Pillarstone Italy is in final negotiations for buying control of the entire capital of Italy’s leading operator of tlc networks Sirti for which the investment veichle sponsored by Kkr entered exclusive talks last january (see here a previous post by BeBeez).

Part of Sirti’s debt will be bought by Pillastone and transformed in equity while part of the new cash that will be invested by Pillarstone in Sirti will be in the form a debt. Anyway the final resul will be that Sirti will receive a 25 million euros of new equity injection, with the old shareholders coming out of the group and banks that won’t suffer any write off or debto-to-equity conversion, MF Milano Finanza writes today.

Pillarstone Italy, the turnaround veichle that was launched last year by Kkr acquiring some corporate credits from Unicredit and Intesa Sanpaolo, will actually buy all Sirti’s shares owned by actual shareholders: Intesa Sanpaolo ( with a 26.84% stake, after having converted a mandatory convetible bond some years ago; the bank is also a big lender for as much as 200 million euros) while the remaing 73.16% of Sirti’s capital is owned by Hiit, a parent holding where are concentrated stakes by industrial shareholders (Techint), the Bonomi family holding BI-Invest, private equity funds (Clessidra and 21 Investimenti, while Investindustrial had exited sometime ago) and mezzanine private debt funds (Ver Capital e Emisys Capital). Pillarstone will also buy the majority of Sirti’s financial debts (net financial debt was 214 millione uros at the end of 2015) with the exception of the revolving cash facilities.

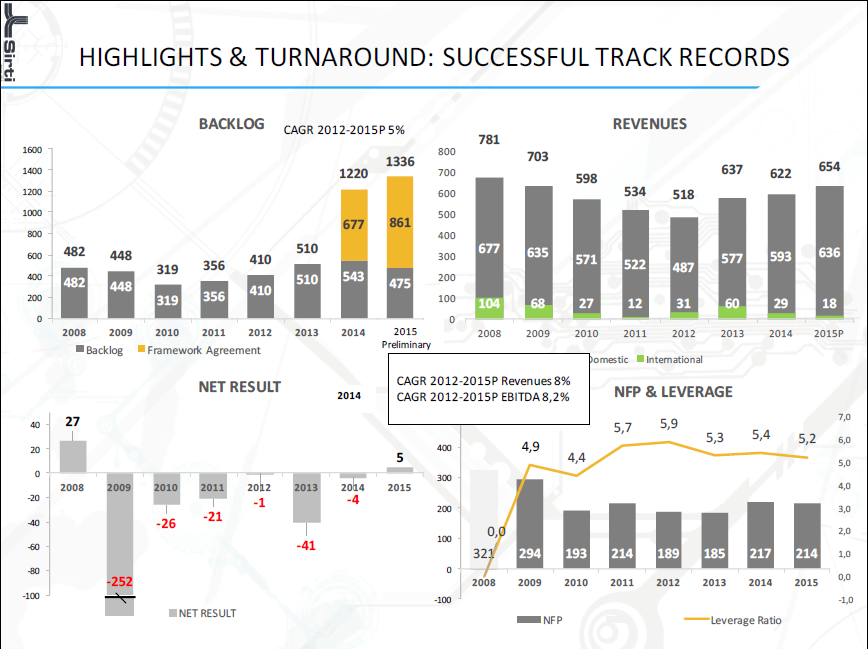

Sirti’s problem is no more its business but the debt burden which was originated in 2009 due to the leveraged buyout deal. Actually ceo Stefano Lorenzi and chairman Angelo Miglietta have been able to bring back Sirti to profit last year after 6 years of net losses.

“FY 2015 closed with 5 million euros of preliminar net profits after 6 years of losses”, ceo Lorenzi told Milano Finanza, adding that “reavenues reached 654 million euros from 622 in 2014 with an 8% cagr in 2012-2015, while ebitda has been growing by 8.2% (Cagcr) in the same period. and all this happened in a rather difficult market where we were able to refocus our activity offering new outsourcing services to our clients”.

As far as debt in concerned, Mr. Lorenzi said that the management !was able to keep it stable even if in the meantime the company has keep on investing in the business and as for the future expectations are good as the market in recovering and big players are starting to seriously invest in the optic fiber sector”. Lorenzi added that “thanks to the new investor I’m sure we will also do big business abroad”.