You’ve all heard of the PayPal ‘mafia’, and here in Europe, the Skype ‘mafia’. Other tech companies that have given birth to a generation of other tech startups include Revolut, Palantir, Monzo and Deliveroo.

But what’s less talked about is that VCs are at it too.

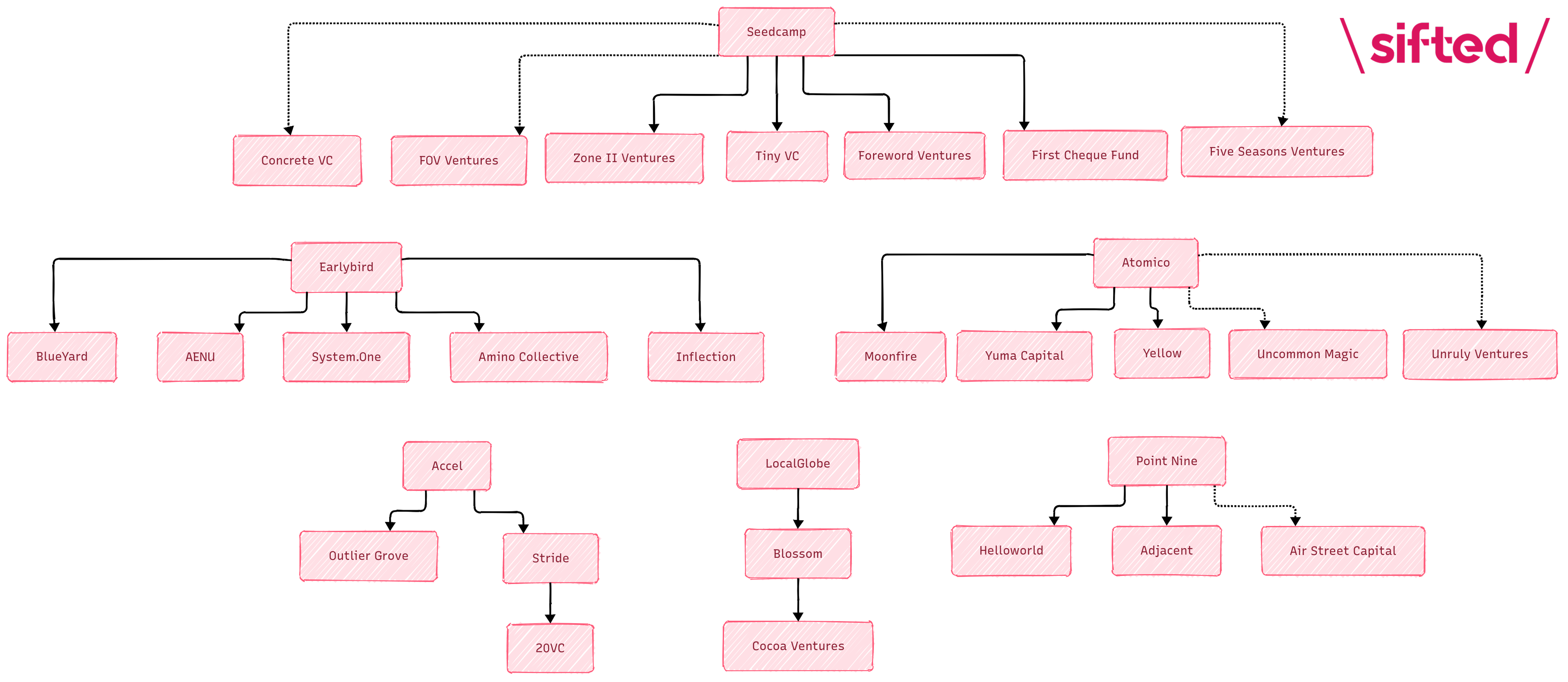

By Sifted’s count, former Seedcampers have started seven other VC firms. Earlybird, Accel and Atomico also have numerous offspring.

At some firms, these spinouts are a sign that there’s no room at the top; at others, a sign that the excellent training and fabulous deals they worked on at said firm equipped them well to win the confidence of LPs.

Several prominent European VC firms — including Creandum — are yet to produce any offspring, they confirmed to Sifted.

We catalogue Europe’s VC family trees here. If we’ve missed any, let us know.

Seedcamp

As an OG of Europe’s investment scene, it’s no surprise that London-based early-stage investor Seedcamp has spun out several other firms, including former principal Philipp Moehring’s Berlin-based Tiny VC.

Former general manager Kirsten Connell launched Octopus Ventures’ First Cheque Fund, former investor Ricardo Schäfer (who went on to become a partner at Target Global) founded Zone II Ventures, while fellow former investor Dave Haynes started deeptech VC FOV Ventures.

Former Seedcamp experts in residence have also been busy setting up funds: Declan Kelly started solo GP firm Foreword Ventures; Taylor Wescoatt cofounded proptech firm Concrete VC; and Ivan Farneti founded food and agritech-focused VC Five Seasons Ventures.

Earlybird

Another prolific creator of new VC firms in Europe is German VC Earlybird. Former Earlybird investors Ciarán O’Leary and Jason Whitmire left in 2015 to start Berlin-based VC BlueYard with a $120m fund. Former Earlybird general partner Fabian Heilemann, meanwhile, struck out on his own in 2022 to found Berlin-based climate VC AENU along with his brother and former Earlybird venture partner Ferry Heilemann.

