A 60 million euro offer came from China for the 38pct stake in the shareholders’ capital of Giochi Preziosi owned by Lauro Ventidue spa, the investment veichle in turn owned by funds of Clessidra sgr (57.6%), Hvb Capital Markets (24.2%) e Hamilton Lane fund (18.2%). The offer was illustrated to the Board of directors by chairman Enrico Preziosi (owner of a 42.1% stake yhrough Fingiochi) last August, MF-Milano Finanza, writes today.

Financing banks are still evaluing the proposal which in detail consists in about 20 million euros to be paid for the 38pct stake and in 40 millions to be given to the banks in order to reduce Giochi Preziosi’s debt (banks were exposed for 260 million euros at the end of June 2014, date of the last available financial statements), Debt had been restructured last year together with a 37.5 million euros capital increase by actual shareholders.

Preziosi and the othe shareholders Intesa Sanpaolo (14.25%) and Idea Capital Funds sgr (5%), will instead remain invested in Giochi Preziosi,

A 20 million euros price tag for the 38% of the group would mean a significant loss for Clessidra fund (the stake is recorded on Lauro Ventidue balance sheet a 112.4 million euro initial value), but Clessidra first fund already wrote off the stake and it still calculates a 50% Irr (the fund raised 800 million euros in 2005, see a previous post by BeBeez)

As for the financing banks it is a completely different story instead: Crédit Agricole, Bnp Paribas, Natixis and Barclays think that 40 millions are too little money to be destinated to reducing debt, while Italian banks Unicredit and Intesa Sanpaolo are more open to accept the offer.

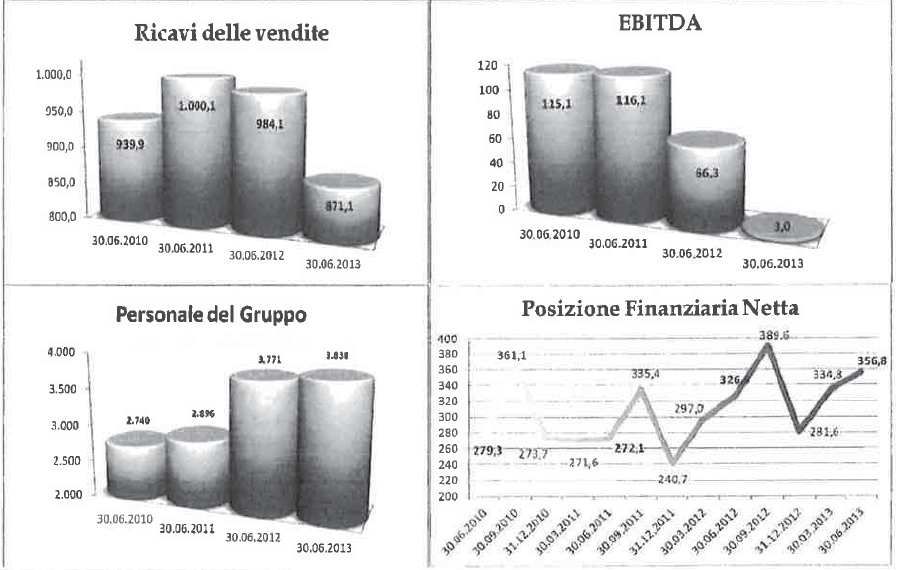

Anyway more equity might be asked to the Chinese investor in order to keep the group in track as ebitda is viewed dropping badly and net financial debt going up. Giochi Preziosi reached consolidated revenues in fiscal year ending in June 2013 of 871.1 million euros (from 984 millions at the end of June 2012) while the value of production was 900.6 millionsi (da 1.006 billions) and ebitda dropped to just 3 millions (from 66.3 millions) with a net loss of 182.3 millions (from -87 millions). Net financial debt was up to 356.8 millions (from 326.6 millions).