NTT’s data center business is something of a Frankenstein’s monster, forged from the remnants of various acquisitions made across the world over the course of 15+ years.

The company had long operated a data center business in Asia that it built itself, and the acquisitions of Dimension Data in South Africa in 2010, Gyron in the UK and NetMagic in India 2012, RagingWire in the US 2014, and e-shelter in Germany in 2015 have helped form its global portfolio, providing a foundation that has enabled the company one of the biggest players in the digital infrastructure space.

In 2015, NTT Com CEO Tetsuya Shoji told DCD that the company had big plans for the sector, and today, it bills itself as the third-largest data center provider globally.

NTT GDC’s footprint globally now spans more than 1,500MW across some 150 facilities in 20 countries.

“There are really only a few data center providers that I would argue even have a truly global footprint,” Doug Adams, NTT GDC’s global CEO, tells DCD.

An investor report from 2023 suggested NTT’s data center business totaled $600 million in 2022, and would reach more than $1.4bn by 2027. Adams says the company is already beyond the $2bn mark, and has been growing at more than 20 percent CAGR.

When we last sat down with Adams in 2019, he was CEO of NNT's RagingWire unit in the US; the data center firm he had helped found at the turn of the millennium with a single facility in Sacramento, California.

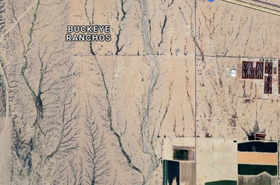

Adams had “stuck around” after RagingWire was sold to NTT to help run the business – which in the US today spans seven campuses and more than 900MW across California, Illinois, Oregon, Texas, Arizona, and Virginia.

Sticking around has paid off, and now Adams is running the company’s whole data center business globally.

After letting its disparate data center units operate under their own names for many years, NTT finally announced that all its regional brands would be rolled under the NTT Global Data Centers (GDC) moniker in 2019. Adams was appointed GDC’s US CEO in 2020, and in June 2023, he was given a global remit.

While NTT’s data center business has operated under the single GDC brand for half a decade now, behind the scenes it still largely functioned as separate global regions.

“I’ve spent the last year and a quarter putting together a global team, putting together the strategy, and moving all 3,500 global GDC employees underneath my global management team,” Adams tells DCD. “In the past, we had four connected but autonomous business units. And the charter, when I took over, was to ensure that we had economies of scale and we were running the business as efficiently as possible.”

While NTT GDC still has four region heads, Adams now has global function heads for every discipline – HR, legal, marketing, operations, construction, engineering, product, etc – all drawn from the best candidates across the company.

“We are truly a global company now, with a global management team, one global P&L, and that frankly makes us a lot more agile,” he says. “Instead of four separate units, we're now one unit. So one set of buying power, one standard design, one set of policies, procedures, and governance.”

One brand, one culture

The number one issue on Adams’ mind when he started on this journey was how to “win the heart, souls, and minds” of what he describes as a diverse, large, multicultural organization.

“I wanted to make sure that we did this in a way that we took care of the employees first,” he says. “If we don't make it a better environment for employees, it's a fail. So we took a year to figure out the process and how to do it.”

Adams says most companies underestimate how much of a task it is to move from managing one geography to a global company.

“Making sure that we have an equitable, diverse, thoughtful, and talented employee pool I think is incredibly important,” he says. “No one completely won. It was a compromise for all of us. We didn't just implement one culture and one team. Everybody had to bend a little bit, move a little bit, and change a little bit. I don't want to say it's a Frankenstein culture, but it is an amalgam of the best parts of each of the operating regions.”

This is good for employees’ career prospects, and Adams says NTT staff now have more opportunities to move across the business globally. He says NTT now benefits from “massive” economies of scale leading to better costing for raw commodities, more standardized products, better governance, stronger processes, all globalized. And for the clients, he says, they get a more aligned global experience.

“We're in the infancy of this. I don't want to claim victory,” he says. “But the early results are very strong. We handily beat our plan on every single metric; bookings, revenue, operating income, every metric we're beating.”

A change of scene

It was important, he notes, that the new-look NTT GDC global leadership team not just be his old confidants from the RagingWire days; a multicultural management team was “mandatory.”

“I've worked with my team in the US for more than 10 years. It would have been pretty easy to move them up to the top management positions and not create a truly global company. But in the long run, you don't get the strength and the resilience and the diversity that you get from having a truly global management team.”

For Adams personally, he says adjusting to working across multiple timezones has been a challenge.

“It's difficult to operate at 4am in the morning and 2am in the morning,” he notes, talking at a more reasonable hour from the US. “It is more difficult, but more rewarding, to manage a global company.” On the flip side, he says he has learned to deeply appreciate the individual cultures and things people bring to the table.

“Prior to taking over this role, I didn't have a lot of exposure to people beneath the top-level management that I do now,” he says. “The strength of the team that's been developed across the globe is significant. What I enjoy and what I love is working with the people, and I think that's our biggest differentiator.”