Other offshoots include former principal Max Claussen’s pre-seed VC System.One — one of Europe’s very first solo GP firms — and former associate Manuel Grossman’s health and biotech-focused solo GP firm Amino Collective, both also based in Berlin. Alexander Lange, who was an investor at Earlybird between 2015 and 2017, before going on to Index Ventures, is now a founding partner at Berlin-based early-stage VC Inflection.

Atomico

Atomico cofounder Mattias Ljungman left the European VC giant in 2019 to start a new data-driven early-stage VC firm, Moonfire. It raised a $60m fund in 2021. Another Atomico stalwart, Hiro Tamura, left in 2022 amid reports that he had been “dismissed” following “complaints from staff over his management style”. He’s since founded a new VC firm, Yuma Capital, and recruited another former Atomico partner, Carter Adamson, to work alongside him.

Former Atomico principal Adam Lasri is now general partner at Yellow, a VC firm with offices in Paris and Barcelona, which he cofounded with Oscar Pierre and Sasha Michaud, the cofounders of food delivery giant Glovo.

Several former members of Atomico’s angel investment programme have also gone on to start their own VC funds, including Unruly Ventures’ Stefano Bernardi and Uncommon Magic’s Sarah Drinkwater.

Accel

Former Accel partner Fred Destin left in 2017 to start his own firm, Stride. Stride, in turn, gave Harry Stebbings his first proper taste of VC life, before he left to launch his firm, 20VC. Stride has more recently hit a bump in the road, stopping fundraising and laying off some staff in 2023. 20VC, meanwhile, raised $400m across two new funds in 2024.

This year, another former Accel investor, Candice du Fretay, launched her own solo GP fund, Outlier Grove, with a target of $20m.

Point Nine

Berlin-based early-stage VC Point Nine has given birth to a handful of solo GP funds. Former Point Nine venture partner Rodrigo Martinez launched pre-seed and seed-stage fund Helloworld in 2020, and former principal Nico Wittenborn (who then worked at New York-based Insight Partners) started his own firm, Adjacent, in 2019. ‘Scientist in residence’ Nathan Benaich runs AI-focused solo GP fund, Air Street Capital, which he launched while at Point Nine.

Balderton

London-based Balderton has had a small family of younger VC firms, including former general partner Lars Fjeldsoe-Nielsen’s 2xN, a VC focused on backing quantum startups.

There’s also Resonance, an early-stage evergreen VC backed by the family office of French entrepreneur Pierre-Édouard Stérin but cofounded and led by Maxime Le Dantec, previously a principal at Balderton. Plus, Harry Stebbings was once an intern at Balderton.

Speedinvest

Anthony Danon, former partner at Austrian early-stage investor Speedinvest, left to start Cocoa with Carmen Rico, before leaving to start a solo GP fund, Rerail, in 2024. Former principal Alexis Majos left to start Nightark, a growth equity firm, last year.

LocalGlobe

Ophelia Brown, a general partner at London-based VC LocalGlobe for a short while (and before that, a principal at Index Ventures), left to start her own firm Blossom Capital in 2018. Blossom raised its third fund, of $432m, in 2022; and in 2024 began raising its fourth fund, according to SEC filings.

In turn, former Blossom partner Carmen Alfonso Rico started her own firm, Cocoa Ventures, in 2022.

Index Ventures

For a bedrock of the ecosystem, Europe- and US-based Index Ventures has spun out surprisingly few European VC firms. One offshoot is former Index principal Gloria Bäuerlein’s Puzzle Ventures, a €21.5m solo GP fund.

Frontline

Irish VC Frontline has one spin-off: former partner Finn Murphy’s solo GP firm, New York-based Nebular.

FoodLabs

Berlin-based foodtech VC FoodLabs has spun out an even more specialised firm, Nucleus Capital, which backs synthetic biology startups. Cofounder Maximilian Schwarz was previously an investor at FoodLabs.

Northzone

Hans Otterling, general partner at European VC Northzone, is also a founding partner of Norrsken22, a $205m fund which invests in African startups.

Mosaic Ventures

Cofounder of London-based VC Mosaic, Mike Chalfen, left in 2018 to start a solo GP firm Chalfen Ventures.

SquareOne

Felix Plapperer, former partner at Berlin-based SquareOne, closed a €17m solo GP fund for his new VC firm, BOOOM, in 2024.

Octopus Ventures

Maria Rotilu, who helped launch UK-based Octopus Ventures’ First Cheque seed fund, left in 2023 to start her own super early-stage solo GP fund Openseed.

Revaia

Yet another firm spinning out solo GPs, France and Germany-based growth stage investor Revaia saw former general partner Robin Haak leave to start his own firm Robin Capital, which closed a €13m early-stage fund in 2024.

Felix Capital

London- and Paris-based consumer VC firm Felix Capital has one spin-off: former investor Joseph Pizzolato’s Defiant.

Sequoia

The storied US-based firm, which has had a London office since 2021, has spawned a new fund started by Matt Miller, its longtime partner responsible for the firm’s bets on the likes of the UK’s Graphcore and cloud company Confluent. Miller announced he was leaving Sequoia late last year, and is currently raising a roughly $300m London-based fund, as Sifted reported.

Several former Sequoia scouts now have funds of their own, including Marc McCabe’s Nomad Capital.

Correction: An earlier version of this piece mentioned Northzone as a firm without any ‘offspring’; more details have since been added.

Read the orginal article: https://sifted.eu/articles/europe-vc-mafia/