Cvc Capital Partners, through its subsidiary Chopin Holdings sarl, sold its remaining 24.4% stake in the capital of Cerved Information Solutions spa, Italy’s leading business information provider listed on the Italian Stock Exchange.

The deal was structured as an accelerated bookbuilding process, which allowed Chopin to cash in 312 million euros from 47,655 million shares sold at a price of 6.55 euro per share, after the offer was raised from 30 million shares due to strong demand from investors (download here the press release).

The deal was coordinated by JPMorgan as sole bookrunner (the bank was one of the Joint global coordinators and joint bookrunners in Cerved’s global offer in June 2014).

Come nell’operazione condotta a inizio settembre, The sale follows a previous sale happened last September, when Chopin sold a 14,87% stake of Cerved’s capital at the same price of 6.55 euro pershare for a total consideration of 190 million euros (see here a previous post by BeBeez). That sale came after another one happened in May when Chopin sold a 16.41% stake at the price of 6.35 euros per share for 203.2 million euros (see here a previous post by BeBeez).

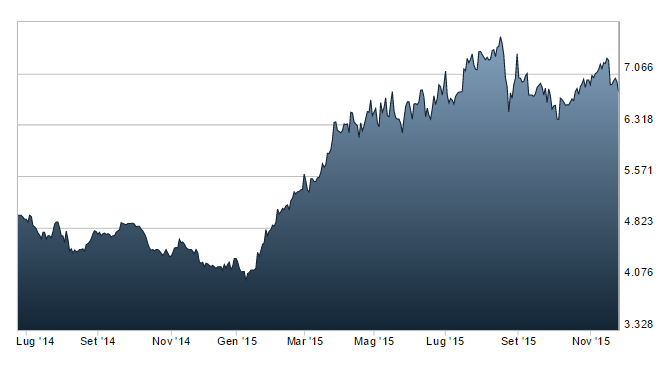

CVC sold 39 million shares at a price of 5.1 euro each In an ipo in June 2014 for a total consideration of about 198 million euros (see here a previous post by BeBeez). Cerved’s share gained 33% since then while they recorded a 61% jump from the beginning of this year. The news of the sale by CVC pushed down the price yesterday bringing the stock to close at 6.8 euros with a 2.09% drop from Monday November 23rd.

CVC Capital Partners bought control in Cerved in January 2013 from Bain Capital and Clessidra funds on the basis of an enterprise value of 1.13 billion euros or 8x Cerved’ FY 2012 ebitda (143 million euros) (see here the press release).

The deal was partially financed by a 780 million euros high yield bond issue in three tranches. The bonds were then listed on the ExtraMot Pro market. One of thos bonds, the 250 million euros one maturing in 2019, was called and reimbursed just after the ipo while last July a new credit facility was issued by a pool of banks in order to repay in fulll all the outstanding bonds (two issues, 300 mln and 230 mln euros respectively) once the January 2016 call option will expire as well as to pay related prepayment premiums for a total of approximately 23 million euros (see here the press release).

Led by ceo Gianandrea De Bernardis, Cerved reached 331.4 million euros in revenues in 2014, with 160.1 millions of ebitda and a net financial debt of 487.6 millions. In the first nine months of 2015 the group reached 256 million euros of revenues (from 235.6 millions in the 9 months of 2014), 120 millions of ebitda an adjusted net profit of 46.3 millions (from 36.7 millions), with a net financial debt of 546.7 millions (download here the consolidated interim report).

Since its listing at the Milan Stock Exchange, Cerved’s stock gained 33% while has been jumping 61% year to date. The news of the sale by CVC weighted on the stock yesterday which closed the day with a 2.09% drop to 6.8 euro per share.