The chancellor has a £20bn gap to plug in the upcoming Budget. Reports suggest she won’t raise income tax rates, so the focus has shifted to freezing or adjusting tax thresholds, which could raise around £8bn.

That still leaves a few billion to find – and this is why property taxes have suddenly become the subject of intense speculation. Rumours are already hitting the higher end of the market

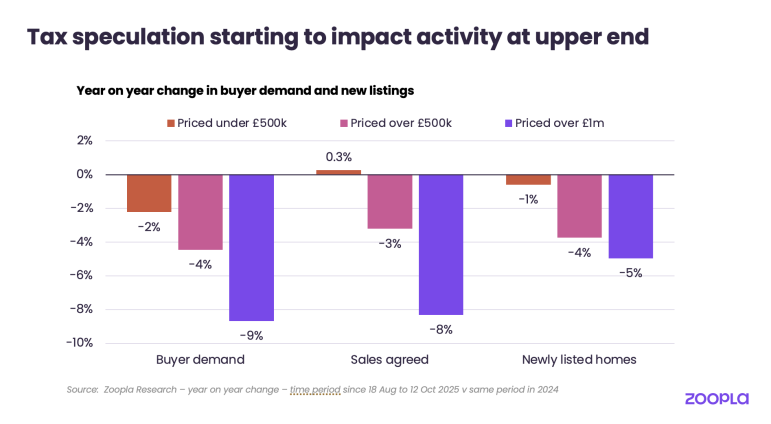

Talk of property taxes has unsettled some buyers. Our data shows that homes over £500,000 — a third of all homes for sale, and far more in southern England — have seen fewer buyers, fewer sales agreed, fewer new listings

Meanwhile, the mainstream market (below £500k) looks steady, as buyers there are less worried about changes.

Why stamp duty keeps coming up

The industry agrees that stamp duty needs reform. Zoopla recently told MPs it should be abolished, but that would cost £10bn a year, so any big changes would need to be paired with reform of council tax.

The burden isn’t evenly spread:

Stamp duty impact on today’s buyers

Our data on buyer leads to agents reveals where the burden falls the most and the cost

First-time buyers

Existing homeowners

+ Over 90% pay stamp duty in southern England, typically £10,000–£20,000.

+ Elsewhere, over half pay, but the typical bill is much lower (around £2,500).

Why stamp duty feels out of date – what would help buyers today?

Stamp duty thresholds haven’t kept up with rising prices. In many southern cities – Reading, Aldershot, Southend, Bristol – buyers are paying up to £10,000, or 2–2.5% of the property price, even for average homes.

A simple fix would be to raise the 5% stamp duty threshold from £250,000 to £500,000.

This would reduce stamp duty to 2% for homes under £500k and make buying more affordable for typical buyers across southern England at modest cost to the Exchequer.

Council Tax changes: what’s really being discussed

Council tax currently brings in £50bn a year and helps pay for local services. Bills vary depending on the property band – a typical Band D home pays about £1,668 a year, while the most expensive Band H homes pay twice that.

Some commentators have talked about doubling council tax for the top bands (G and H). That would raise around £4bn, but it would hit a small number of owners very hard.

The more realistic idea being discussed in the media is much smaller – raising around £600m a year from the 10% of homes in the top bands (F, G and H).

This would mean:

+ Up to a 10% rise for these higher-band properties

+ Roughly £10–£30 extra a month for affected owners

+ Packaged politically as “higher-value homes paying more tax”

The likely outcome? More media bark than Budget bite

Nothing is certain, but the evidence suggests the Budget is unlikely to hit the property market as hard as the headlines might suggest.

Sales activity in 2025 has recovered to long-term norms, and agents are heading into 2026 with strong pipelines worth over £1bn in commission. The priority for the government should be supporting this progress, not undermining it.

Richard Donnell, executive director, Zoopla.