US multinational Honeywell is planning to file draft IPO papers for its quantum computing unit, Quantinuum, with the US securities regulator.

Timings for the filing were not disclosed, and the company said the number of shares to be offered and the price range for the proposed offering have not yet been determined.

Quantinuum was founded in 2021 when Honeywell spun out its Quantum Solutions division and merged it with UK quantum computing startup Cambridge Quantum Computing. Honeywell owns a 54 percent stake in the company, and IBM is also an investor.

Reports first emerged in July 2024 that the company had been in discussions with a number of investment banks ahead of a potential float on the US stock exchange, with sources at the time claiming Honeywell was seeking a valuation for Quantinuum of around $10 billion, a figure it achieved after closing a $600 million equity fundraise in September 2025.

That round saw participation from Nvidia’s venture arm NVentures and Quanta Computer, in addition to previous investors, including JPMC, Mitsui, Amgen, and Honeywell.

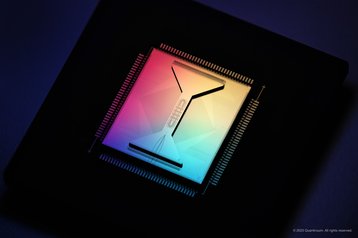

In November 2025, Quantinuum launched Helios, a general-purpose quantum computer that allows developers to program quantum and heterogeneous classical computers in the same way, therefore enabling hybrid quantum capabilities to be combined in a single program.

That same month, the US government’s Defense Advanced Research Projects Agency (DARPA) announced that Quantinuum had advanced to Stage B of its Quantum Benchmarking Initiative (QBI).

Read the orginal article: https://www.datacenterdynamics.com/en/news/honeywell-planning-to-file-ipo-for-quantum-computing-unit-quantinuum/