Centerbridge is preparing to list on the Italian Stock Exchange its Italian portfolio company Banca Farmafactoring, a leading provider of credit management and non-recourse factoring services to suppliers to the Italian and Iberian health public sectors, Reuters wrote yesterday.

Centerbridge is preparing to list on the Italian Stock Exchange its Italian portfolio company Banca Farmafactoring, a leading provider of credit management and non-recourse factoring services to suppliers to the Italian and Iberian health public sectors, Reuters wrote yesterday.

Centerbridge had acquired the Italian bank just one year ago from funds sdvised by Apax Partners, after Apax had open a dual track sale process mulling ipo (see here a previuos post by BeBeez).

Mediobanca, Morgan Stanley and Deutsche Bank are the mandated advisors for the ipo which is going to see a floating capital of about 50%. Banca Farmafactoring’s listing is expected by next July or in September at latest.

Centerbridge (through BFF Luxemburg) owns a 94.25% stake in Banca Farmafactoring while pharma group Bracco retains a 3.28% stake. The bank had been valued about 500 million euros last year for the buyout.

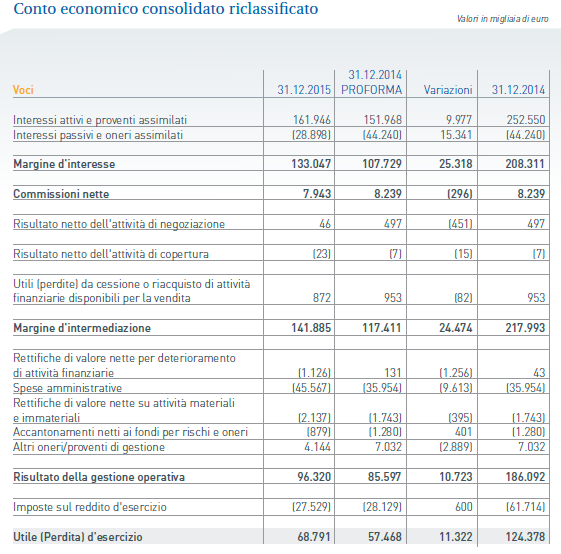

In 2015 the bank managed about 6.3 billion euros of credits, up 15% from 2014, in crescita del 15%. The bank listed a 300 million euros bond at the Irish Stock Exchange in November 2014 maturing in June 2015 an paying a 2,75% coupon ( see here a previous post by BeBeez).

Meanwhile Banca Farmafactoring is looking to develop its business in Central Europe. Last January launched a tender offer to purchase 100% of the shares of Magellan sa, a Polish joint-stock company listed on the Warsaw Stock Exchange (see here the press release). The subscription period has been postponed more times and the tender offer is now expiring next May 27th.