London-based startup Rivan, which develops a synthetic fuel that can be used in place of natural gas by heavy industry, has raised £10m in a round led by VC firm Plural, with participation from Harry Stebbings’s 20VC, NFDG and Patrick and John Collison, the founders of Stripe.

Rivan was founded in 2024 by former professional footballer Harvey Hodd, who previously founded and sold two software companies. Hodd funded Rivan’s seed round himself with an undisclosed amount.

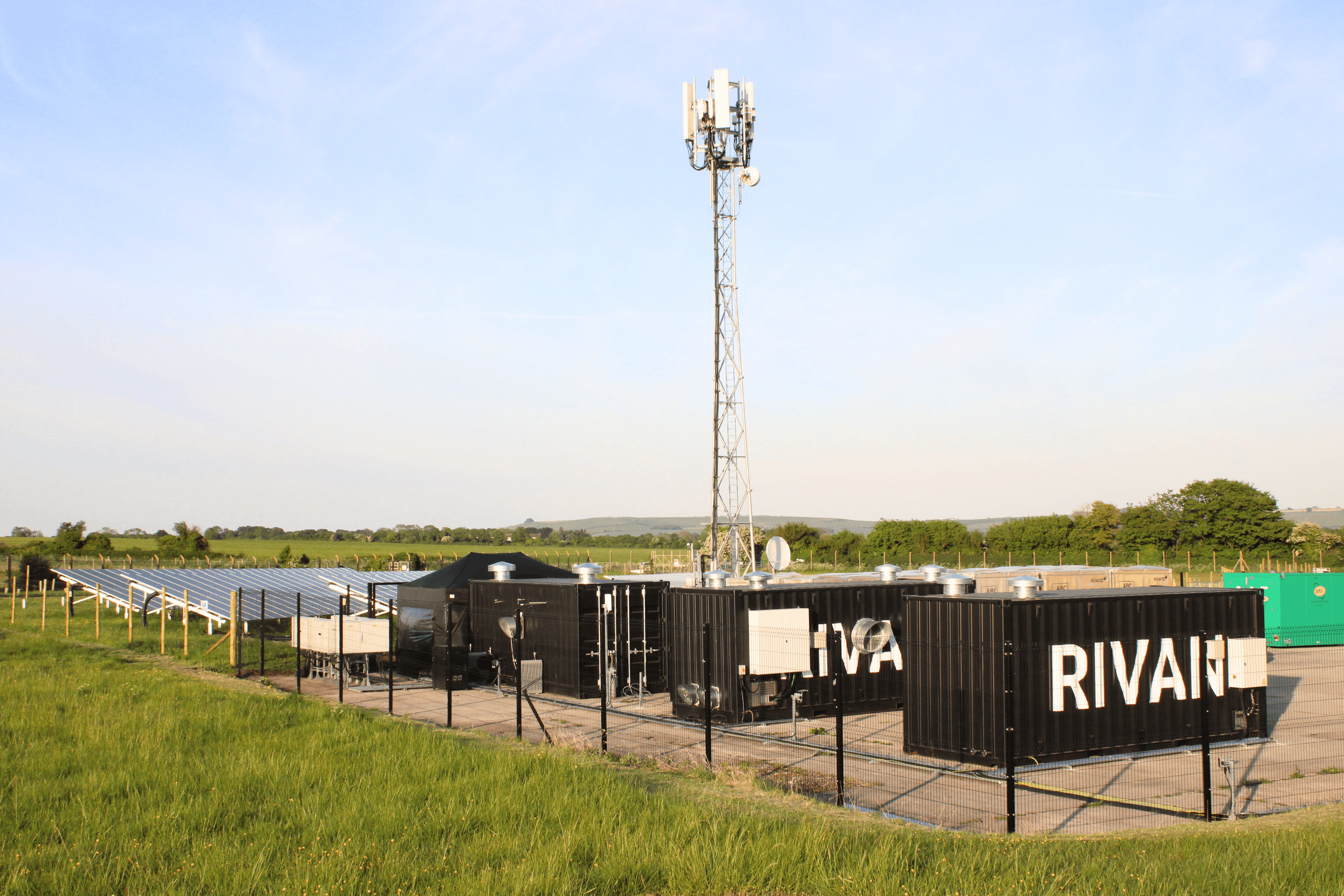

The company captures carbon from the air and combines it with hydrogen, produced by splitting water molecules, and combines the two to form CH4: synthetic natural gas. Rivan uses solar energy to power the process, meaning its only inputs are carbon and water.

The fuel is chemically the same as the gas used by industries such as concrete and steel production. Unlike hydrogen, which is sometimes touted as a way to decarbonise heavy industry, synthetic natural gas can be piped through the existing gas network.

“It’s a drop in replacement,” Hodd says. “If you’re a large trucking company, a steel works or a paper mill, if you currently use a lot of natural gas, in theory, you could decarbonise overnight.”

Rivan has a pilot plant in Wiltshire in the UK and plans to scale it up to meet the fuel orders it has already signed.

“We have a huge backlog of customers that we signed, and that’s part of the reason we were able to raise quite a lot of money,” Hodd says. He declines to name the companies but says they include industrial companies, fuel distributors and brokers.

At present, synthetic gas is more expensive than gas produced by fossil fuels, but Hodd says he expects the price to fall to match natural gas in “three to eight years.”

There’s increasing discussion about the need to provide green alternatives at the same price point as incumbent products, but Hodd says he thinks customers are willing to pay a ‘green premium’ for a limited time.

“They’ll pay a green premium for now but, ultimately, we have to use the headroom that the green premium pays us to then drive down the cost of production,” he says.

Read the orginal article: https://sifted.eu/articles/rivan-synthetic-fuel-stripe-20vc/