2025 has been a year where you’re more likely to see announcements of multi-billion-dollar AI campuses, joint ventures, or debt packages than data center deals, but there have been a handful of notable acquisitions in the last 12 months.

Aligned acquired for $40 billion

While relatively quiet on the large-scale acquisitions front, the largest deal of 2025 blew all previous records out of the water.

October 2025 saw Macquarie Asset Management sell Aligned Data Centers to a consortium comprising the AI Infrastructure Partnership (AIP), MGX, and BlackRock-owned Global Infrastructure Partners (GIP). Microsoft, MGX, and BlackRock are members of the AI Infrastructure Partnership, as are Nvidia and Elon Musk’s xAI.

The $40 billion deal is expected to close in the first half of 2026. It is by far the largest acquisition deal ever announced in the data center, more than doubling the previous record of $16.1 billion Blackstone and CPP spent acquiring AirTrunk the year prior.

Texas-based Aligned has campuses across Illinois, Texas, Utah, Arizona, and Northern Virginia, with sites in development in Maryland, Ohio, Illinois, and Virginia, as well as across Latin America with OData. The company also has a stake in Canadian operator QSacale. In total, its active and planned capacity is 5GW.

Macquarie first invested in Aligned in 2018, joining BlueMountain Capital Management. Mubadala, Patrizia, and CenterSquare had also previously invested in the firm.

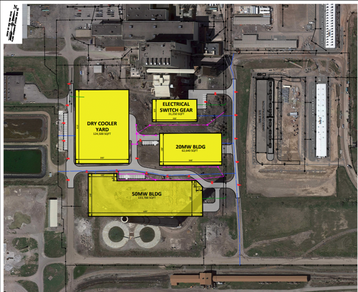

Aligned is known for focusing on large-scale new-build data centers. Its facilities feature its proprietary air and liquid cooling systems, Delta³ & DeltaFlow, the latter of which can reportedly offer cooling densities of 300kW per rack.

The move further cemented BlackRock and GIP’s foothold in the data center sector, with Aligned joining previous investments including CyrusOne, Mainover Webhouse, and a recent joint venture with Spain’s ACS.

MGX was set up by the Abu Dhabi government via G42 and the Mubadala sovereign wealth fund. The firm has been a major backer of OpenAI and its Stargate project, and is an investor in UAE operator Khazna.

Microsoft has a sizable data center footprint of its own and may well lease some facilities from hyperscaler-focused Aligned. It’s rare for a hyperscaler to make any sort of investment in its third-party providers, and it’s hard to imagine the cloud giant’s involvement in the deal (via AIP) is more about profit than gaining access to Aligned’s previous capacity.

Will this acquisition signal a new era of mega-deals in 2026? It’s hard to tell. Many of the other data center operators with similar-scale portfolios as Aligned have changed hands in recent years (CyrusOne, Stack, Switch) or been recapitalized (Vantage).

Google invests in cryptomining firms pivoting to AI and power companies

It’s not unusual for hyperscalers to invest in companies, especially if it benefits the bottom line of their cloud divisions. Microsoft has made investments in several companies that, in turn, have committed to using Azure as their primary cloud platform.

But the AI cloud boom has seen the battle lines redrawn. The hyperscalers are investing in multiple AI labs – Microsoft with OpenAI, Anthropic with Google and Amazon – while Nvidia will seemingly invest in anyone willing to buy a GPU cluster.

To cope with the demands of these AI firms, the incumbent cloud providers are turning to the upstart neoclouds for capacity. Microsoft has signed capacity deals with AI cloud providers, including CoreWeave, Nebius, Iren, and Nscale.

Microsoft’s investment in Aligned, a hyperscale-focused data center firm, was a surprise. But Google investing in two cryptomine providers pivoting to host AI firms was borderline shocking.

In a series of convoluted deals, AI cloud firm Fluidstack has signed leases with TeraWulf and Cipher Mining to secure more than 700MW of capacity at sites in New York and Texas, with more under option. All the deals feature Google as guarantor, and will the search giant take on the capacity if Fluidstack goes under.

