110 million euros of senior secured bonds 7.625% (see here the Tender Offer Memorandum). Joint global coordinator and joint bookrunner for the issue are Deutsche Bank, Unicredit, Goldman Sachs and BnpParibas.

The announcement of the bond issue has been delivered last Monday Oct. 24 by Snai itself adding that a new 85 million euros senior revolving facility has been issued to the company (see here the press release).

Standard & Poor’s and Moody’s raised Snai’s corporate rating yesterday, respectively to B and B2 with stable outlook, quoting a better operative performance of the group, a significant increase in its ebitda in H1 2016, synergies deriving from the Cogemat merger, a better liquidity profile to follow Snai’s debt refinancing process, good expectations as for a substainable growth of company’s business in the next 12-18 months and a more favourable regolamentary regime. S&P’s and Moody’s also assigned a B and B2 to the new bond issue.

For the two months ended August 31, 2016, total wagers for the consolidated Snai Group increased to approximately €1,573 million from approximately €1,528 million for the two months ended August 31, 2015 (calculated, for the 2015 period, as an aggregation of Snai and Cogemat Group wagers).

Snai adjusted ebitda for the two months ended August 31, 2016 increased to approximately €20.3 million from approximately €19.6 million for two months ended August 31, 2015, despite a higher payout in the 2016 period for sports fixed odds betting compared to the same period in 2015. Although adjusted ebitda increased during such period, revenues (net of non-recurring income and revenues) in July and August 2016 declined by 6.2% compared to the same period in 2015, driven mainly by tax increases (especially in AWP business) following implementation of the Italian Stability Law of 2016.

All previous figures for the two months ended August 31, 2015 are an aggregation of the Cogemat Group results and the Snai results for such periods. Snai did not begin operating as an integrated company until November 2015.