As well as being global CEO, Adams has still been moonlighting as CEO of the US business for more than a year – when we spoke in October 2024, he was finally set to hand over the reins of the US biz to Joe Goldsmith, who will be stepping up from chief revenue officer of GDC’s Americas business.

Joining NTT in 2018, Goldsmith previously held the same role at Vantage, and spent nearly a decade at Digital Realty before that.

“It's a little bittersweet. The US will always be my baby,” Adams says. “But it opens a great role for Joe. He'll do an incredible job, and it allows me to concentrate on ensuring that we are doing a better job on globalizing.

“I like to talk about how we're borderless, but at the end of the day, you can't just centrally manage an organization that's as large as ours from a central location, you have to have those regional folks that have the local client intimacy, the local employee intimacy, understand the legislation, and have government, city, and county contacts.”

Data centers are getting bigger

NTT bought 80 percent of RagingWire in 2014, completing the purchase in 2017.

When DCD spoke to Adams in 2019, it was in the wake of many telcos offloading data center assets to whoever would buy them and NTT noticeably bucking the trends and buying up operators in major markets globally. The industry’s biggest and latest facilities were still only offering capacities in the low tens of megawatts.

In 2024, the winds have changed and everyone is focused on AI. Hyperscalers, AI cloud firms, and even telcos and enterprises are seeking capacity en masse to cope with the power demand of today’s GPU hardware. Data center campuses are often in the hundreds of megawatts, if not gigawatts. Outside of retail colocation, NTT generally offers 6MW data halls as a minimum, but is signing much larger leases.

A major shift in recent years has been the switch to liquid cooling. Adams says the company has more than 150MW of liquid cooling capacity in production or in the latter stages of development – a more recent call with the company suggests that figure is now above 200MW.

“What we're seeing in the market is so much different than we saw just a few years ago,” Adams says. “We're getting massive takedowns all across the world, especially in the US and India for liquid-to-the-chip AI deployments. I think we have one of the largest footprints of liquid of any of the competitors.”

According to Adams, this equates to “a substantive lead within the marketplace because of the amount of liquid-to-the-chip we've actually deployed.”

He says that, while the competitors are talking about liquid cooling, “we've actually done it,” and adds: “I think we have some very substantive learnings.”

Most of NTT’s liquid deployments are direct-to-chip, but the company has done some limited immersion deployments in Asia.

Immersion is “not easy and brings a whole new set of unique challenges,” Adams says. “But one of the massive values of globalizing businesses is we just bring the best practices. When clients want us to liquid immersion in the US, we bring all those learnings with us from India.”

Secret Weapon: Money, money, money

NTT, officially the Nippon Telegraph and Telephone Corporation, is undoubtedly a Japanese company. Founded as a state monopoly in August 1952 to take over the telecommunications system operated by AT&T during the occupation of Japan by US forces after World War II, the Japanese Ministry of Finance is still the largest shareholder in the telco business.

The US, however, is the center of gravity when it comes to the data center industry. Despite this, US-based Adams says working with his bosses across the Pacific has been “probably the best experience of my 35-year career.”

He says: “The team in Japan wants to do nothing but nurture and support the business, period. They've been incredible business partners and one of our secret weapons.”

He notes that he often gets asked about culture clashes and whether his superiors in Tokyo are controlling or difficult to work with, but says the opposite is true.

“They don't control us,” he reveals. “I'm not on the phone every week asking for permission. I do an annual budget, I manage the business, and they want to see us flourish.”

Today, the whole company has total revenues of more than $20 billion a quarter, along with a $10bn war chest from the mothership to build out data centers, which is a boon for Adams.

“We're self-funded by NTT, we're not beholden to any banks,” he says. “We don't have to go ask permission from banks if we want to expand or make changes in the portfolio. That gives us long-term thinking and makes us very formidable in the marketplace.”

That easy access to cash is paying dividends in the current AI gold rush. Adams says one of the big changes in recent years is hyperscalers wanting providers like NTT to do infrastructure build-out because time-to-market is so important right now.

“Historically, they've built out the infrastructure because they could save money on it,” he says. “Now, they're growing so quickly that they want to have that done during the construction stages of the build – they want to have all the circuits put in place, the racks put in place, the liquid cooling in place.

“If you are beholden to a bank to make your financial decisions and to build your business, you have to have a complete design, all the building materials, all the parts list, all the pricing for all the equipment, and you have to take to the bank and then ask for permission and get the loan. The covenants that they have to deal with and the banking arrangements they have are not easy.”

He adds: “I don't have to go through any of that. There's no working with the banks to get the money to build a business. It is a much more agile way of managing things versus my competitive set.

"It's much different when you just write a check out of your own checkbook.”

Read the orginal article: https://www.datacenterdynamics.com/en/analysis/dougs-secret-weapons/