Under the deals, Google is set to acquire a 14 percent stake in TeraWulf, and a 5.4 percent stake in Cipher. Both firms were previously focused on hosting cryptomining equipment for themselves and customers, but are both pivoting to AI.

LLM-maker Anthropic seems to be the most likely benefactor of the deals. Fluidstack and Anthropic recently announced a $50 billion partnership to develop data centers in Texas and New York. Google owns around 14 percent of Anthropic, best known for developing the Claude family of models.

As with the Aligned deal, it’s unclear if this is the start of a trend or just isolated incidents amid a capacity crunch.

Separately, December saw Google’s parent company Alphabet acquire energy infrastructure developer Intersect Power for $4.75 billion. The company will partner with Google’s technical infrastructure team to continue work on in-development and new joint projects.

DigitalBridge stays busy (and gets acquired)

As well as being acquired itself, digital infrastructure investment firm DigitalBridge had a busy year.

The company sold Finnish data center and tower firm Digita (along with Icelandic tower firm IslandsTurnar) to GI Partners.

DigitalBridge also closed on its deal to buy Yondr, with the acquired firm selling its Malaysian unit to Vantage and divesting its Indian joint venture to partner Everstone.

The company also invested in new developer Takanock alongside ArcLight Capital.

Most notably, however, the Christmas period saw the company acquired by Japanese technology SoftBank.

The Marc Ganzi-led investment firm has around $108 billion of assets under management, including investments in AIMS, AtlasEdge, DataBank, Switch, Takanock, Vantage Data Centers, and Yondr Group. DigitalBridge has some 5.4GW of capacity in development or operation.

Alternative investment management firm 26North had been in talks to acquire DigitalBridge back in May, with SoftBank’s interest surfacing in early December. The Japanese firm is a major backer of OpenAI, and such a move may well help OpenAI leverage available capacity more quickly.

SoftBank is also separately rumored to be interested in buying Switch. That deal, which could reach $50 billion, would see another M&A record broken in the data center sector.

Bain looks to exit the data center space (in China at least)

One of the other notable deals of the year was Bain offloading Chinese operator Chindata.

Bain acquired Chindata in 2019, but this year sold it to a consortium of Chinese companies for $4 billion. The group is led by Chinese manufacturing and construction company Shenzhen Dongyangguang Industry, the parent company of Guangdong HEC Technology Holding.

The sale didn’t include Bridge DC, another Bain company that has long operated as Chindata’s international arm. Bain is, however, reportedly looking for new backers for the unit. The investment firm could seemingly retain a stake in Bridge, which has facilities in development and operation across Malaysia and Thailand.

Northern Data becomes uncancellable

We are in the era of the pivot.

Numerous companies that started out as crypto companies mining Bitcoin have restyled themselves as AI cloud providers and HPC data center firms.

Northern Data, a German firm that began life as Northern Bitcoin, recently completed that metamorphosis and has ended up owned by an ‘alt-tech’ video platform and cloud services provider.

After it launched in 2009, Northern pivoted in 2020, splitting into a data center unit, a cloud division, and a crypto business. After reports that two of the three units could go public, the company divested its crypto division in November and the remainder was acquired by Rumble Inc.

Founded in 2023, Rumble operates the Rumble video platform and Rumble Cloud units and went public in 2022 via a SPAC merger. The company espouses freedom and promises not to cancel customers. It hosts Donald Trump’s Truth Social platform.

DWS pivots data center focus from mainland Europe to UK

Investment firm DWS acquired data centers in the UK from Colt and local managed service provider Redcentric, using them to launch a new operator known as Stellanor.

The two sites acquired from Colt are located in London and built by Level3 at the turn of the new millennium. Colt Technology Services acquired the sites when it bought Lumen’s EMEA operations in November 2022. The Redcentric assets, meanwhile, total eight sites and 41MW of capacity across the country. Many of the assets were taken over via the acquisition of UK colocation provider 4D Data Centre and the acquisition of three Sungard data centers in 2022.

This year also saw Germany’s DWS sell its NorthC business to Antin Infrastructure Partners.

NorthC was formed in 2019 from the merger of Dutch data center firms TDCG and NLDC, originally a subsidiary of Dutch telecoms company KPN. Today, the company has more than a dozen data centers across the Netherlands, eight in Germany, and four in Switzerland, with more in development in all three markets.

News that DWS was seeking a buyer for NorthC surfaced in October, with Antin reportedly going up against EQT. Terms weren’t shared but press reported at the time that NorthC could be valued at up to €2 billion ($2.34bn).

Other deals: the best of the rest

There were a handful of other interesting deals throughout the year, mostly on the smaller side.

Damac-owned Edgenex acquired Nordic developer Hyperco.

Altice finally sold its Covilhã data center in Portugal after some three years of rumours. Asterion bought the site for €120 million ($140m) in December.

Network firm Megaport acquired midsized cloud provider Latitude.sh.

Norwegian renewable investment firm Magnora entered the data center market with the acquisition of local developer Storespeed.

Brookfield’s Csquare (formerly Centersquare) spent $1 billion acquiring 10 North American data centers. Details are fuzzy, but include two data centers in Boston and Minneapolis that the company had been operating under long-term lease agreements, along with eight additional colocation facilities in Dallas, Tulsa, Nashville, Raleigh, Toronto, and Montreal.

IFM Investors acquired Swiss operator Green from investment firm InfraVia Capital Partners.

Apollo Global Management acquired Stream Data Centers from Stream Realty.

Rogers sold nine facilities in Canada to InfraRed, which used them to launch a new operator called Qu.

EcoDataCenter sold three facilities in Sweden to CapMan Infra as part of hyperscale pivot.

Stack sold its colocation assets in Europe to Apollo.

Nova Infrastructure took a controlling stake in US data center operator DartPoints.

IPOs and SPACs

The big data center and cloud IPO of 2025 was CoreWeave joining the Nasdaq. Seen by some as the canary for any potential AI bubble, the company went public in March.

The float was disappointing for some, however, seeing the company valued at ‘just’ $23 billion. The company is valued at some $36.88 billion at time of writing, down on its summer peak of around $70 billion. The company’s first quarterly reports have seen sizable revenue growth offset by equally sizable increases in infrastructure costs. The clock is ticking for CoreWeave to come good on profit before its debt becomes unserviceable.

NTT was busy. The main group took its NTT Data division private in a $16.4bn deal, while also floating a data center REIT in Singapore seeded with stabilized assets in the US, Europe, and Asia.

The crypto sector continues its odd march onwards. American Bitcoin – the merger of Hut 8’s crypto operations and the American Data Centers business owned by Eric and Donald Trump Jnr. – went public via a merger with Gryphon Digital. Hut 8 moved all its crypto operations under the new business, which is leasing capacity from data center firm.

Bitzero, a crypto and HPC data center firm backed by Shark Tank star Kevin O’Leary, also went public, listing on the Canadian Stock Exchange. Galaxy Digital floated on the Nasdaq. Two other crypto firms, Blockfusion and Ionic Digital, are looking to go public in 2026.

Fermi America went public with a $15 billion valuation based on hopes and dreams. The company plans to develop a multi-gigawatt campus in Texas that will combine nuclear, solar, natural gas, and other energy sources. How this gets paid for is still an open question.

GPU cloud firm Boost Run, one of the smaller AI cloud firms currently competing for attention, is aiming to go public on the Nasdaq via a SPAC merger.

Cerebras, a hardware and cloud company known for its giant wafer-scale chips, withdrew its S-1 filing in October. The company, however, said it was because the info was out of date and will not impact its plans to go public.

Are we inching closer to the era of quantum advantage where quantum computers are an essential part of the stack instead of a novelty? Who knows. But both Infleqtion and Xanadu plan to go public on the Nasdaq via SPAC mergers. They will join the likes of IonQ, Rigetti, and D-Wave in the public eye.

DCD expects that a number of the AI companies and AI cloud providers could well go public in 2026.

Vendors go in for liquid cooling

While much of the focus is on the buildings and the GPUs that go inside them, 2025 has seen many of the data center supply chain’s largest firms make statement acquisitions. Incumbent power and cooling firms have been keen to get their slice of the AI boom, often buying liquid cooling firms that will allow vendors to support higher-density workloads.

The largest deal in the supply chain saw Eaton acquire Boyd Thermal for $9.5bn. The deal gave power and cooling firm Eaton a greater foothold in the liquid cooling space. The unit was acquired from Goldman Sachs Asset Management.

Vertiv acquired PurgeRite for $1 billion in cash plus up to $250 million based on future performance. PurgeRite offers filtration services for data centers, an essential part of cooling system maintenance. This year saw Vertiv automation platform WayLay.io, which develops monitoring and control technologies for power and cooling systems, and rack maker Great Lakes for $200m.

HVAC firm Trane Technologies acquired data center liquid cooling firm Stellar Energy Digital. Trane previously invested in liquid cooling provider LiquidStack in March 2023.

HVAC company Daikin acquired liquid cooling firm Chilldyne, giving the latter a portfolio of direct-to-chip cooling systems.

Industrial company Johnson Controls made a “multi-million-dollar” strategic investment in two-phase direct-to-chip liquid cooling firm, Accelsius. Johnson currently offers data center cooling tech under the Silent-Aire brand.

2025 saw cooling firm Xnrgy Climate Systems secure investment from a number of investors across two funding rounds. The company secured backing from Decarbonization Partners (a joint venture between BlackRock and Temasek), Climate Investment (CI), and Activate Capital.

Industrial firm Legrand continued its recent data center-focused acquisition spree with the purchase of load bank provider Avtron in October, following the acquisition of four other data center-focused companies this year and five more last year.

The ongoing deals and rumors

Deals rarely happen in a vacuum, and the rumor mill continues to generate whispers of new mergers and acquisitions that are in the works.

Despite trundling on for some five years, the hunt to find a buyer for Global Switch goes on. Rumors have swirled since around 2021, with the only confirmed movement being the sell-off of Global’s site in Sydney, Australia, to HMC Capital last year.

As noted above, Bain is said to be looking for a buyer for Bridge DC.

US colo giants Digital Realty and Equinix are said to be vying to acquire European operator atNorth. A deal – potentially valued at €4 billion ($4.6bn) – would give either company a new footprint in Iceland and expanded portfolio in the mainland Nordics.

APAC operator ST Telemedia Global Data Centres (STT GDC) could have new owners come the new year.

Singtel recently confirmed it is in negotiations with the company about a takeover. The telco took a minority stake in the data center firm last year alongside KKR.

In Hong Kong, local real estate firm Grand Ming is said to be nearing a deal to sell its data center business to Actis. The portfolio comprises two live facilities and two in-development sites.

Chipmaker Intel is said to be close to acquiring AI server and cloud company SambaNova. Founded in 2017, SambaNova was valued at $5 billion in 2021 but has recently reportedly struggled to complete a new funding round. The firm offers cloud services and on-premise hardware based on its SN40L AI chip.

Telecoms group Orange is said to be potentially looking for a buyer for its facilities. Reports suggest, however, it is likely a stake sale in its French facilities rather than a buy-out of its entire portfolio, which totals around 75 data centers across EMEA.

Investment firms Oaktree Capital and Elliott Investment are both reportedly looking to offload at least a portion of their respective data center developers, Pure and Ark. Both have a sizeable presence in the UK and growing footprints overseas.

Investment firm EQT is said to be looking for a buyer for Nordic fiber broadband and data center firm GlobalConnect. The deal could be valued at around €8 billion ($9.41bn).

More in Investment / M&A / Financing

Read the orginal article: https://www.datacenterdynamics.com/en/analysis/2025-data-center-ma-in-review/